Navigating the college conundrum

Amid soaring costs and souring sentiment, it's worth weighing higher education's ROI

For a broad swath of American families, this April's stress levels extend beyond the normal tax matters and spring cleaning plans.

After months of applications, acceptances, rejections, deferrals, online tours, videoconference informational sessions and (COVID-willing) campus visits, April is crunch time for households with a graduating high school student eager to step out into the world.

And while parents play an important supporting role in the process, the adults in the room would be wise to keep their nostalgia in check, said Kimberly Bridges, director of financial planning at BOK Financial®.

"Many parents of today's high schoolers had the opportunity to go off to school and have the full college experience while figuring out what they wanted to do with their lives," she said. "But considering how expensive the college experience has become, many parents cannot afford for their children to do the same.

"You have to be realistic about how much you can spend and where you can afford to send your child."

Soaring costs

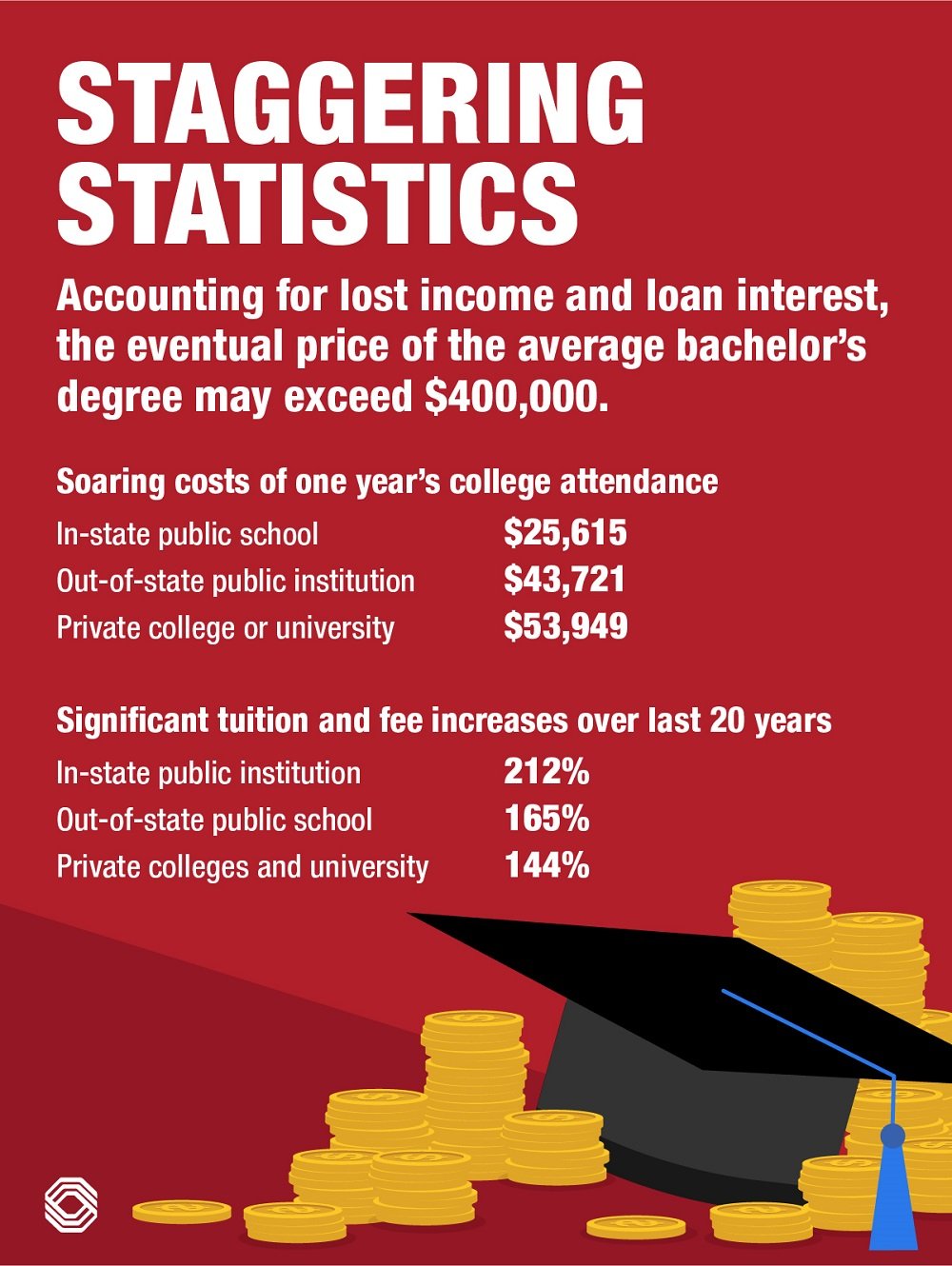

The last two decades have seen an extraordinary jump in the cost of higher education (see graphic). In fact, it has increased at least four times the rate of the Consumer Price Index, which increased 48.6% over the same period.

Today, the cost of one year at a public four-year institution averages $25,615 for an in-state student, according to educationdata.org. The same year at a private college or university averages $53,949.

Meanwhile, as the pandemic drove students of all ages to online instruction—and forced many colleges to justify their high price tags—the number of high school seniors planning to enter a four-year college or university plummeted from 71% to 53%, according to a recent poll from the non-profit ECMC Group.

"The cost of college is a prominent factor in the college decision," Bridges said. "It has become so expensive that I believe families should talk about the return on investment (ROI) of a college education."

Although ROI is hardly a dinner-table topic in most households, Bridges said families should discuss:

- Potential majors, given the student's passions, interests, skills and abilities

- Career options for graduates in those fields

- Average starting salaries and earnings trajectories for those majors and career options

- The job outlook for each career option

- The student's expectations regarding their future standard of living, and a reality check around whether their desired career path will support those expectations

Another consideration: Is your child mentally and emotionally prepared for college? On average, only 62% of students at four-year institutions complete a bachelor's degree within six years.

"Is college the right solution for this child at this time? Or do they need to gain some maturity first? Or develop a work ethic first?" Bridges said. "If it's not a fit, you'll be wasting money, so maybe it's better to find an alternate course."

A well-planned gap year, such as a church mission, military service or an AmeriCorps stint, can help develop maturity and perspective that enables students to sharpen their focus for college and beyond, she said. It also allows parents to add to any existing college savings.

"There are many options for getting your kids on the path to adulthood, some that include college and some that don't," Bridges said.

Ultimately, if you factor in the wages lost by taking time out of the workforce, a failed attempt at college could easily run between $200,000-$300,000. That money might be better spent helping your child learn a trade, receive job-related training, start a business or buy their own home.

Crunching the numbers

If college appears to be the right call, then it's time to weigh the pros and cons of each option and do some math. Scholarships, grants or work-study offers can help offset tuition, fees, room and board. Don't forget to factor in travel costs to and from campus.

When it comes to student loans, Bridges recommends that families take only what they need and not max out on what's offered. More broadly, she offered two ways to approach education debt:

- Limit the total of all loans to no more than the first year's average salary in the intended career. For a teacher, that translates into $44,507.

- Calculate the monthly payment for a standard 10-year loan using the current student loan interest rate and ensure that it equals no more than 10% of the expected gross monthly income for that first job. For a first-year teacher, that's $371.

But Bridges strongly cautions parents not to divert funds from their retirement savings efforts.

"That can be a very hard pill to swallow and many parents disagree with me, but consider that there are no substitutes to retirement readiness."

To help soften the financial blow of a college education, Bridges suggests enrolling at a community college, where general education requirements may be completed at a lower cost than most four-year options. Two-year schools frequently offer assessments and other diagnostic tools to get a better handle on a student's interests and abilities.

Fortunately, the financial challenges of higher education opportunities are mainstream enough that resources abound, from the U.S. Department of Education's College Affordability and Transparency Center to Glassdoor's list of the 50 highest paying college majors.