Jobs report hits economic sweet spot

Data could greenlight continued Fed rate changes

The U.S economy added more than 300,000 jobs in August, right in line with market expectations. The market was expecting an increase, and the reality was on par with expectations, said Michael Kitchen, senior money market portfolio manager at Cavanal Hill Investment Management.

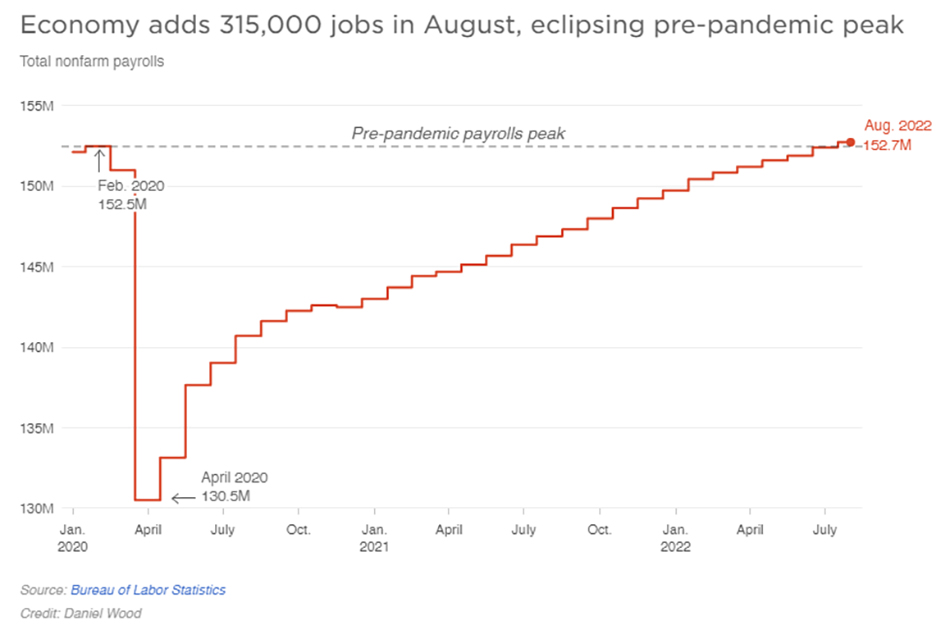

Nonfarm payrolls rose by 315,000 jobs in August. While unemployment rate climbed to 3.7%, two-tenths of a percentage point higher than expectations; wages increased, with average hourly earnings up 5.2% from this time last year, slightly lower than the expected. The biggest sector gainers were professional and business services, health care and retail.

Kitchen weighed in on the implications of last week's data as reported by the U.S. Department of Labor and the Bureau of Labor Statistics.

What do you think of the August nonfarm payroll number released on Friday?

Kitchen: The nonfarm payroll number was slightly bigger than expected, but only mildly so. Month-to-month, the pace of job gains slowed significantly. Alternatively, the unemployment number was a little worse than expected and the monthly average hourly earnings were down a bit.

The bottom line here is that the Fed's campaign to get inflation under control may be beginning to bear some fruit. More people are participating in the workforce. The job market is still strong. It's safe to assume the Fed will take this as a green light to continue powering rates higher.

Markets are breathing a sigh of relief, and signaling that what the Fed has been doing appears to be working so far. We don't see markets reflecting the sense of urgency that we would have if the number had come in radically higher than expectations. Still, whether the Fed will move 50 or 75 basis points on Sept. 21 when the Fed meets again is still an open question.

What do you think of the numbers released earlier in the week?

Kitchen: Thursday's jobless claims numbers offered some conflicting clues as to the economic environment; initial jobless claims came in lower than expected, indicating a strong labor market. One might expect claims to rise as the Fed continues to tighten, but we didn't see it in that report.

Also coming in lower than expected was the job-opening data, released on Tuesday. Revised private payroll data released by ADP on Wednesday, though, showed that corporate staffing rose at a somewhat tepid pace last month.

However, the fact that productivity was down 4.1% was unhelpful to the Fed because higher productivity means you don't have to hire as many workers. This is one reason many employers want people back at their desks; they say lower productivity is due in part to remote working.

So what does it all mean?

Kitchen: There are many measures of inflation, but all of them are above the Fed's target of 2%. Inflation remains at a 40-year high as supply constraints collide with stimulus driven demand. In response, financial conditions are tightening faster than they have in 40 years. In total, the Fed has raised rates 2.25% through July. Higher credit spreads are also playing a part in tightening financial conditions.

To combat this inflation, the Federal Reserve is targeting a decline in job openings as a result of higher interest rates, together with quantitative tightening. August numbers represent a 20-month streak of positive job growth—which means the labor market is something of a shining star amid the rest of the economy. U.S. hiring might be slowing, but it's remaining strong.

But that shining star has a downside: With COVID halting a lot of economic activity, followed by a swift recovery, labor has become a scarce resource. That means labor, for the first time in decades, has significant bargaining power regarding wages. This creates the risk of a wage-price spiral; the imbalance favors labor and higher wages, which is inflationary. In sum, the Fed—and the U.S. economy—might have a long road ahead before inflation dips to 2%.

“The Fed—and the U.S. economy—might have a long road ahead before inflation dips to 2%.”- Michael Kitchen, senior money market portfolio manager at Cavanal Hill Investment Management