Amid higher prices, holiday spending remains strong

74% of consumers expect to spend the same or more than last year.

Amid higher prices, holiday spending remains strong 74% of consumers expect to spend the same or more than last year.

Almost two-thirds of the U.S. economy is built on consumer spending, with the holiday season being the most important period for many retailers. Keeping track of spending during this period can provide clues to how consumers are feeling and color the outlook for the economy in general.

There are, of course, many factors that influence spending. A solid job market is near the top of the list as consumers with a job are more likely to spend. This year appears to be in fine shape as unemployment remains low at 3.70% in the last report from the Department of Labor, and overall demand for labor is robust.

An offsetting factor this year is inflation. Prices have increased at the fastest level in some forty years, and the response from the Federal Reserve has been to raise rates faster than any past period of Fed tightening. The goal of higher rates is to slow the economy, setting into motion a cycle of reducing demand, which reduces corporate incomes, leads to higher unemployment, and slows the economy.

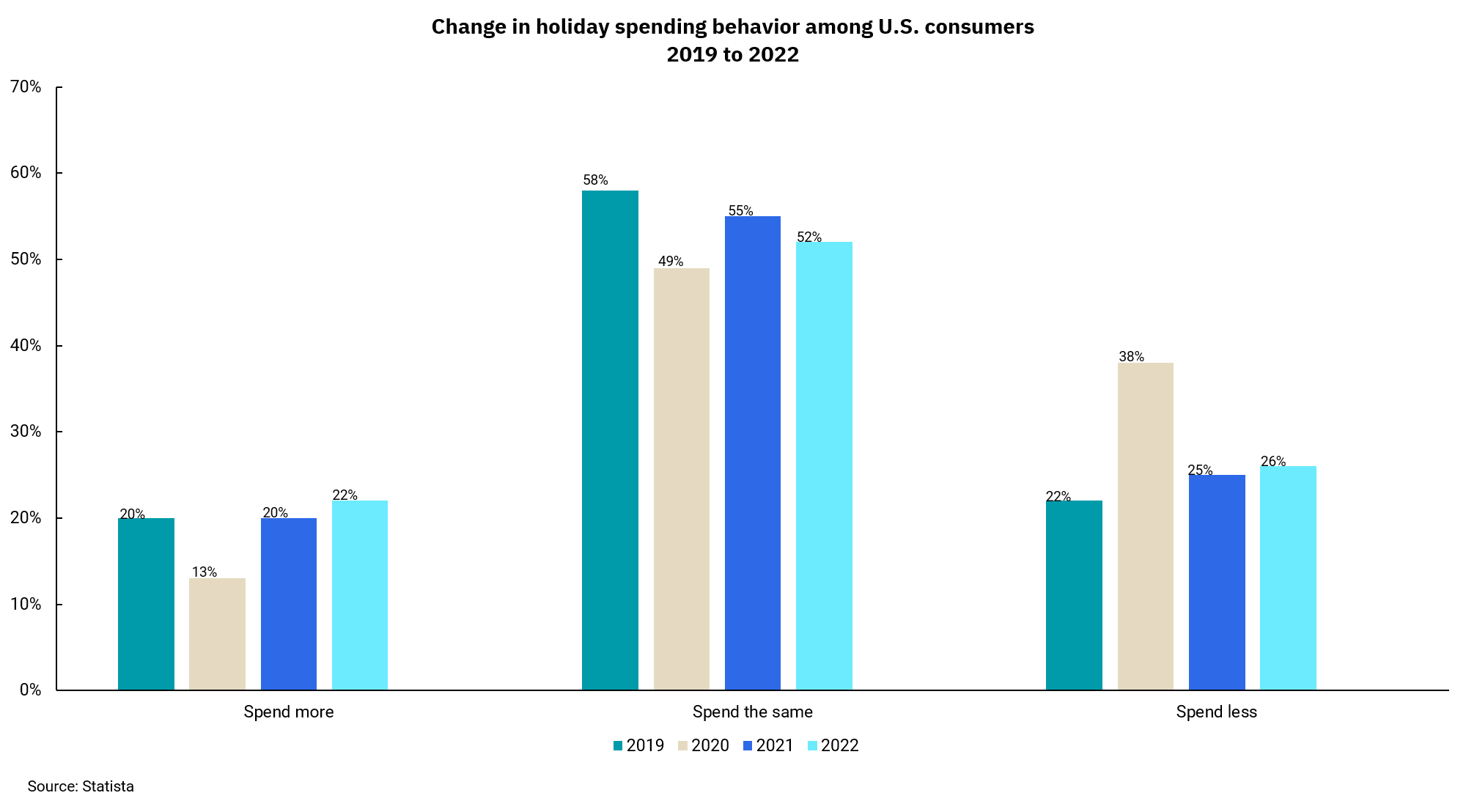

Increases in interest rates act with a lag, so it is not surprising that the economy has yet to react. As our chart shows, consumers expect to spend about the same amount this year as last, and things look a lot better than the pandemic impacted 2020 season. It is worth noting that if the spending level is the same and prices are higher, the actual amount of goods purchased will be somewhat less than in 2021.

Not trying to be a Grinch this holiday season, but we are aware that the effects of this year’s Fed tightening may be felt a bit more in 2023. We wish you and yours a safe and happy holiday season.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)