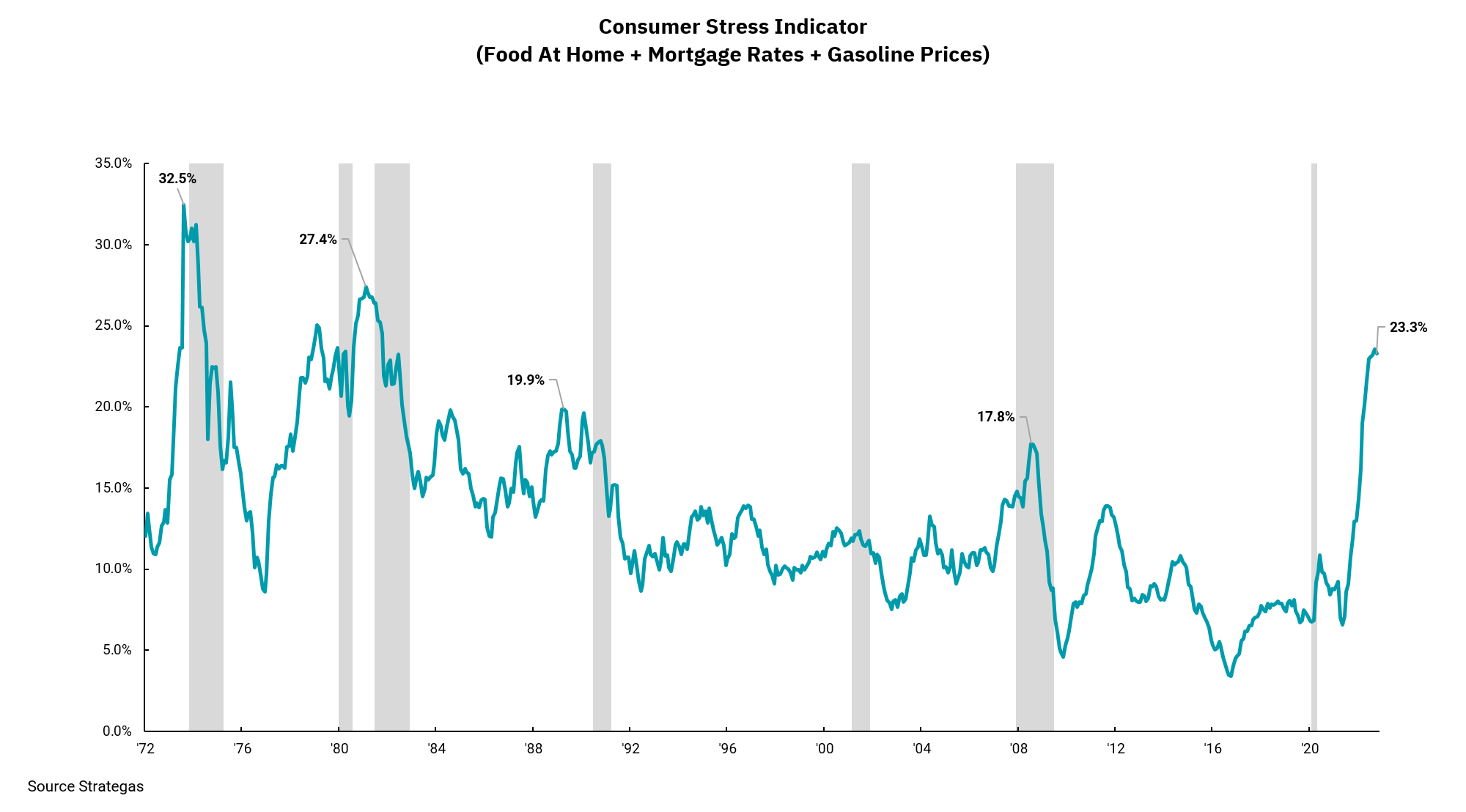

Consumer stress indicator skyrocketing with prices

Sharp increases in indicators have historically preceded a recession. Is history repeating itself?

The U.S. economy is driven primarily by consumer spending. Higher inflation has the impact of stressing consumer spending as essentials cost more and limit the amount of money consumers have available to spend on discretionary items.

One way to measure consumer stress is to combine the cost of three main areas of spending – groceries, housing, and gasoline. Adding the inflation rate on groceries, mortgage rates, and the price of gasoline gives us an idea of how much is being spent on these essentials. When we look at past periods of economic activity, pay close attention to the gray-shaded areas representing recessions, we can see how higher consumer stress levels equate to periods of economic weakness.

The recent bout of inflation has pushed stress indicators to levels not seen since the early 1980s and are certainly at levels that preceded past recessions. This highlights why the Fed focuses on inflation areas that most affect U.S. consumers.

Unfortunately, part of the Fed's remedy for higher inflation is higher interest rates which can lead to higher mortgage rates. The good news is that those periods of higher stress were followed by periods of reduced stress as economic slowdowns ultimately led to lower inflation and interest rates.

A recession from here is not a foregone conclusion; however, if we have one, it should subsequently allow inflation and overall consumer stress levels to decline.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)