Where there's a will—even when there isn't

The pandemic left many young Americans unprepared to be sudden executors of their parents' estates

Of all the tragedy wrought by the COVID-19 pandemic, one of the most heartbreaking was the number of people who died alone in quarantined hospital beds. Some families' last goodbyes were by video chat.

Those deaths left grieving loved ones—including many young adults—to make sense of their parents' or grandparents' wishes and to sort through their estate plans—if they had estate plans.

Although it is impossible to know how many COVID-19 victims died without a will, available numbers paint a grim picture. Since the beginning of the pandemic, more than 600,000 COVID-19 deaths had been reported in the United States, according to the Centers for Disease Control and Prevention's data on July 9.

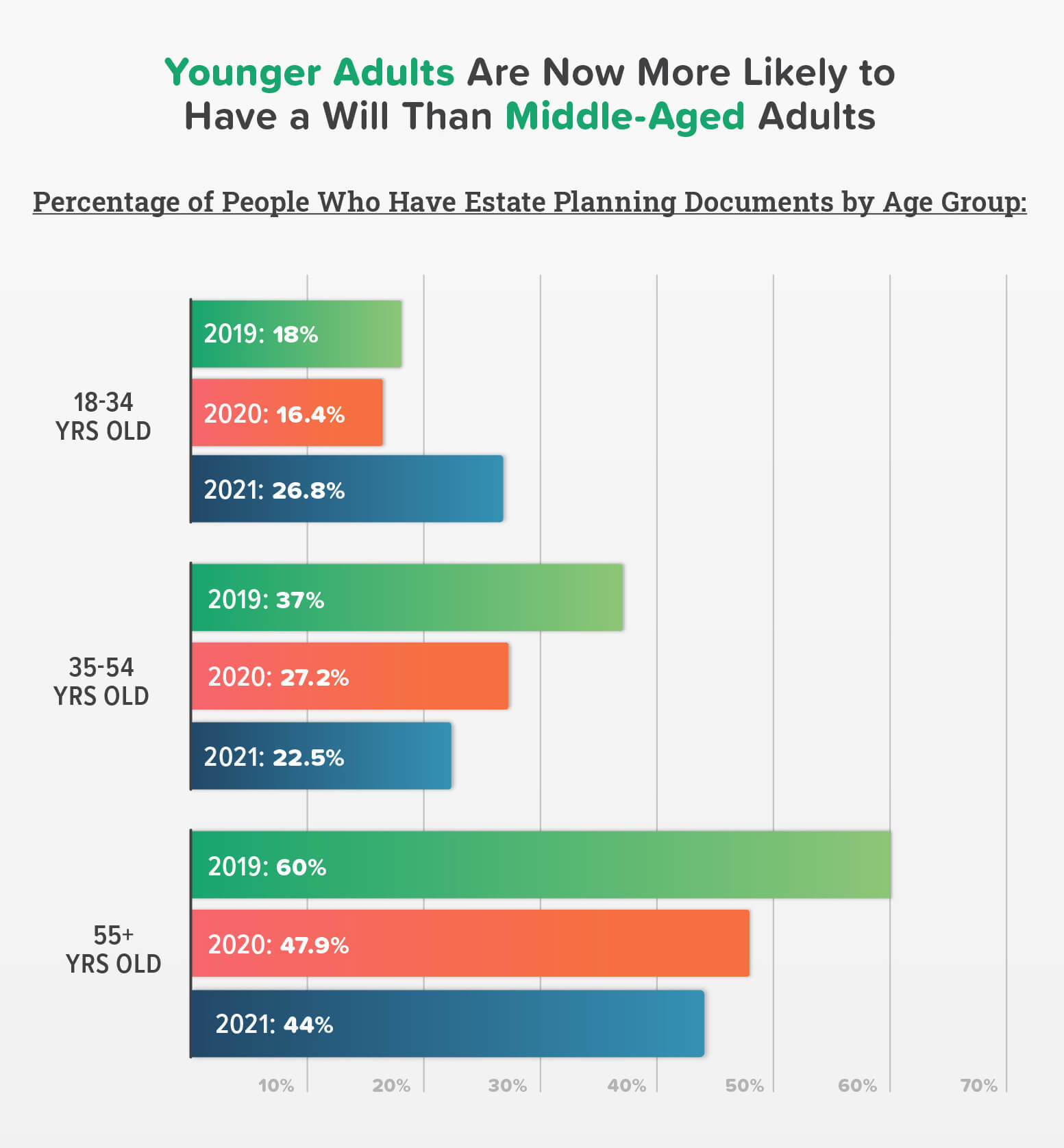

Consider that a meager one-third of Americans have prepared estate planning documents, according to a 2021 Wills and Estate Planning Study from Caring.com. That's down from pre-pandemic 2019, when 40% of Americans had a prepared will and other estate planning documents.

The COVID-19 pandemic put many young Americans in particular in this position, due to the sudden death of parents and grandparents, according to a University of Southern California analysis published in the Proceedings of the National Academy of Sciences.

With little or no estate planning documents left behind, the already-challenging process can become an emotional minefield.

"The biggest challenge is not knowing what to do, so these individuals are put in a really difficult situation," said Ry Whiteman, manager of BOK Financial's® Trust Services Group. "Not only are they grieving the loss of their parents or other loved ones, but then they have to figure out what's next. They are thrust into this scenario where they have to figure it out as they go."

Start with advice

Individuals who have to administer a loved one's estate should seek out professional assistance and advice, according to experts.

"The most important thing to do is to seek out attorneys that specialize in estate planning and probate administration as well," Whiteman said.

There are also potential tax liabilities to consider. When someone dies, the executor of the estate is responsible for filing the final income tax return for that person, noted Kimberly Bridges, director of financial planning for BOK Financial. If the deceased owes taxes, that will have to come out of the proceeds of the estate before any distributions can be made, she explained.

"One caution for anyone who ends up in a position of having to settle an estate for a parent is that they shouldn't just start divvying up the property because they believe 'mom and dad wanted so-and-so to have this or that' or even where there is a will telling them so," Bridges said.

Administrative matters must be taken care of first. For example, the estate may have to go through probate and the claims of any creditors, including the Internal Revenue Service, must be satisfied, she said.

Additionally, if an adult child inherits a parent's pre-tax assets, such as a 401(k) or individual retirement account (IRA), they will have to pay taxes on it when the money is distributed. That distribution must be done within 10 years in most cases, Bridges said.

"Whether or not the inheritor should choose to take the distribution all at once or over the applicable time period depends on the situation—such as their current tax bracket, their expected future tax bracket, and potential changes to tax laws—so they should discuss the decision with a tax professional."

Wills on the rise

Younger Americans are already heeding the call from the pandemic: 26.8% of 18- to 34-year-olds now have wills, which represents a 10% jump compared to 16.4% in 2020, the Caring.com study found.

But there's bad news as well. The percentage of adults 55 and older with a will has continued to decline, to about 44% of this year, from 60% in 2019.

In addition to preparing a will, it's important to review estate plan documents on a regular basis.

"Life changes and so do final wishes of parents," Whiteman said. "They may have an estate plan that made sense five years ago, but it doesn't make sense today."

The pandemic taught us all the dangers of waiting, he added. But across all ages, what's the No. 1 reason respondents to the study gave for not having a will? "I haven't gotten around to it."

Information in this article should not be construed as legal or tax advice and is offered for general informational purposes only. Links to other sources of information are provided only for the convenience of the reader and should not be considered a recommendation or endorsement.