Loaded for bear

Seemingly whenever excessive volatility hits the stock market, witty observers haul out their trusty bear traps, poised to unleash images of snarling, angry grizzlies in full attack mode for that precise moment when stocks slip into a bear market.

Yet, while the decline of 20% from recent or all-time highs in the stock market's major indexes—the definition of a bear market—is certainly unsettling and noteworthy, the amount of bandwidth spent on dissecting the downturn is rarely warranted for investors with long-term horizons.

"If you're getting stressed because of what you're seeing on the financial news stations or within your portfolio on a daily basis, change the channel and stop checking your portfolio," said Kimberly Bridges, director of financial planning at BOK Financial®. "Instead, talk to your financial advisor and confirm your financial goals. If you know you have a well-diversified portfolio and you don't need to make portfolio withdrawals in the next couple of years, then don't worry about bear markets. Managing your emotions is key."

And while past performance is no indicator of future returns, bear markets traditionally follow a well-worn path, said Steve Wyett, chief investment strategist for BOK Financial.

"Stocks go up and stocks go down—they have behaved this way many times in the past and will continue to do so in the future," he said. "As your financial advisor can help you see, periods of declines—even sharp downturns—are as much a part of long-term investing as stretches of positive performance. Market volatility should not cause your investment objective to change."

Beyond generalization

While a 20% downturn officially triggers bear market talk, underlying conditions usually aren't that cut and dry.

For example, through mid-June, the S&P 500 Index had landed in bear territory a couple of times after establishing an all-time high in January. Meanwhile, the Nasdaq Composite Index has spent much of 2022 wallowing with the bears after recording an all-time high in November 2021. The Dow Jones Industrial Average turned away from the bear den after touching a 16% decline in mid-June.

Every stock market swoon has its own catalysts. Wyett pegs this year's stock market woes to:

- Elevated inflation worldwide;

- Increased U.S. interest rates driven by the Federal Reserve's rate hikes in response to inflation;

- Rising energy prices and food costs, along with lower global growth outlooks brought on by the Russia-Ukraine war; and

- Continued global repercussions from the COVID-19 pandemic.

And just like the markets, the effects of the bear market on individual portfolios can vary greatly.

"What people should remember is that the impact on different sectors and companies can be quite different," Wyett said. "While we've seen many technology and consumer discretionary stocks drop considerably, the energy sector gained more than 50% through the first five months of the year."

Since World War II, the S&P 500 has entered bear (or near-bear) market territory on 17 occasions, according to LPL Research. The downturns have historically averaged about 30% and lasted about a year. Wyett said this time, a drop in inflation along with signs of steadying in the U.S. economy should support a rebound.

"Bear markets are part of the natural course of events if you're invested in the market," he said. "You must keep perspective that they're going to happen and create a plan to prepare for these periods."

Abrupt moves likely painful

Downturns are most painful for those in retirement who are relying on their savings to fund their living expenses. Perhaps the best bear-proof component of an investment draw-down plan is a cash reserve fund that can cover between two and three years of required spending, Bridges said. Ideally, such a cushion will allow you to ride out the downturn without selling stock holdings at depressed prices.

Bridges said plugging into safer income sources can help those who rely on the income from your retirement savings for day-to-day living. Bonds and dividend-paying blue chip stocks can limit the fallout from a market downturn and cover essential expenses along with Social Security, pension and annuity payments.

Ultimately, she encourages individuals to connect with a financial planning professional to ensure that their life and savings goals are aligned, to determine an ideal investment mix and solidify a rational approach to selling your holdings.

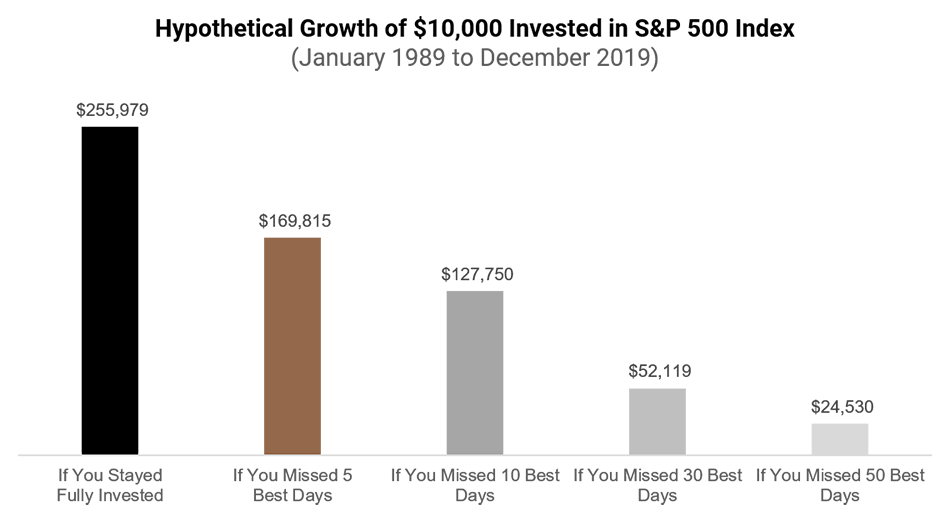

Acting without any forethought can be painful, especially for those who sell into the depths of a bear market and try and jump back in later to recoup their losses. According to Bloomberg research, missing the S&P 500 Index's five best days between 1989-2019 slashed a portfolio's ending value by a third.

"The track record for those who try to time the market's ups and downs isn't good," Bridges said. "Even if you were lucky enough to pull your money out at the peak, you must get back in before it starts going up again. Yet, the natural inclination when the market is at the bottom is to get nervous and hold on until it feels better, but by then, you've missed a portion of the recovery."

Alternatively, if you're actively saving for future needs, a bear market can be your friend.

"If you're adding to your portfolio when the market is down, you're getting more for your buck," she said. "Many stocks are essentially on sale, and you'll take advantage of the market's rebound, which tends to offer solid returns."