Omicron overwhelms stock market news

Experts analyze Omicron shake-up, market and economic impact

The emergence of the COVID-19 Omicron variant was a troubling post-Thanksgiving headline that caused tumult throughout the weekend. By Tuesday, stocks and oil prices were continuing to decline while concern climbed—but financial experts say there's no cause for panic.

"It's important to keep a longer-term perspective and not let short-term blips get in the way of your goals," said Steve Wyett, chief investment strategist for BOK Financial®. "What feels like a big shake-up now, might not turn out to be that way down the line. Short-term market volatility is not a reason to change investment objectives."

"Omicron has been named a variant of interest by the World Health Organization (WHO)," said Wyett. "It's caused uncertainty, and uncertainty is unsettling."

Wyett broke down Friday's key numbers:

- The S&P 500 was down 2.2% for the week; year to date it's still up 23.9%.

- Mid-cap stocks were down 3.2% but up 21.8% since the beginning of the year.

- Small-cap stocks were down 3.3% for the week but still up 24.2% year to date.

And market numbers continued this trajectory over the next several days.

"But we saw the opposite in the bond market last week," he said. "The Barclay's Aggregate was up 10 basis points last week, and it's still down 1.5% year-to-date. This is exactly why we diversify."

Stocks took another tumble Tuesday as Federal Reserve Chairman Jerome Powell announced he would consider speeding up the Federal Reserve bond-buying taper.

Setting the stage

"Omicron is the newest variant, but it's not the only factor at play right now," said Matt Stephani, president of Cavanal Hill Investment Management, Inc. "The biggest wave of the Delta variant in Europe is taking place right now. Part of this market sell-off in the last few days actually reflects the increase in European cases over the past three to four weeks."

However, not all negative COVID news has been met with market swings, Stephani said.

"The market sell-off was mild when Delta hit the U.S. last summer. So far, the sell-off caused by the current Delta wave in Europe has also been mild. It remains to be seen whether Omicron results in a significant market sell-off. Global economies may be impacted as countries consider increasing anti-COVID lockdown measures," he said.

Omicron enters the scene

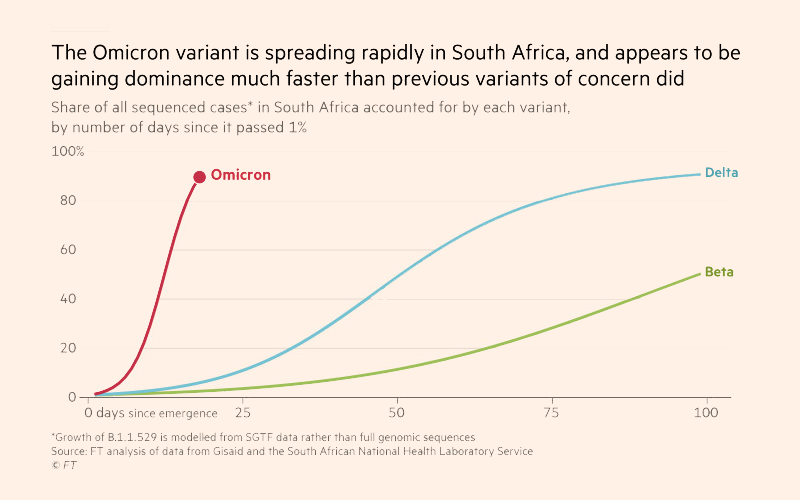

"This new variant has become close to 100% of new South African cases, and it's spreading," said Stephani. "The concern is what happens globally. It's important to note the South African total number of cases is exceptionally low right now. There's not an explosion in total global Omicron cases."

Why is the World Health Organization so concerned about Omicron relative to some other variants?

"The concern is two-fold," said Stephani. "First, there's uncertainty around how well the vaccine will work against the variant. The second concern is about ease of transmissibility—and that's an unknown right now."

Stephani shared what we know (and don't know) about Omicron so far:

- Omicron has spread quickly. Cases have already been identified in Asia, Europe and the U.S., according to the WHO.

- Omicron was discovered in South Africa where 65% of cases were in unvaccinated patients. The majority of the rest of the infections were in patients with only the first dose of the vaccine.

- South Africa has a low vaccination rate (around 30%) and has a high number of immunocompromised people.

- A key unknown is how well the vaccine protects against this variant given its large number of spike protein mutations. We may not know for several weeks.

- There is no indication the disease from Omicron is more severe.

Both Pfizer and Moderna have said they can develop an Omicron-specific booster within the next six weeks, with delivery probably within 100 days, Stephani said.

All of this news came out on the lightest trading day of the year.

"You have a lot of individual sellers coming to the market while typical career buyers are at home on the holiday. In a 3.5-hour market session with exceptionally low volume, this kind of news hits, and you get an exaggerated move," Stephani said.

What's the impact on the stock market and economy?

The range of outcomes is wider than it was a few weeks ago.

"I don't think another lockdown in the U.S. will happen," Stephani said. "Europe and Asia have a bigger risk. The bond market is starting to anticipate a slowing of global growth. It could mean volatility for equity markets for a relatively short period of time, perhaps a couple of weeks, while waiting for data around vaccine effectiveness and booster availability.

Brian Henderson, chief investment officer for BOK Financial, added, "One factor that's important to consider—in relation to economic and market impact—is the severity of new cases and hospitalizations."

He added that we haven't seen an increase in severity or hospitalizations with this new variant as of yet.

"I am encouraged that we have made it through previous variants this year—and it hasn't been too troublesome for the markets," Henderson said. "COVID is still out there; we're not over it yet. Markets are learning how to deal with COVID setbacks and how to manage through them."

He said he's optimistic that there will be economic growth in 2022.

"A lot of that is going to be driven by the strength of the consumer, which is in very good financial shape," he said. "If this third-quarter market rebound from Delta stays with us in the first part of 2022, the stock market is going to be in decent shape. Later in 2022, as we're getting further away from the stimulus and consumers have kind of worn down some of that excess savings, I wouldn't be surprised if the economy starts slowing down, but still remaining positive."