Inventory and inflation dampen retailers’ holiday spirit

Shoppers starting early to find the best deals; some in search of in-store ‘experiences’

Some diehards won't even consider shopping for the holidays until after Thanksgiving, but "organized consumers" will likely be done before the turkey is out of the oven, according to Accenture's Annual Holiday Shopping Survey, which found that 45% of respondents shopped earlier or throughout the year in search of the lowest prices.

This is not a new trend, says Benjamin Wolthuizen, an equity analyst who covers the consumer discretionary sector, including non-essential retail industries, at Cavanal Hill Investment Management, Inc., a subsidiary of BOK Financial Corporation. "Retailers are making a shift to promote the holidays and run deals even earlier as the demand has shifted away from piling everyone into a store all in one day," he said.

Inflation is playing a part as well. A National Retail Federation October 2022 survey found that nearly half (46%) of consumers were beginning to buy or at least browse before November, with budget driving the decision to start early for 60% of those early shoppers, up 6 percentage points from last year.

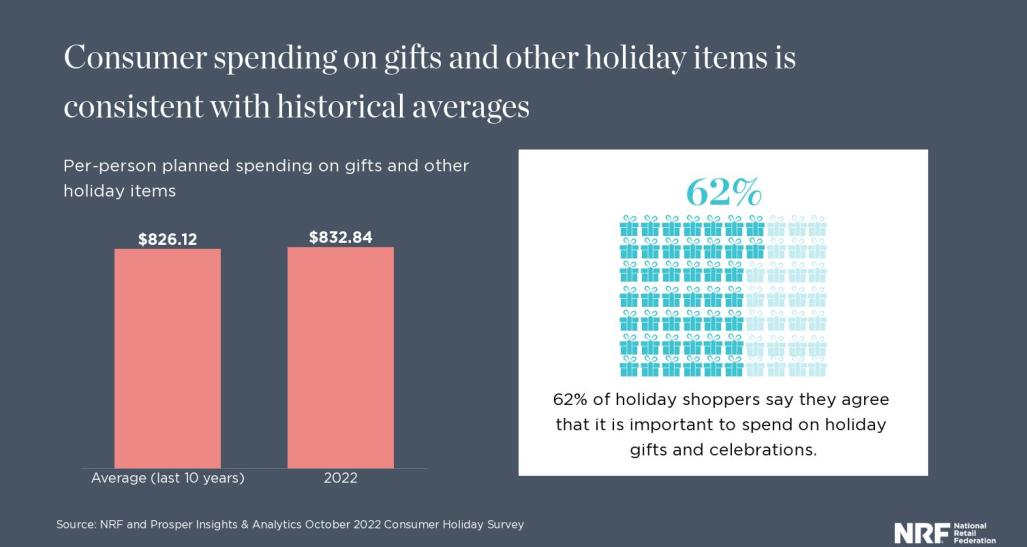

While it's been a challenging year with month after month of record-setting inflation, consumers are still prioritizing holiday spending.

Retailer outlook tepid at best

The holidays look very different than they did the past two years, Wolthuizen said. "The last few years were anomalies—first, everyone was locked up inside, not spending money on travel or eating out. Then in 2021, the pandemic relief efforts put some additional cash in some families' budgets. This year, high prices are a huge challenge for many would-be shoppers."

While more than half agree that it's important to spend on holiday gifts and celebrations, experts predict we'll only see single digit-growth in retail sales this holiday season. KPMG's retail executive outlook expects 4.2% growth compared to prior years, which is within the typical range of 3-5%, but actually flat when you factor in inflation.

"Inflation is the most frequent talking point on retail company earnings calls," Wolthuizen said. "A 4-7% increase in sales looks solid until you factor in inflation and identify that in reality it's more like a 1-2% decline."

People are being more selective about where they spend their money, Wolthuizen said. "For a family to maintain their same budget, they'll have to make cuts in certain areas because food and travel costs are up 10-15% alone. That may mean they'll trim spending on other discretionary areas like spending on gifts."

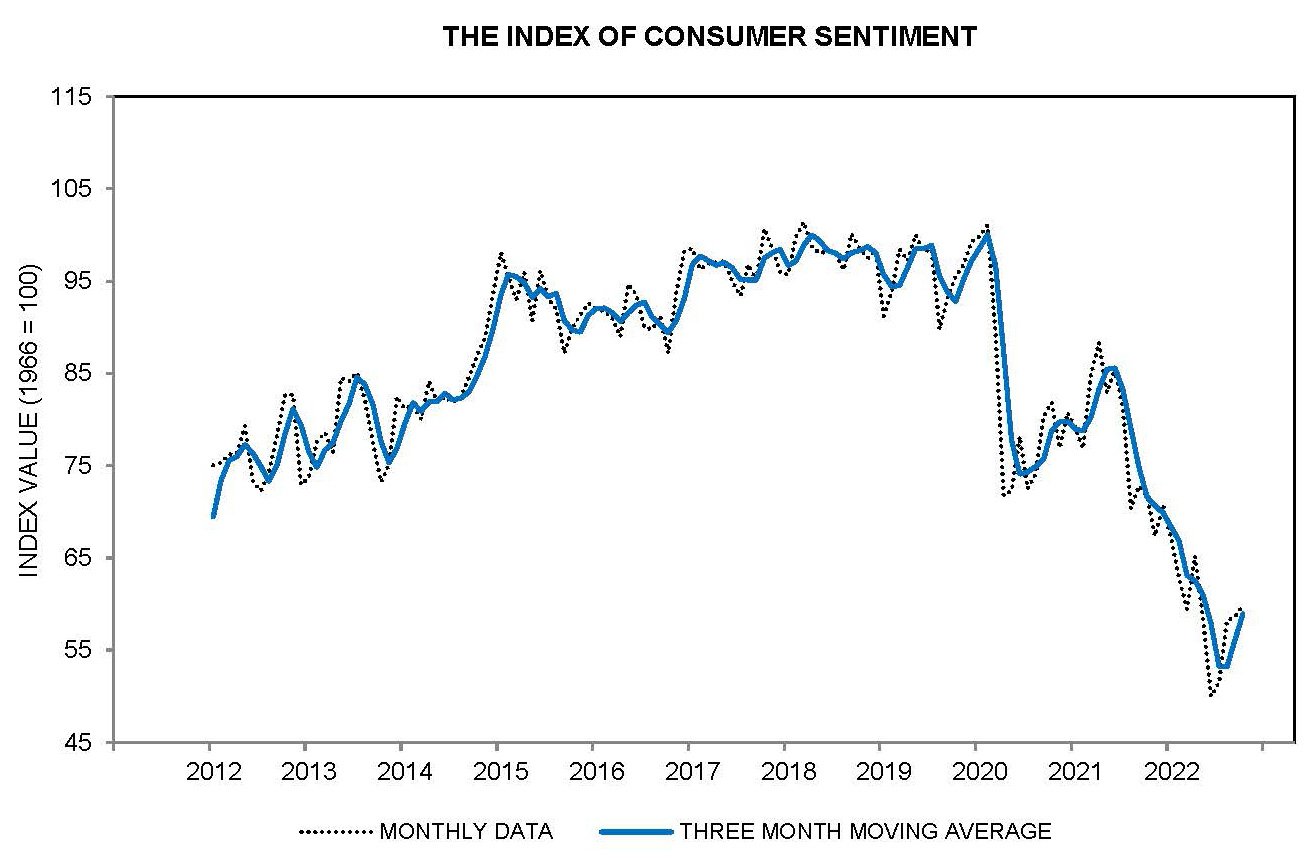

Consumer sentiment going into the holiday season isn't too rosy either. While the University of Michigan Index of Consumer Sentiment shows a slight increase since June, it stands at just 59.9%, down from 76.4% year-over-year.

"One of the most telling stats I've seen going into this holiday season is that only 10% of consumers expect to spend more this holiday season than last year," Wolthuizen said. "That group is usually in the 60-80% range, and retailers are likely to feel the difference."

From inventory woes to experiential shopping

As consumers struggle to navigate the higher prices, retailers are also struggling to manage mounting inventory.

"Many of the companies have been discounting products throughout the year, rather than waiting for the holiday season in attempt to manage excess inventory," Wolthuizen said. "It's a much different situation than last year when supply chain challenges were causing delays for all types of businesses."

Among respondents in the KPMG survey, 56% of retail execs expect to have significant inventory hangover after the holiday season, and correspondingly, 52% planned to increase discounting in an effort to move inventory.

While sales may be enticing some shoppers to a business, unique experiences are attracting others. Accenture found that 68% of consumers (and even more older millennials—88%) said in-store services or experiences would entice them to choose one retailer over another.

"Retailers with physical stores could be set to gain this holiday season as consumers go in search of the perfect gift, the experience of seeing Santa, or the peace-of-mind of picking up items in-store themselves to ensure that have the product in their hands," said Jill Standish, a senior managing director at Accenture who leads its retail industry practice globally. "Innovative retailers are applying creativity to the store layout to maximize the sales for each square foot of their allocated selling space."

The Mastercard SpendingPulse mirrors that expectation with in-store retail sales projected to be up 7.9% year-over-year, adding that in-store spending made up 80% of retail sales from January through August 2022.

One additional difference Wolthuizen noted for this year is the increasing cost of shipping. "As smaller retailers attempt to keep pace with the Amazons of the world, shipping costs could really put a dent in some retailers' profitability."

It's on consumer's minds as well. A Radial holiday survey found that free shipping remains a top deciding factor for consumers when shopping online.

"I expect the primary themes of the holiday season to be too much inventory and too much inflation," Wolthuizen said. "We'll just have to wait and see how it all plays out, and if the enticement of a holiday experience or discounts are more attractive to consumers."