Life changes—big and small—should prompt a conversation with the experts

Put a call to your financial advisor on your to-do list when big milestones approach

Roughly 6 million people in the U.S. are expected to retire in the next five years according to the St. Louis Federal Reserve Bank. It's likely that many of them have already met with a financial advisor. In fact, 72% of advisors reported that retirement is the most common prompt for a client meeting

But that shouldn't be the only time you meet with your financial advisor said Matt Mitchell, senior financial advisor at BOK Financial Advisors.

"As major life events take place, be proactive and keep your advisor up-to-date" he said. "These changes may be career oriented or personal events which could result in the loss of income or an inheritance."

In addition to retirement, there are other milestones in life where you might benefit from the knowledge and experience of a financial advisor. Here are five that might cross your path.

1. Marriage/divorce

On average, two million people get married in the U.S. every year. As two lives come together, seeking the guidance of a financial advisor is essential for discussions on taxes and long-term investment strategies. Marriage may result in a variety of economic changes for new couples, such as shared bank accounts, joint tax filing and retirement planning, to name a few. These changes bring new financial questions that an experienced advisor may help to answer.

However, while marriage may be bliss to some, U.S. divorce rates are close to 45%. The end of marriages likely leads to separating financial assets, bank accounts, and any other shared investments. While many couples seek the assistance of attorneys to handle this separation, experts advise consulting with a financial planner as well to help navigate these possibly complex economic changes.

2. Starting a family

While children bring joy and fulfillment, they also bring a high demand on your finances. On average, Americans spend more than $200,000 per child from birth to age 17, according to figures from the USDA, and these cost estimates don't even include saving for college tuition.

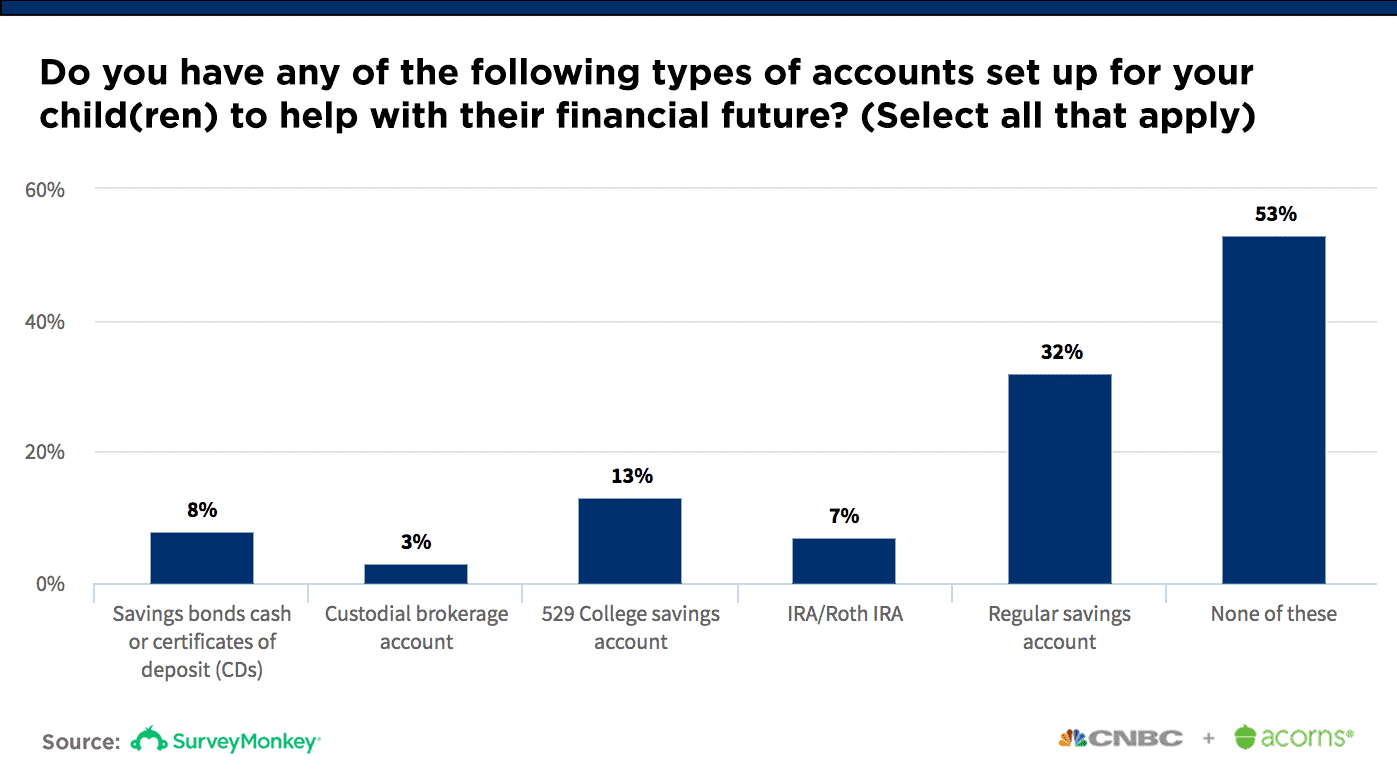

In fact, more than half (53%) of couples reported not having a savings plan or college fund for their children, according to a 2020 CNBC survey. Only 13% reported having a 529 college fund, 8% had a savings bond, and 7% had a Roth IRA for their children. Financial advisors can help parents determine which type of savings tool is right for their family.

"Identifying the overall need for college funding starts with a well-designed financial plan" Mitchell said. "Once a funding amount is identified an advisor can help the client navigate toward the most appropriate college savings plan, the investment allocation, and the annual contribution needed to reach their goals."

3. Buying/selling a home

Buying and selling a home is a major financial life event. There are many steps, fees, and other considerations in the process that can make the experience feel daunting. "Buying a home normally includes a large outflow of cash as down-payment, especially for first-time homebuyers that do not have current home equity to use as part of their down-payment" Mitchell said. "A financial advisor can help in deciding where and how to get those funds."

4. Buying/selling a business

If you decide to go out on your own, a significant milestone would be the transition to owning and operating a business. For individuals starting a business, there are a variety of tax laws and financial obligations to consider.

"Business owners can face a great deal of complexity in the financial planning process. A good financial advisor will quarterback efforts for open dialogue with the client's tax advisor and attorney when necessary," Mitchell said. "When the financial advisor understands key components of the overall tax and estate situation of the client, this may present an opportunity to deliver a tax-effective investment solution."

5. Retirement

Retirement is the No. 1 reason people seek a financial advisor. This major life transition often results in a drastic change in financial status that can be tricky to navigate. "Successfully preparing for retirement is about addressing your fears," Mitchell said. "This could be the fear of running out of money, worrying about Social Security cuts, planning for an unexpected health expense, or seeing low portfolio returns coupled with a high inflationary environment."

With nearly 49% of Americans ages 55-66 having no retirement savings, working with a financial advisor to address this stage in life is crucial to establishing financial security before you get there. Experts recommend working with a financial advisor at least 10 years before retirement to ensure these questions are answered and any issues resolved.

"Time is the most important factor in wealth creation, followed by your investment allocation," Mitchell said. "Time gives you the power of compound interest and the ability to absorb the ups and downs of your portfolio returns. The earlier you start saving and investing, the better off you will be in the future."