Strategic Petroleum Reserve release

Is there a correlation between gas prices and the presidential approval rating?

With inflation running hot, it is not surprising to see those in Washington try to take action to reduce the burden on U.S. consumers. One area affecting all consumers, but often hitting low and middle-income households the hardest, is gasoline prices.

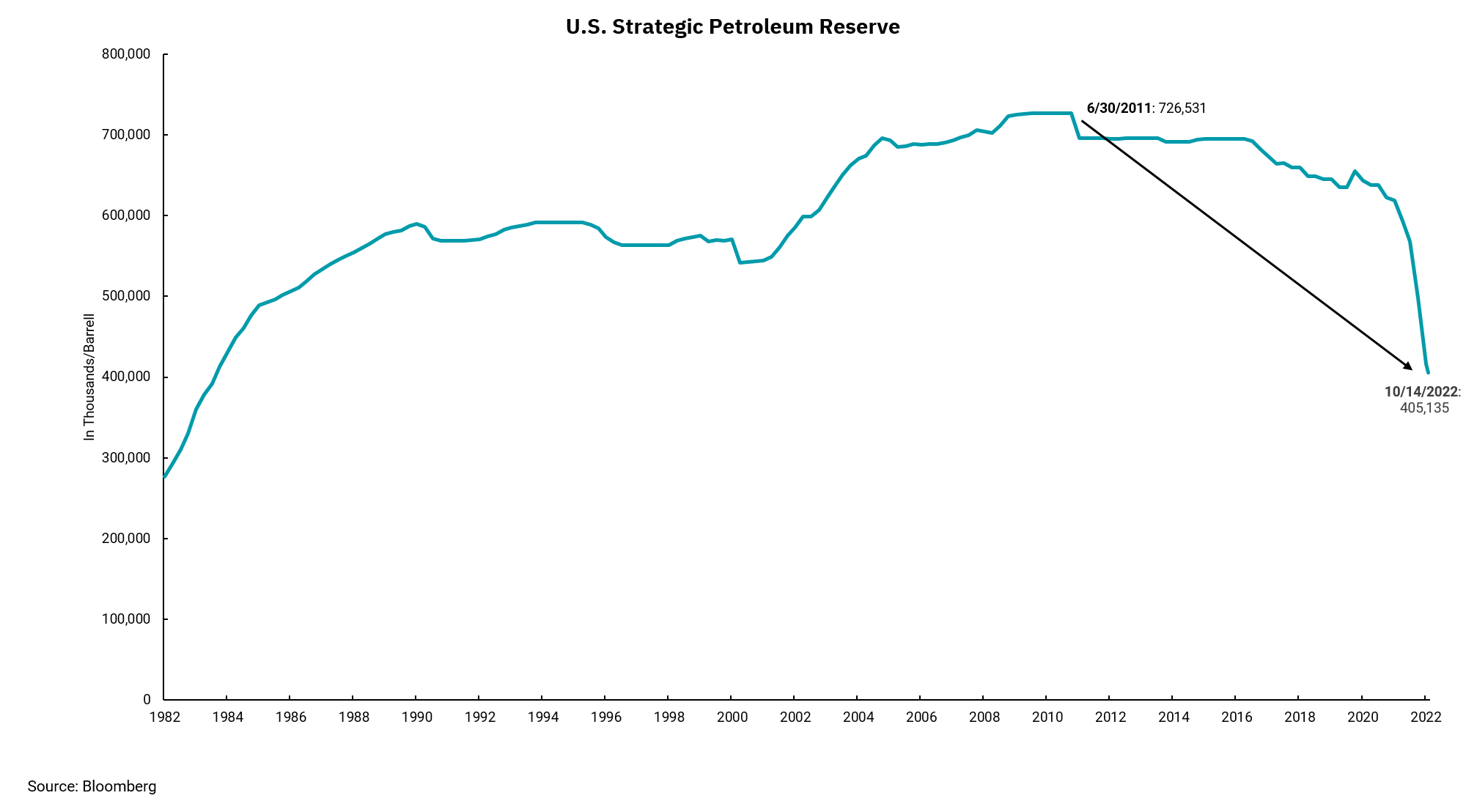

In June, President Biden announced a release from the Strategic Petroleum Reserve (SPR) in an effort to reverse an increase in gasoline prices. Until recently, gasoline prices declined. But as OPEC+ announced a cut in production, oil prices and gasoline prices have risen. President Biden subsequently announced an additional release of oil from the SPR along with calls on refiners and gasoline marketers to ensure price declines in oil flowed through to consumers.

These actions can also have an effect on voter sentiment and can take on more urgency as we approach important midterm elections. There are, of course, many factors that influence how people vote. Still, the economy and inflation, especially at current inflation levels, will usually be near the top of the list of concerns. Why does this matter? Gasoline prices are historically the data point with the highest correlation to approval ratings. The President’s current approval rating is at a level that has seen changes in the control of one or both houses of Congress in the past.

President Biden is not the first President to use the SPR as a means to raise, or as in this case, lower oil prices. However, as the SPR is reduced, it naturally raises the topic of when it will be refilled and at what price. In addition, lower reserves in the SPR potentially reduce flexibility in responding to a supply crisis in the future. The global energy market is being buffeted by many factors as we move towards an energy environment with less reliance on fossil fuels. But the world is not ready to forego fossil fuels entirely.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)