Implied Fed rate hikes

Third 0.75% increase in a row intended to combat inflation.

The rate-setting arm of the Federal Reserve, the Federal Open Market Committee, or FOMC, met last week to discuss their outlook for the economy and inflation.

It was no surprise when the announcement came on Wednesday afternoon of a unanimous vote to increase the target on overnight fed funds by 0.75% resulting in a new range of 3.0-3.25%. This marked the third meeting in a row of an increase of 0.75% as the Fed considers how they need to get ahead of current inflation rates to reduce price pressures going forward.

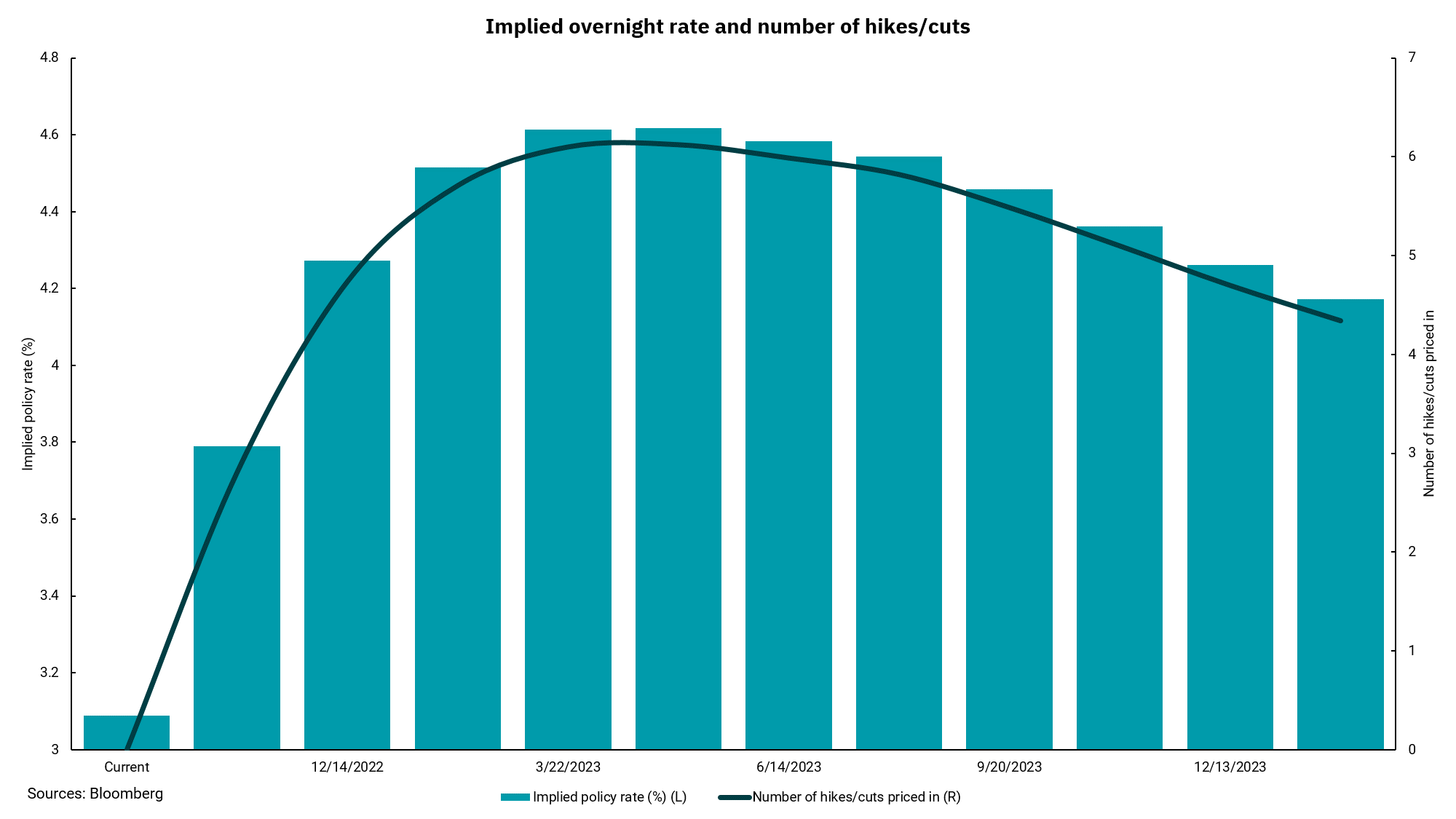

However, the capital markets reacted negatively. Interest rates rose across the yield curve, and stock markets swooned after the FOMC raised expectations of how rates may go in their two remaining meetings this year and into early 2023. The Fed now anticipates rates at 4.4% by year-end, implying another 1.25% of increases over the next two meetings. In 2023 a further hike to 4.6% is expected before the Fed pauses. In addition, the FOMC’s outlook is for rates to stay steady throughout 2023 before slowly falling in 2024.

Some view this extended outlook coupled with a forecast for unemployment to reach 4.4% as an admission by the Fed for at least a shallow recession before their program of higher rates and quantitative tightening is complete. This is the clearest evidence given so far that the Fed will not step in to ease policy even as the economy weakens.

Stocks took this to mean earnings estimates will need to fall further and reduced the outlook for the multiple on these now lower earnings going forward. This process is not pleasant but is necessary to assure stable prices and better growth prospects in the longer term.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)