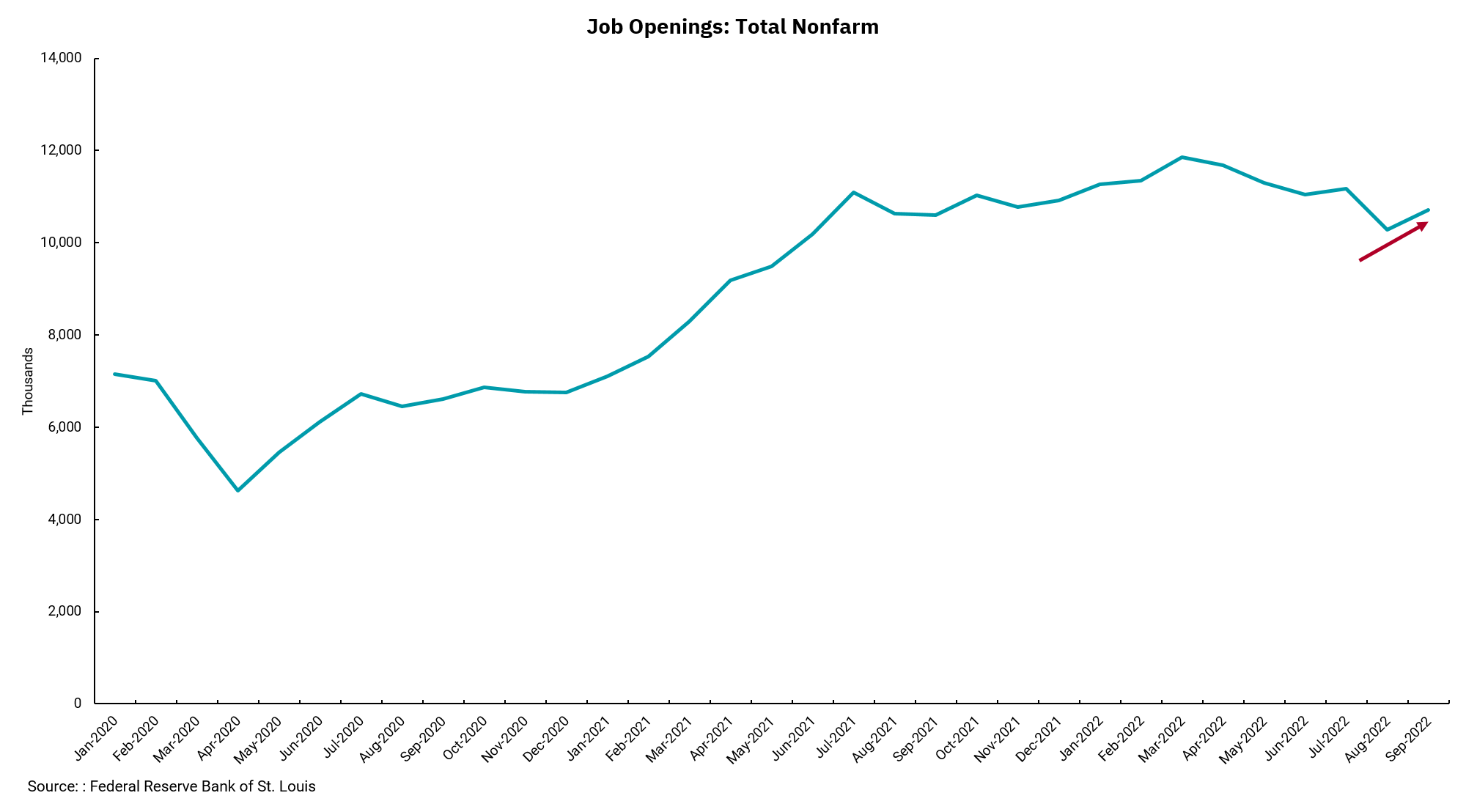

The hot job market may keep inflation high

Latest data shows open jobs still outweigh the number of unemployed.

As we think about inflation going forward and, more importantly consider how the Fed thinks about inflation, the labor market is a key variable in how we move forward. There are many aspects of the inflation picture where the Fed has no control, including items like food, energy, and global goods. Still, the domestic economy is driven primarily by the U.S. consumer, and employment, wages and rents are material parts of longer-term inflation.

As a result, the Fed is watching several data points that help give us insight into the health of the employment market. Friday morning, the monthly employment data was reported, showing job growth of 261,000 while the headline unemployment rate increased to 3.7%. In addition, wage growth within the employment data was slightly higher at 0.4%, which annualizes to 4.5%.

Another key data point is the monthly Job Opening and Labor Turnover Survey (JOLTS), where we can see the number of job openings, as well as information on people quitting and getting hired. Our chart this week focuses on the job openings data within this week’s JOLTS release. There are over 10 million open jobs against only 6 million unemployed people. The point is not that there is a job for every unemployed person, as there will always be skill sets of geographical differences between the two, but this does reflect a job market that remains very robust. Within this environment, we expect the Fed to remain on a path to raise rates as they work to reduce demand leading to slower job growth and hopefully lower inflation pressures moving forward.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)