A decade-by-decade guide to retirement planning

From your 20s to your 60s, what to do to make sure you’re prepared

The ability to retire doesn't happen overnight. It takes time and effort to make sure you're ready for life after your nine to five.

Only 51% of adults age 60 and over believe their retirement savings are on track, according to a 2020 Board of Governors Federal Reserve report. How much to save has a lot to do with when you plan to leave the workforce and the type of lifestyle you want to have.

"Everyone, no matter their age or amount in savings, can—and should—get started," said Jessica Jones of BOK Financial Advisors.

According to Jones, there are some general guidelines you can follow at every age to help you be ready for retirement.

In your 20s: Don't wait—start now!

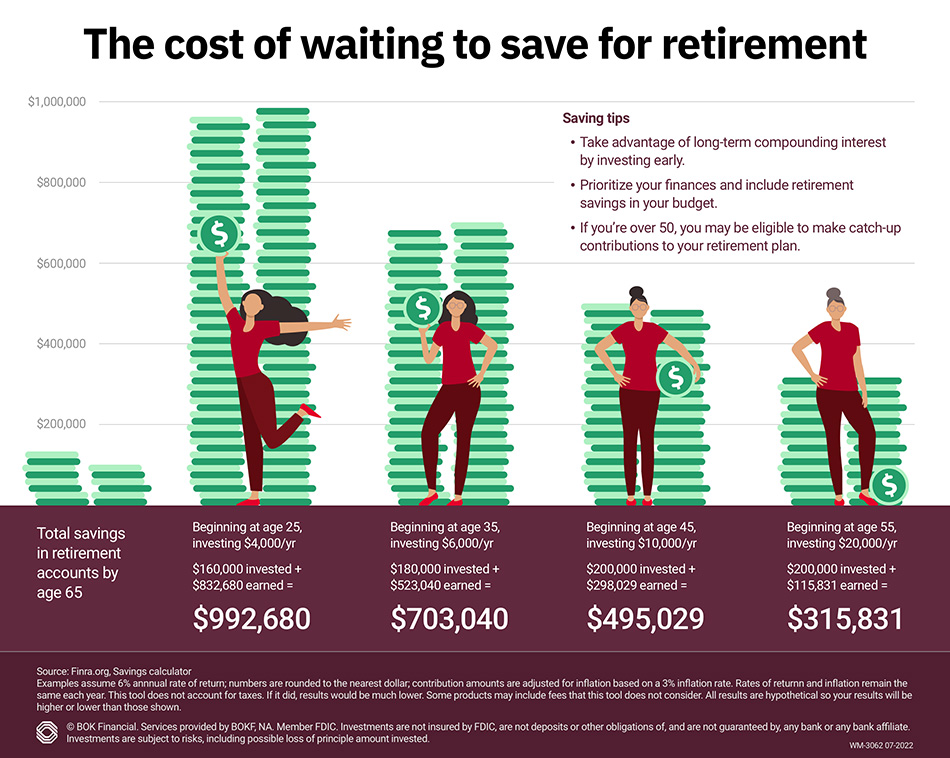

Time is on your side during your 20s. Consider this: Every dollar invested at 20 years old has the potential to become $88 by the time you're 65, but that drops to $23 by age 30 (assuming a rate of return of 10% for a 20-year-old, decreasing 0.1% each year). Thanks to compound interest, which is interest earned on interest, it's beneficial, dare we even say a necessity, to start saving early—even if it's just a small amount each month, Jones said.

First, get yourself in the right mindset. Educate yourself on how money works, and learn to set a budget and stick to it. Being disciplined with your money will set you up for success.

When you get your first full-time job, sit down with a financial advisor and build a financial plan to personalize your short, mid, and long-term goals. A financial plan acts as a road map for your money.

At this age, consider investing in simple index funds with low expense ratios or annual management fees.

"You will never find someone who says 'I wish I didn't start investing at 20 years old,'" said Jones. "Don't wait! Aim for $100-150 per month, but any small amount is better than nothing, and over time, that small amount can turn into a lot."

In your 30s: Find balance

In your 30s, your obligations to work and family likely start to increase. It's also when some people lose track of their financial goals and fall prey to unnecessary lifestyle creep. Jones suggests being conscientious about credit card debt and carefully considering big purchases.

Time is starting to catch up with you, so save, save, save! By your 30s, you should have some type of retirement account open, either through your employer or independently, and be diligently investing every month. Many ask, "Should I pay off debt or invest that money?"

"Your goal in this time period is building retirement savings," explained Jones. "Investments are the priority in your 30s, and debt payoff, especially low-interest debt like a mortgage, may be secondary because you can never make up the lost investment time."

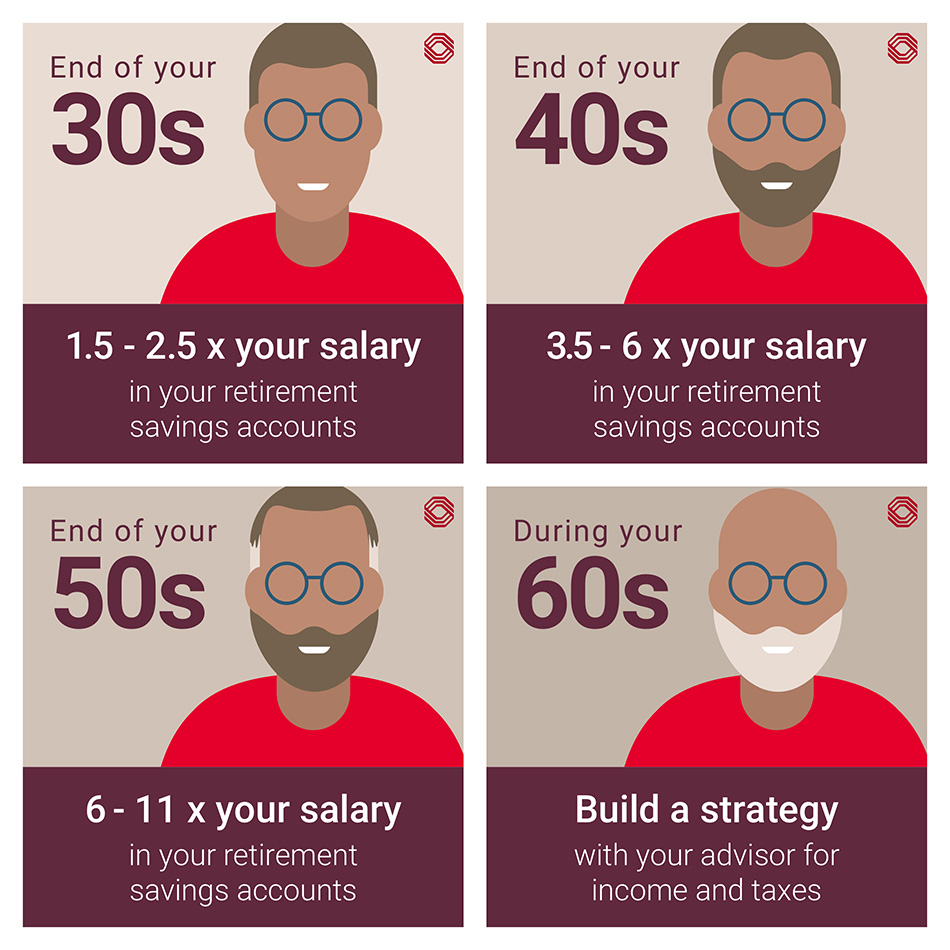

If you weren't able to save in your 20s and you're just starting out, aim to save at least $350-$500 monthly to catch up. A good rule of thumb is to have saved 1.5 to 2.5 times your salary by the end of your thirties.

"Don't leave money on the table," Jones said. "Take full advantage of any employer matches to your 401k. If you don't, it's like walking away from free money."

At this stage in the game, do you have people who rely on you, like a spouse or children? If so, you need to have adequate life insurance. Work with a financial advisor to review policy options, which may include a term life insurance policy that lasts until you're 55 and can replace five times your income. Hybrid long-term care policies and whole life policies are other options to consider. Set a goal to build an emergency fund with three to six months of expenses.

"Stuff happens to everyone, and you don't want the inevitable bump in the road to throw you off track," Jones said.

In your 40s: Stick with the plan

By now, you should be well on your way with retirement savings. If not, make this a financial priority ASAP, Jones suggests.

Think about what you are saving for and how you envision spending your time in retirement. After all, that's the reason you're saving in the first place. Do you want to live quietly in your current home? Move to the beach? Travel? These factors will determine when you can retire and how much money you will need.

In your 40s, your investment risk exposure is typically still moderate to high so you may consider a mix with something like 80% of your investments be in equities like stocks and 20% be in cash or low-risk investments. By 49, you should have 3.5-6 times your salary saved to be on track.

Review and update your financial plan annually. Take time to address your tax strategy and review the different types of pre- and post-tax accounts. For example, if you anticipate being in a higher tax bracket at retirement, you may want to invest more in a Roth IRA, which you can pull from tax-free later in life.

In your 50s: Dial down the risk

You can see the light at the end of the tunnel, so it's time to dial down the risk.

"Your risk strategy should be moderate to moderate plus at this point," said Jones. "You won't have time to recover from another stock market crash, so you need to allocate your funds accordingly."

By now you should have 6-11 times your salary saved in your retirement accounts. Individuals 50 and over can make annual catch-up contributions up to $6,500 to their retirement accounts. Note: this amount changes periodically, so be sure to pay attention to the annual limit. Jones highlights the importance of working toward being debt-free in your 50s, including your mortgage. See if you can trim expenses, like any unneeded life insurance policies or monthly expenses you no longer need.

Start exploring Social Security options like spousal benefits and if you want to defer drawing from Social Security or not.

Healthcare can be one of the most significant expenses a person faces in retirement. Be familiar with your company's health insurance policy and if you will need to purchase health insurance out-of-pocket.

"We have seen an uptick in people waiting to retire until they are eligible for Medicare because of the large expenses associated with health insurance," Jones explained.

In your 60s: Be tax savvy

Work with your financial advisor to develop an income and tax strategy to ensure your investment accounts are set up correctly to pay you forever.

The last thing you want is to unnecessarily lose large chunks of savings to taxes. Jones suggests thinking about a mixed tax strategy where some of your money comes from pre-tax accounts like a 401(k) or an IRA and some from after-tax accounts like a Roth 401(k) or Roth IRA.

"Withdrawing from various accounts means your tax burden will be lower, for longer," she said.

Unless you plan to spend it all, review your will, powers of attorney, and beneficiary designations to make sure your wishes are correctly recorded so your family, favorite charity, or whoever you select, will benefit from your generosity.

"It's never too late or too early to starting planning for the future," Jones concluded. "Working with a financial advisor who can guide you through each phase of retirement planning is a perfect way to get on the right track for a stress-free retirement."

Note: If you're feeling behind, you may be interested in reading this piece on catching up on your retirement savings.

Update (May 15, 2024): A revised version of this article is available.