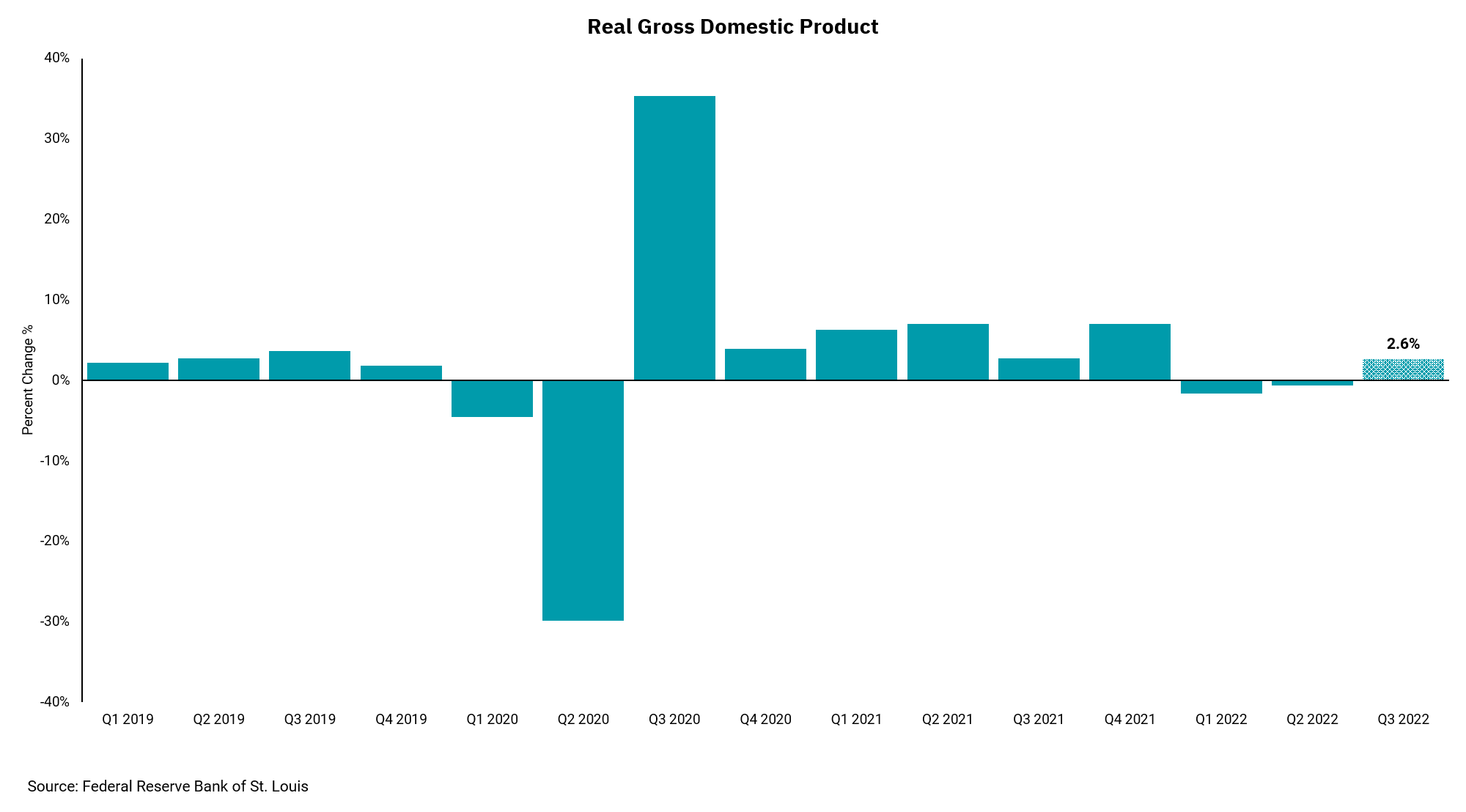

Third-quarter GDP increases

The inflation rate increases slow, but is still above the Fed target.

After first- and second-quarter measures of U.S. gross domestic product (GDP) showed declines in economic growth, the focus on the first look at third-quarter GDP was more intense than normal. Economic growth of -1.6% for the first quarter and -0.6% for the second quarter were followed by a reading of +2.6% for the third quarter. While this number is subject to revision, a positive reading helps lessen questions about whether or not we are currently in a recession. Our stance has been we are not, but two negative readings in a row have corresponded with recessions in the past.

Factors which had led to the declines early in the year, including trade and inventories, were less impactful this quarter. Non-residential investment and consumer spending, along with government expenditures, overcame the drag of slowing residential investment as the housing market felt the full impact of the Fed’s move to raise interest rates to cool inflation.

Speaking of inflation, the headline measure of inflation within the GDP report slowed to 4.2% while the core number also slowed to 4.5%. The core number is most important from a monetary policy standpoint and remains well above the Fed’s stated target of 2%. Still, a slowing in the rate of increase in inflation is a positive development.

As the Fed meets this week, there is nothing in this report that would slow the Fed from raising rates by an expected 0.75%. Further, they remain on track to increase interest rates again in December and early next year.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)