Job creation key in KC

Improving labor market amid pandemic rebound could boost incomes, retail sales

An overall brighter outlook in the Kansas City metro area is rooted in a job market recovery that the Greater Kansas City Chamber of Commerce projects to be stronger than the national average. Led by job growth in the healthcare, transportation and warehousing, professional services and consumer-facing industries, employment levels were anticipated to return to pre-pandemic levels during the first quarter of 2022.

Extending such gains for the rest of the year, the Wichita State Center for Economic Development and Business Research projected that the unemployment rate would fall to 2.9%.

Although Kevin Kramer, CEO of the Kansas City market for BOK Financial®, echoed the optimistic outlook, macro conditions temper some of the enthusiasm.

"The unemployment rate dipped to pre-pandemic levels in late 2021, but it does feel like uncertainty around where interest rates are headed is weighing a bit, although economic activity is still much more robust than it was a year ago," Kramer said. "It seems like people are still getting their footing in 2022, although we haven't seen anything significantly different from the upbeat expectations."

A leading factor in the underlying sentiment, Kramer believes, is the downgrading of COVID-19 risks.

"For the last six quarters, all we talked about was the pandemic and how it was going to affect the economy," he said. "That risk factor is being minimized—it's still there, but it's no longer in the top two or three risk factors when we talk to businesses."

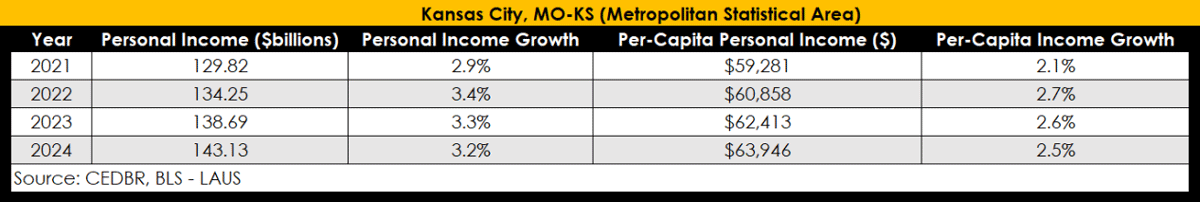

More broadly, along with a sharp decline in unemployment levels, the Wichita State Center for Economic Development and Business Research projects solid advances in personal income levels of around 3% and a 5.4% rise in retail sales. It also predicts steady gains in job creation, which Kramer identifies as a key metric for growth prospects.

"We're definitely starting to see an uptick in true job growth in the first quarter and indications that we'll see more significant activity in the second and third quarter of this year," he said.