Is de-globalization a good thing?

Multinational tensions causing disruption on global stage.

As the Berlin Wall fell, the world economy embarked on a decades-long process of globalization. This period was marked by a new era in which capital could be deployed over a much broader part of the globe as companies sought to reduce costs and maximize profits.

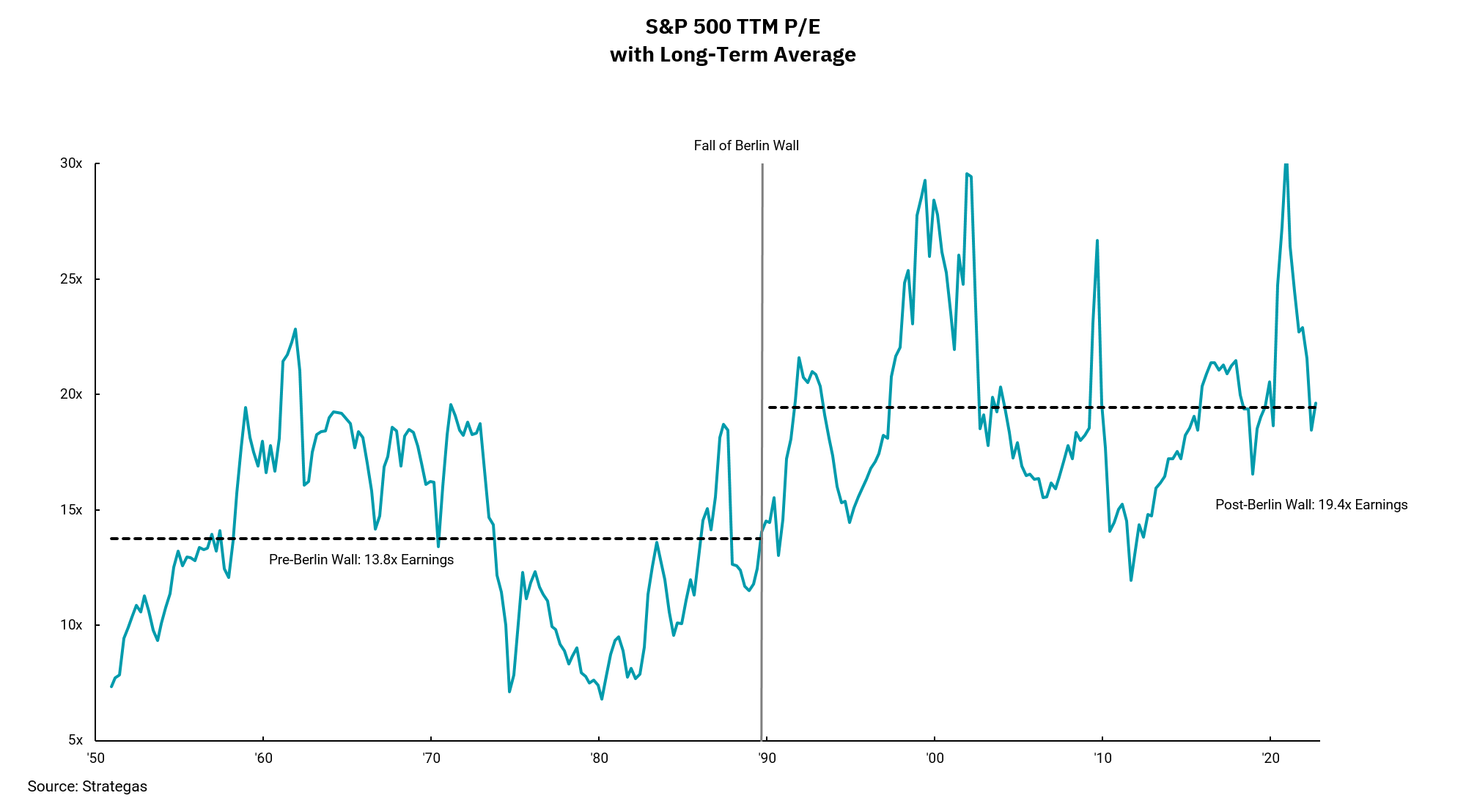

The ability of companies to lower costs meant prices and inflation were lower and more stable, and political divisiveness declined as more countries became part of a global economy. This week’s chart illustrates how, on average, better profit margins and lower inflation led to a period of higher multiples on company earnings.

The recent actions of Russia in Ukraine, along with the impact of COVID -19 on production and distribution channels in China, may serve as a watershed moment in the reversal of this multi-decade movement. We may be seeing a move towards de-globalization as tensions between countries increase and the risks of supply chain disruptions go higher.

Importantly, this trend will not happen overnight and is not all bad. Globalization, for all its benefits, was not all good. In the U.S., we offshored millions of jobs as labor costs were lower overseas. The opportunity to bring some of those jobs back may impact inflation, but higher-paying jobs would be a welcome development longer-term. For domestic equity markets, this could mean a generally lower multiple on earnings. Still, one can see a high degree of variability around this average, meaning periods of positive stock returns will remain.

Higher interest rates allow investors to generate additional cash flows while imparting some measure of capital discipline on companies. A move towards a less global economy will add to this trend.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)