Core inflation still far above target

Fed on edge about inflation becoming ingrained in longer-term expectations.

The inflation numbers reported this week did nothing to discourage the Fed from thinking they need to continue aggressively raising rates for the next few months.

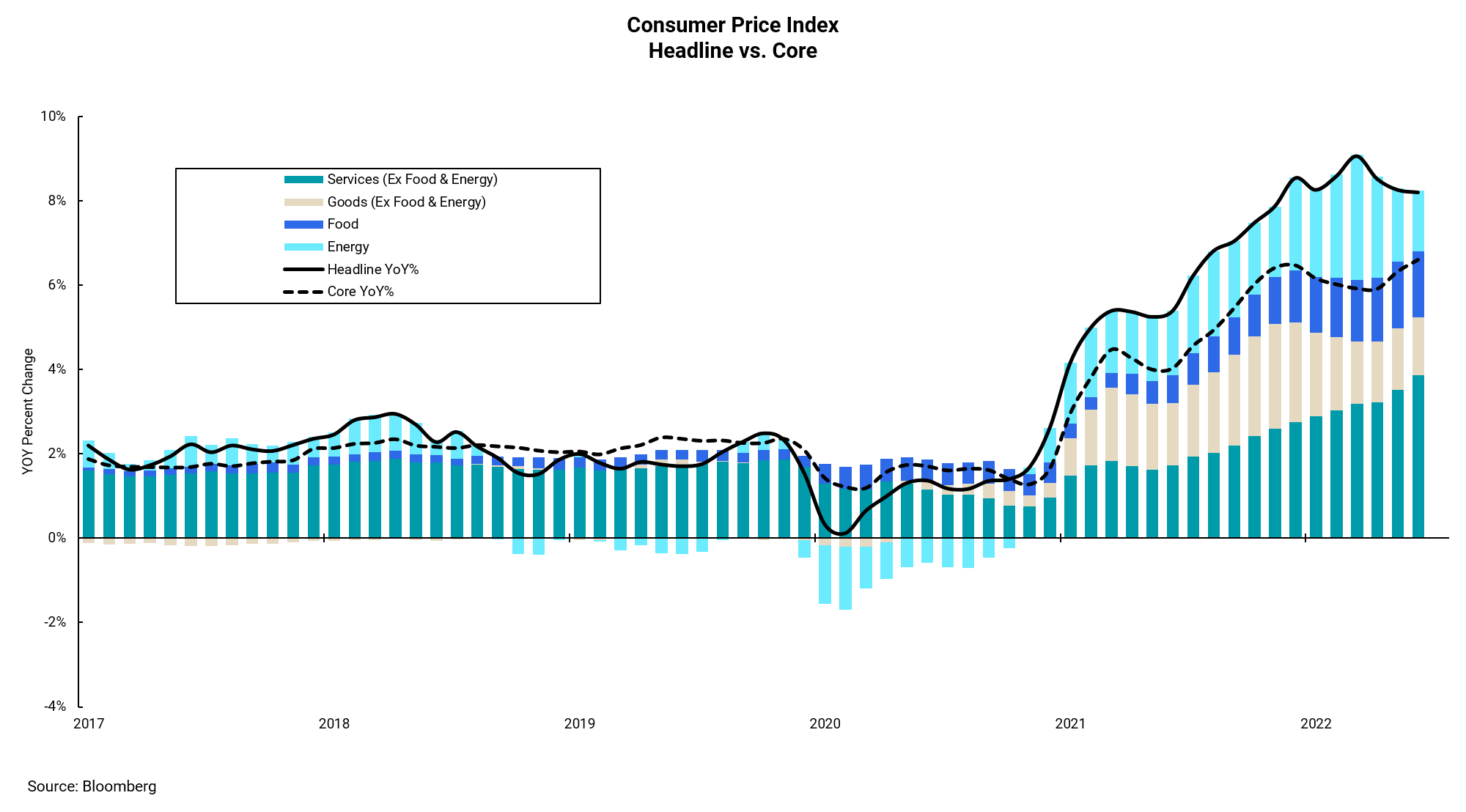

While this week’s chart focuses on the Consumer Price Index (CPI), the Producer Price Index (PPI) would be similar. In both cases, we see some relief as the headline rate of inflation has slowed month-over-month and declined on a year-over-year basis, but the core rate of inflation continues to accelerate as rents and wages remain hot.

To be sure, both measures are still far above the Fed’s goal of 2%, but the more important of the two is core inflation. Recent measures of strength in the labor market continue to have the Fed on edge about inflation becoming ingrained in longer-term expectations, leading the market to now expect another 0.75% increase in rates in November and a better than 50/50 chance of a 0.75% hike in December. Before the CPI release, the market was building in a 0.50% increase in December and another 0.25% in early 2023.

We should begin to see some relief in the cyclical areas of inflation, including some commodity markets and areas such as used cars, where prices have declined. However, rents are still in an uptrend and wage pressures are still evident. The Fed has committed to “stay at it” until they see clear evidence inflation is retreating towards their 2% target. Currently, there is scant evidence that we are close to seeing such a trend.

As the Fed raises rates and shrinks its balance sheet, the economic and market risks are elevated. Our outlook remains on the cautious side while maintaining our long-term optimism on the U.S. economy.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)