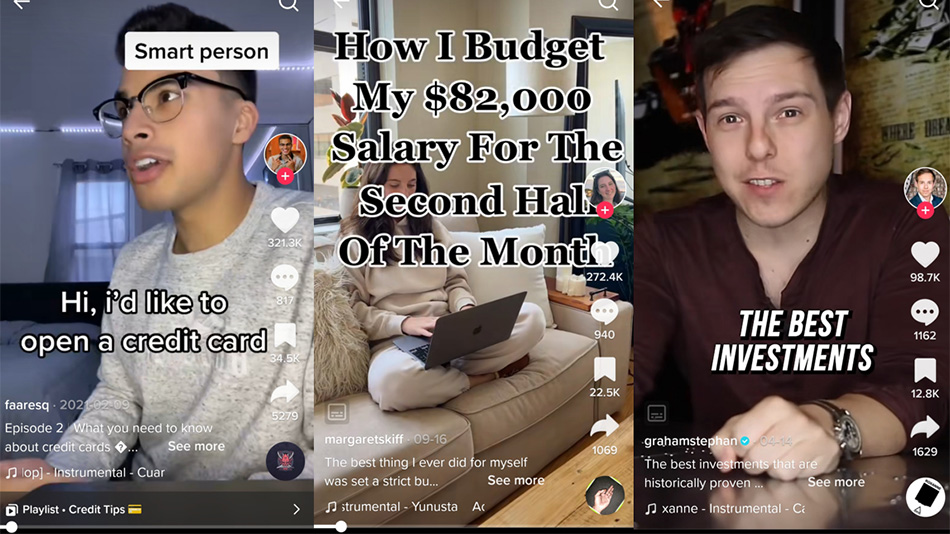

Should TikTok be your financial advisor?

Gen Z turns to social media for financial advice on everything from credit cards to investments

When Gen Z gets curious about something, they don't want to "Google it"—they want to look it up on their favorite social app.

New data shared by Google revealed that almost 40% of young people ages 18 to 24 prefer to search for information on social media apps like TikTok or Instagram rather than Google.

Gen Z prefers these apps for their brief, easy-to-scroll-through videos that show off how to make fresh guacamole, what to wear on a first date, where to go if you're visiting Dallas for the weekend—and even advice on personal finance.

While the world of personal finance is vast and nuanced, Gen Z tends to focus on topics like debt management, budgeting, credit cards, investments, and women's finances.

When people search on Google, the top results are typically from organizations established in an industry. Top results on TikTok are most-liked videos, often posted by popular users.

"The information people are finding on social platforms could be from influencers, and the question becomes, what are their credentials? What is the quality of the information they're providing?" said Maureen Kelley, family office director, BOK Financial®.

These questions illuminate real concerns that social media users must consider, especially when the consequence of losing your money in a crypto investment gone wrong is likely much worse than mistakenly adding parsley instead of cilantro to your fresh guacamole.

Research shows that Gen Z appreciates listening to advice on TikTok from someone who looks, sounds and feels like a friend. These influencers may come across as more relatable and accessible for this audience than a credentialed financial advisor, who may be more than twice their age and appear out of touch with their interests or concerns.

Young people getting financial advice on TikTok should ask themselves a few questions, Kelley said.

- What's in it for the person giving the advice?

- Are they trying to sell a product or a course?

- What is their motivation for putting the information out there?

"Anytime there's a hot tip—that's dangerous," advises Kelley. "But if they're giving advice that's educational about budgeting or spending, then that's likely going to be helpful."

Source: TikTok handles @faaresq, @margaretskiff, @grahamstephan

"Anytime there's a hot tip—that's dangerous, but if they're giving advice that's educational about budgeting or spending, then that's likely going to be helpful."- Maureen Kelly, family office director, BOK Financial

Who is Gen Z, really?

Gen Z is not a generation marked by greed, scrolling TikTok with ambitions to get-rich-quick. Taking a look back at the throng of headline events Gen Zers have lived through, it shouldn't come as a surprise that this generation's relationship to money is defined by conservatism and a reverence for the dollar.

Today's young adults are sure to remember the unease at home during the 2008 financial crisis, along with the uncertain times brought on by the pandemic: mass unemployment, the stock market plunging thousands of points in a single day, and more recently, record inflation that has driven up prices for rent, gasoline, groceries and more, just as this group was entering adulthood.

"Between being entertained by funny videos, this generation is interested in learning," Kelley explains. "They're searching on social media for advice on a broad range of topics including how to make wise decisions with their money."

So, despite concerns over listening to a potentially untrustworthy influencer or finding questionable financial advice, Kelley maintains an optimistic attitude for what it all amounts to. "I am so encouraged for today and future generations because these young people care about their finances and they are looking for information."

Filling in the gaps

How can parents or mentors help Gen Z in their pursuit of financial literacy? "It's important to encourage a young person's curiosity and independence, but at the same time, help them to make good decisions," Kelley said.

This does not mean denouncing TikTok or disparaging its influencers but rather, meeting them where they are. "You can't tell an entire generation to turn it off, don't get your information from those apps. That's not going to happen," Kelley said. "I believe that when a parent or mentor can be involved in their learning, that's when the information becomes real and takes hold. Show them you care."

For some, this may feel like a tall order.

Kelley implores parents to not let a low level of confidence result in avoiding difficult conversations. "My suggestion to parents is to initiate the conversation and get involved by asking questions more often than you're talking. Ask the young people in your life to explain a concept to you based on what they've gathered through other sources."

Letting them lead the conversation opens up a dialogue and a starting point for a parent or mentor's guidance. You may discover that they're interested in a credit card because a TikTok influencer said it was a good way to build credit. Free from the pressure of having to understand interest rates or fees, you can simply share your experience using credit cards, whether good or bad, and what you learned along the way, Kelley suggests.

"You just want young people to be discerning," she added. "Encourage their desire for knowledge—no matter where it's coming from—because the more knowledge we have, typically, the more equipped we are to make better decisions."