Deficit continues to grow

Congressional budget flexibility to be limited in coming fiscal years.

This week, it was reported the national debt surpassed the $31 trillion mark. With continuing deficit spending, this number will grow, albeit at a much slower pace. The Fed responded to the onset of the pandemic with accommodative monetary policy, while Congress passed multiple rounds of fiscal stimulus, all to reduce the risk of an extended period of negative economic growth and elevated unemployment.

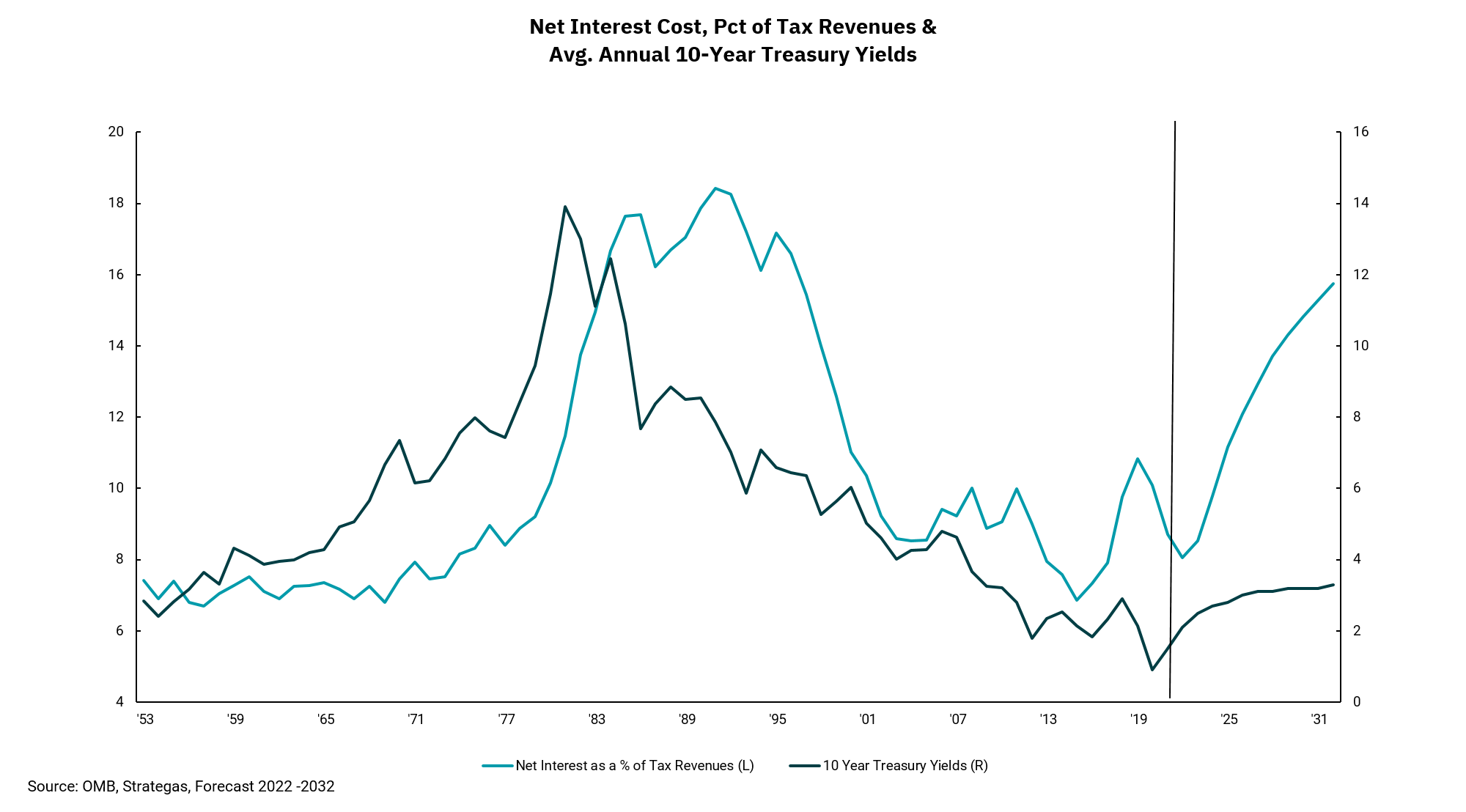

While their actions successfully avoided this risk, we now have higher debt levels and inflation causing the Fed to raise interest rates to slow the economy and cool inflation. This week’s chart shows a forecast of budgeted tax revenues going to service current and expected debt levels as interest rates rise.

Though we are not back to levels seen in the early 1980s, the direction we are going indicates debt service will be a growing headwind to the budget process in Washington in the years to come. The level spent on debt service remained low in recent years, even as total debt increased rapidly, because interest rates were pegged near 0% on the short end and longer-term rates declined to very low levels. Looking forward, we now have a large amount of debt and rapidly increasing rates.

Roughly one-third of the Treasury’s outstanding debt will mature in the next three years. With the rate increases we are seeing today, this will impact overall debt service reasonably quickly and continue to increase even if the Federal Reserve slows and eventually stops raising rates.

Some variables could impact this forecast. The amount of future debt and the level of interest rates will be key inputs. But, it seems relatively certain Congress will be dealing with interest expense as a bigger portion of tax revenues, which could limit budgetary flexibility in future fiscal years.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)