Crypto 101

From Bitcoin to digital currency, what does it all mean?

By now, cryptocurrency is part of our everyday lexicon—and Bitcoin is a household name.

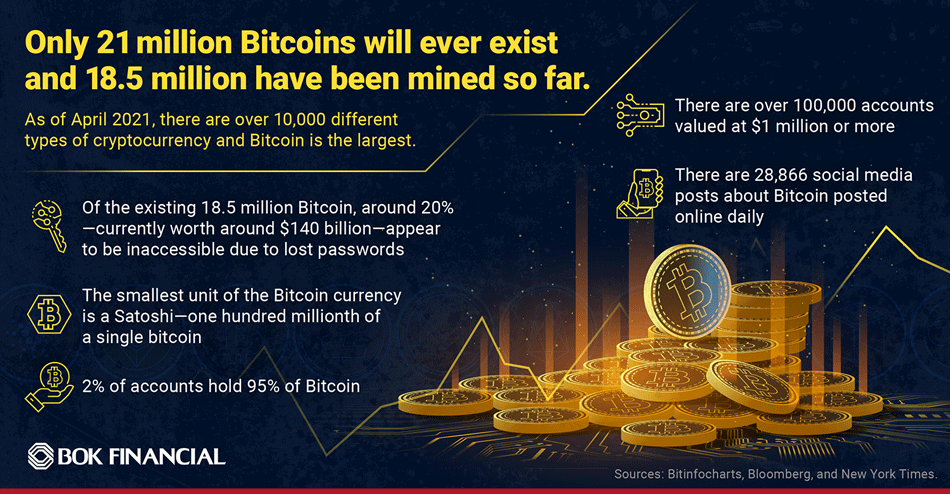

In fact, a 2021 cryptocurrency stat revealed that there are 28,866 social media posts about Bitcoin posted online daily—that's about 1,203 posts every hour, or 20 posts per minute.

But knowing of it, and knowing what it all means or how it works, are very different.

"It can be an intimidating or confusing thing for people to grasp," said Jeffrey Nowakowski, foreign exchange sales specialist at BOK Financial®. "It's a lot to break down."

For those looking for an introduction to the topic, Nowakowski did just that, starting with some basic definitions.

What is cryptocurrency?

"Cryptocurrency is a digital currency that, unlike traditional banking which is account based, is token based and does not have a physical tangible counterpart like the U.S. dollar or Euro," he said. "And even though some people use cryptocurrency and Bitcoin interchangeably, they're not the same thing."

As of April 2021, there were over 10,000 different cryptocurrencies, including Bitcoin, Ethereum, Dogecoin and others. "Bitcoin, more specifically, is a type of cryptocurrency that was created in 2009," Nowakowski said.

He explained that cryptocurrency is bought and sold like a stock investment, with valuation fluctuations directly tied to the activity of "whales" or large-quantity cryptocurrency holders, plus supply and demand.

Drilling down

"It's not limitless," Nowakowski said. "Only 21 million Bitcoins will ever exist, and 18.5 million have been mined so far. It is estimated the final Bitcoin will be mined in 2140. After that point, miners will be paid transaction fees to maintain the infrastructure."

Crypto mining is the process of verifying and recording transactions in the public blockchain ledger. In exchange for providing the needed infrastructure, miners receive bitcoin for their effort.

Of the existing 18.5 million Bitcoin, around 20%—currently worth around $140 billion—appear to be inaccessible due to lost passwords. "Because there's no physical counterpart, if you lose your password or privacy key, you've lost access."

The smallest unit of the bitcoin currency is a Satoshi—one hundred millionth of a single bitcoin, named after the creator Satoshi Nakamoto, whose true identity is still unknown. Bitinfocharts estimates there are over 100,000 accounts valued at $1 million or more and Flipside Crypto reports that 2% of accounts hold 95% of Bitcoin.

"The numbers all feel a little arbitrary," he said. "Think of them like tokens in a Mario game. Even though it can seem like a lot, you can only play with the tokens already existing in the game. And like Mario tokens, there's no real life equivalency."

What about blockchain?

"Blockchain is the technology that enables cryptocurrencies," he said. "It's a decentralized record of all transactions across a peer-to-peer network. It is based on a distributed ledger technology that is shared by all members of a network. This means information is being shared constantly and the entries become fixed so they cannot be changed once added."

Being decentralized means that blockchain can run on its own, without oversight. And having the digital ledger, he said, prevents the same cryptocurrency from being used or counted twice.

Big picture

Interest, value and movement are constantly in flux, Nowakowski said.

He added, "While the anonymity of crypto is what draws some people in, it's important to remember that there are no safeguards in anonymity."

Cryptocurrency lingo used online

HODL: Hold on for dear life

FUD: Fear, uncertainty and doubt

Weak Hands: Crypto newbies who, instead of holding, sell in a panic

Whale: Large investors who hold so much Bitcoin that their moves affect the market

FOMO: Fear of missing out

Aping: Entering a position in a coin

To learn more, read a piece authored by Steve M. Wyett, BOK Financial chief investment strategist, titled "With Cyptocurrencies, Speculate Responsibly."

This material is not a solicitation or recommendation to buy or sell, or an endorsement of, any security or other financial instrument including, without limitation, Bitcoin or other virtual currency products or to participate in any trading strategy related to them. Bitcoin and other virtual currency, and securities, listed and/or over the counter derivatives or other financial instruments that derive their value from, have a price linkage to, have exposure to or result in a payment or distribution of Bitcoin or other virtual currency, are not currently available for custody, distribution, settlement, purchase or sale at or through BOK Financial ("BOKF"). This is due to, among other factors, the potential high risk and volatility of Bitcoin and other virtual currency products and the fact that virtual currency remains an experimental concept that is not presently regulated or backed by any central bank worldwide and has no tangible intrinsic value.