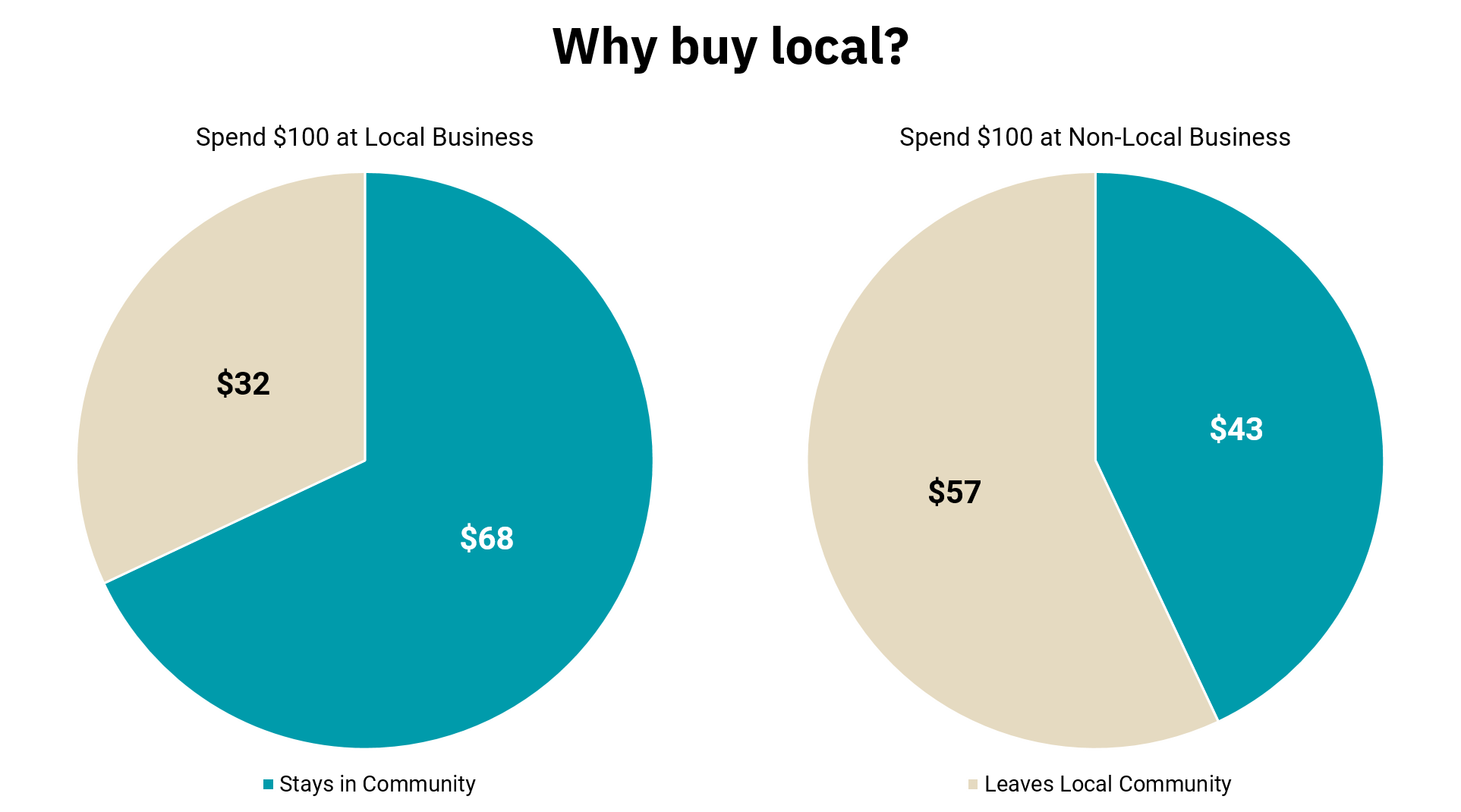

Why buy local?

The big impact of supporting small local businesses.

Small businesses are an essential part of the U.S. economy, producing roughly 44% of our annual economic activity. Additionally, the 30 million small businesses operating across the country are significant drivers of innovation, jobs and economic growth.

November 26 was Small Business Saturday, a day to celebrate small businesses and encourage people to include them in their holiday shopping. The chart on the left shows the importance of doing so. When you spend locally, 68% of your dollars remain in your community, compared to only 43% when shopping non-local.

The very act of shopping has changed materially over the last few years as consumers now have significant options to shop. Online spending continues to rise as a percentage of total retail sales, and most major store brands offer in-store and online options. While smaller shops can have an online presence, the focus, in many cases, remains the person-to-person shopping experience.

As you think about your holiday shopping this year, please consider locally-owned stores and businesses as an option for your gift purchases.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)