What’s in your credit report?

280,000 credit report errors reported last year

You may know your credit score—but how closely have you looked at your credit report?

More than one-third of Americans found at least one error on their credit report.

This is according to a new Consumer Reports investigation that also found 29% of those people discovered personal information errors and 11% identified account information errors. Complaints of credit report errors have soared in recent years. In fact, more complaints of errors were filed in 2020 alone than in the previous three years combined, with roughly 280,000 complaints filed.

A credit score is a three-digit number that influences your ability to borrow money, like vehicle or mortgage loans, and influences the interest rate you are able to secure.

"Many people don't fully understand how a credit score is formed," said Andrew Iven, a product strategy manager at BOK Financial®. "They don't always feel empowered to ask questions about the score or how it was calculated, so they trust that it's accurate without ever really checking it."

Iven explained that the three major credit bureaus—Equifax, Experian and Transunion—are only as good as the information they receive.

"These three bureaus manage, consume and aggregate data," he said. "It's not unheard of for one to have a piece of data that the other two don't—your credit card account could show up on one report, but be left off of the other two. This may ultimately result in differences in credit scores."

While a mistake in personal information simply makes it harder to access a credit report, a mistake in account information can have a significant impact on an individual's credit score—which people often don't notice until they're in the middle of seeking financing.

"Your credit score and credit report are personal to you, so it's important to familiarize yourself with them," Iven suggests.

First, know how the score is calculated.

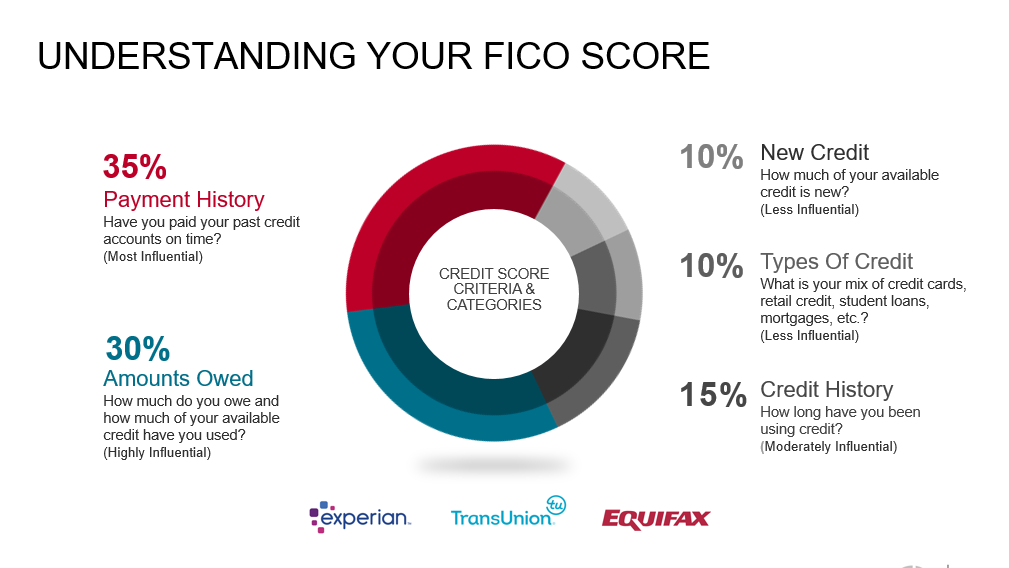

The composition of a credit score used by all three credit reporting agencies includes:

- Payment history: 35%

- Total amount owed: 30%

- Length of credit history: 15%

- Types of credit: 10%

- New credit: 10%

Next, you'll want to keep a look out for mistakes.

He suggests monitoring your credit at least once a year using a secure site like www.annualcreditreport.com, which allows consumers to access their credit report for free once per year.

"Keep an eye out for things like duplicate accounts, debts that don't belong to you or aren't the right amount, accounts inaccurately listed as open when they're closed, or vice versa," said Iven.

If you've found a mistake, the next step is reporting the error to all three credit bureaus. Typically, disputes can be filed online and are followed by a waiting period as the agency investigates the validity of the dispute.

"Even if no mistakes are found, it's good practice to stay on top of it and understand how your credit history impacts your overall credit score," said Iven.