Minding the racial wealth gap

Impact of the gap is seen vividly in retirement planning

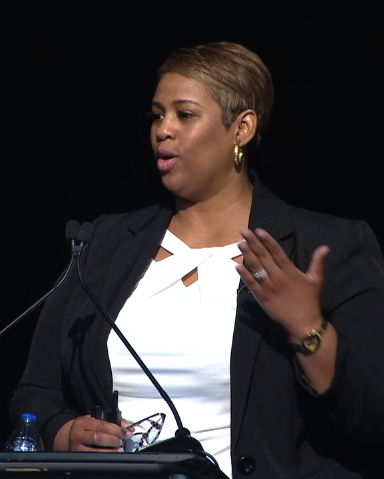

Seven numbers changed the way Aerika Morris looks at money: 48, 35, 300, 10,000, 3, 0, 1.

"For 48 hours, 35 city blocks of a community were destroyed and 300 of its citizens died in that tragedy 100 years ago during the Tulsa Race Massacre," said Morris, institutional client advisor at BOK Financial®. "And 10,000 residents of that community became displaced.

"Three individuals recently spoke before Congress about the impact it had on their lives. Zero people were brought to justice. We have one obligation to break the cycle…breaking the cycle regarding a lack of education and resources; breaking the cycle of feeling hopeless or victimized; breaking the cycle of not leaving a legacy of building and sustaining generational wealth."

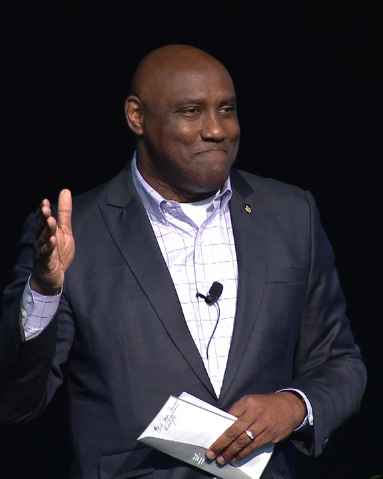

Morris painted that picture in a June 1 presentation at the 2020 Economic Empowerment Day, one of many events that marked the 100th anniversary of the Tulsa Race Massacre. She was joined on the panel by Kristi Rodriguez, leader of the Nationwide Retirement Institute; and George Nichols, president & CEO, The American College of Financial Services.

Wealth gap

Morris said the story of the Tulsa Massacre inspired her to take a deeper look at the country's racial wealth gap—and especially what it means for retirement planning.

"There have been historical barriers that have made it difficult, if not impossible, for African Americans to have a clear path to retirement. What occurred in the Greenwood neighborhood in Tulsa 100 years ago was an American tragedy, but it's not unique to Greenwood. These types of tragedies have occurred all across the country. And the effect has been felt for generations. What's been left in its wake are significant disparities: in education, wealth and retirement savings."

“There have been historical barriers that have made it difficult, if not impossible, for African Americans to have a clear path to retirement…. What’s been left in their wake are significant disparities: in education, wealth and retirement savings.”- Aerika Morris, institutional client advisor at BOK Financial

The statistics are staggering.

In the second quarter of 2019, the Black homeownership rate dropped to 40.6%, down seven percentage points from roughly a decade earlier. It now hovers closer to 44%, while the white homeownership rate is far higher (approximately 74%).

This is partly due to the fact that Black workers made 14.9% less than their white counterparts in 2019, according to the Economic Policy Institute's (EPI) Wage Report. This disparity is worsening as the gap has grown significantly in the last 20 years, up from 10.2% in 2002.

The impact of the racial wealth gap is seen vividly in retirement planning.

"One in four Americans have no retirement savings—that's startling," said Rodriguez. "Only 44% of Black individuals have retirement accounts, and in those retirement accounts, their average balance was only $20,000."

And the report shows people of color nearing retirement age have average savings of $30,000, a mere one-quarter of the average saved by white households ($120,000).

Start with why

Experts say the key to getting started on retirement planning is to identify your "why."

"When it comes to retirement and financial planning, it's important to first identify your why: to have a clear vision of where you're going and what legacy you want to leave," said Rodriguez. "What would you do if money wasn't an option? What do you want to accomplish in life? And what legacy do you want to leave? All of that is your why. "My why is about how I can change that dialogue and that trajectory of wealth in my family."

She said the idea of legacy is an important one. It's what you want to leave behind.

"Income and wealth aren't the same," said Nichols. "Income is what you make and live on; wealth is transferable, it's what you leave behind."

“Income and wealth aren't the same. Income is what you make and live on; wealth is transferable, it's what you leave behind.”- George Nichols, president & CEO, The American College of Financial Services

The median Black family has $24,100 in wealth. This is just 12.7% of the $189,100 in wealth owned by the typical white family.

Start early—or at least now

After identifying a why, Morris said it's imperative to begin saving for retirement as early as possible.

"I can't emphasize enough the value in getting started now because the cost of procrastination is significant," said Morris.

To get started, she suggests identifying a savings goal and timeline.

"This can include short-term goals like starting an emergency fund or saving for a car, midterm goals like saving for a down payment on a house, and long-term goals like saving for retirement," Morris said. "Write those goals down to keep yourself honest and on track. Having a plan helps you maintain focus when competing priorities arise—because they always do."

Experts suggest a goal of saving 10-15% of your income to be on track with retirement goals.

But it's important to be realistic when setting goals—both the amount you think you'll need and how you'll reach those targets.

"Be realistic about your retirement numbers and don't expect Social Security to be enough," Morris said. "For many retirees, Social Security benefits make up 33% of your overall retirement income. In the African American community, 83% of retirees rely solely on Social Security income."

Morris suggests determining your investment strategy by asking yourself:

- How much will you need?

- How long can you invest?

- As an investor, what's your risk tolerance?

Have hard conversations

When it comes to breaking the cycle of feeling hopeless or victimized due to lack of education and resources, having difficult conversations is key.

"Having open, honest conversation is important to changing mindsets, changing trajectories and keeping you honest to your why," said Rodriguez. "This is an opportunity, particularly for us in the Black community, to start normalizing conversations around financial health and legacy."

She suggests having multi-generational conversations around money, planning and priorities. She said when one person becomes empowered about their financial future, they can share what they've learned with others.

That's a mission that hits close to home for Nichols.

In 2020, the number of Black and Latino certified financial planners (CFPs) in the U.S. grew 12.6% from the previous year—certainly good news. The more sobering statistic from the CFP Board is that there are still only 1,493 Black CFPs today, and they make up less than 2% of all CFP professionals, according to NerdWallet.

"The American College of Finance Services is launching their Four Steps Forward approach to address these issues through its new Center for Economic Power and Equality," said Nichols. "It's an effort to promote upward mobility and wealth building in Black communities. This means financial education for Black women, recruiting and training for Black financial professionals, and executive leadership programs for up-and-coming Black leaders."

Find your people

When it comes to matters of money, no one knows everything.

“Just because someone has money doesn't mean they're good with money. Often, employing a team or seeking help from a financial professional is the best way to achieve your financial goals, especially in terms of retirement planning.”- Kristi Rodriguez, leader of the Nationwide Retirement Institute

When considering a financial advisor:

- Ask yourself, "What's the problem I'm trying to solve?"

- Understand that not all financial professionals are the same. Do some research on their licenses, titles, certifications, designations, etc., and understand how they're paid (and what that pay structure means for you).

- Know that it might take a team. This financial team could include advisors, tax professionals, lawyers, etc. Knowing your goals and your why will help determine who you need on your team.

"Sometimes people don't want to admit that they don't have all the answers, so they don't want to seek help," said Nichols. "And sometimes people don't want to part ways with an advisor. But if your needs and goals have changed and that advisor isn't the right fit, you're allowed to fire them and go a different direction.

"It's about being empowered to take control of your financial future."