Consumers adjust spending to combat persistent inflation

Price hikes have consumers spending more on life’s necessities—and searching for savings

You may recall hearing the word “transitory” often in mid-2021. It was supposed to mean “brief” or “temporary” when describing the year-over-year monthly inflation rate that rose from 1.4% in January to 5.0% in May.

Roughly 18 months later, 7.7% is the average monthly inflation rate for 2022, as of October.

So much for transitory.

Inflation—and how households are managing—has become a way of life. This in spite of the Federal Reserve’s efforts to slow its pace by repeatedly increasing the Federal Funds interest rate from 0.25% in fall 2021 to 4% in fall 2022. More hikes are anticipated.

Inflation or not—recession or not—U.S. consumers will spend. Maybe less in some areas due to higher costs, but more in others due to pent-up, post-pandemic feelings of entitlement.

Inflation is straining households at all income levels. “Low to moderate income families are feeling inflation’s pinch because a high percentage of their earnings pay for necessities like housing, food and transportation. Other households are absorbing rising prices through a combination of wage increases or spending down their savings,” said Amanda Barrett, senior deposit product manager at BOK Financial®.

Source: Strategas

Housing costs, for many people their largest monthly expense, offer little in the way of financial flexibility. Count yourself relatively fortunate if you had a fixed-rate mortgage prior to 2022—with new 30-year mortgage rates near 7%, double a year ago. In addition, homeowners are also paying more for:

- Homeowner’s insurance: Premiums are escalating with the inflated costs of building materials and labor needed for eventual remediation. Reviewing your insurance coverages annually and adjusting them as needed can help limit your potential loss liability.

- Energy costs: Fall 2022 home heating oil prices were recently 56% higher than 2021, and up to 80% higher in early summer. Prices for insulation or other efficiency measures designed to reduce energy costs are also increasing.

- Maintenance: Costs for windows, paint, fertilizer, air conditioner coolant (up 40% or more in both 2021 and 2022) and appliances continue to trend higher due to material costs and availability.

Consumed at home or away, food is a way of life

We all feel the pinch here, wherever we eat. Grocery costs have increased 12% on average this year, according to the U.S Department of Agriculture. For August, the year-over-year jump was 13.5%. It was the 14th consecutive month of growth and the largest 12-month increase since 1979, outpacing the 8.3% jump in overall consumer prices.

Essential fresh food items like eggs, margarine and butter have increased 20%-40%, along with flour, olives and relish. Additional issues have impacted food prices as well—animal illnesses like the Avian flu that have hindered egg production; crop-affecting droughts; and the Ukraine conflict.

How are consumers coping?

To compensate, consumers are becoming more proactive—and perhaps preparing for a potential recession.

Shoppers are:

- Buying meat in bulk, either partial or full sides of beef, to partially offset price hikes of up 11%. To store it all, they’re buying freezers ($700 and up) as they try to reduce per serving prices by 50% or more. Some are eating meat less often or buying cheaper cuts.

- Purchasing private label or store-brand versions of generic items like pasta, beans, seasonings, salt and sugar to save 25% or more over name brands.

- Using or even rediscovering coupons, which enjoyed great popularity in the Great Recession. Their evolution from paper to digital has increased their overall availability and effectiveness. Smart shoppers can combine digital coupons with weekly store specials, paper coupons and loyalty cards. Store apps can also trigger additional savings at checkout.

For those who prefer what the industry calls “away from home” meals, many restaurants and newer meal providers are enjoying a post-pandemic resurgence. And, continued price increases are not discouraging dining out. The National Restaurant Association has projected 2022 sales of $898 billion, up 12% from 2021 and 4% from 2019, with households spending an average of $3,500 annually.

Diners appear to be spending less on tips, however—which were often robust during the pandemic—partly due to patrons’ empathy and generosity. By some accounts, only 20% of consumers tip for take-out meals, much to the dismay of the workers who prepare them and would benefit most.

“Families can manage their overall food spending by budgeting or tracking their home and away food expenses. Planning their home meals and prioritizing nutritious foods when grocery store shopping will help,” said Barrett. “However, enjoying a meal out together and supporting local business owners is also important in a tough economy.”

What’s old is new again for many car buyers

With new-auto sales down and prices up, averaging $47,000 for the first half of 2022, drivers are spending to acquire, repair and retain used cars.

Averaging $33,000, used vehicles are $10,000 above normal. The average vehicle age exceeded 13 years for the first time in 2022, and at 11 million, the number of scrapped cars in 2021 was the lowest in 20 years.

Record sales of auto parts are helping to keep those cars on the road. Genuine Parts Company, largely known for its NAPA retail brand, reported record sales of $5.6 billion, a 17% increase, and record earnings, for the quarter ended June 30. AutoZone reported full-year sales of $16.3 billion in late August, up 11%.

Ongoing supply chain issues are also helping to limit new car production and drive demand for used cars up. U.S. domestic auto production of 1.56 million vehicles in 2021 was about half of 2017 and down 37% from 2019’s 2.511 million.

Five consumer claw backs

As inflation persists, experts expect more consumers to seek savings from their spending by:

- Establishing or fine-tuning budgets.

- Eating more at home than restaurants, though this can hurt local shop owners who have little choice but to pass along their own higher costs, even at the risk of losing customers or sales.

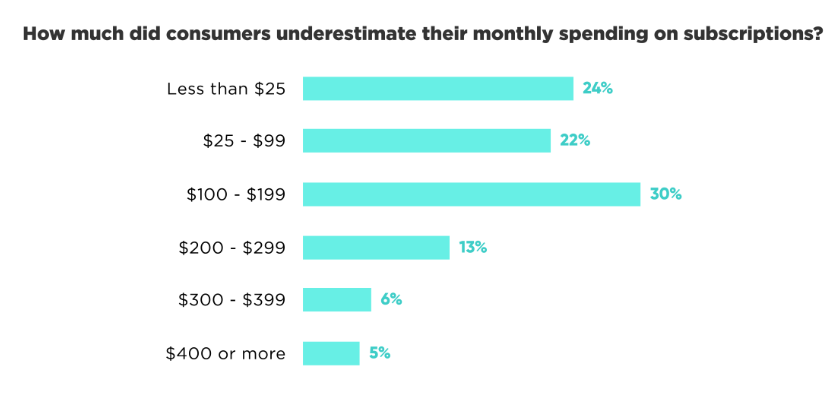

- Reducing subscriptions. In a recent survey, 50% of respondents underestimated their monthly subscription spending by $100 - $400.

- Shopping at secondhand, vintage or resale shops and websites, when updating their wardrobes.

- Seeking free or low-cost local activities as an alternative to higher-priced entertainment, or planning staycations in the face of increasingly expensive travel.

“Small, mindful changes in spending habits like not delaying scheduled car maintenance, fixing a drippy faucet, or turning down lights and thermostats when you’re not at home can save you from bigger expenses later,” said Barrett.

While inflation persists, savvy consumers have an opportunity to reevaluate and change their longtime spending habits—and to make the savings anything but transitory.