Does over-paying on my mortgage really help?

3 ways to pay off your home early

High inflation is causing many Americans to pinch their pennies. For budget-conscious homeowners, overpaying on their mortgage is one tool to help reaching long-term savings goals.

It’s a great savings tool, but there are misconceptions, said Tanya Bates, regional director of home loans for BOK Financial Mortgage.

“Does over-paying cut your mortgage in half? No,” said Bates. “But it does drastically save you money in interest and reduce the terms of your loan. There is validity to the rumor, but not to that extreme.”

The total amount saved depends on the size of your loan and the original terms, but the savings can be significant.

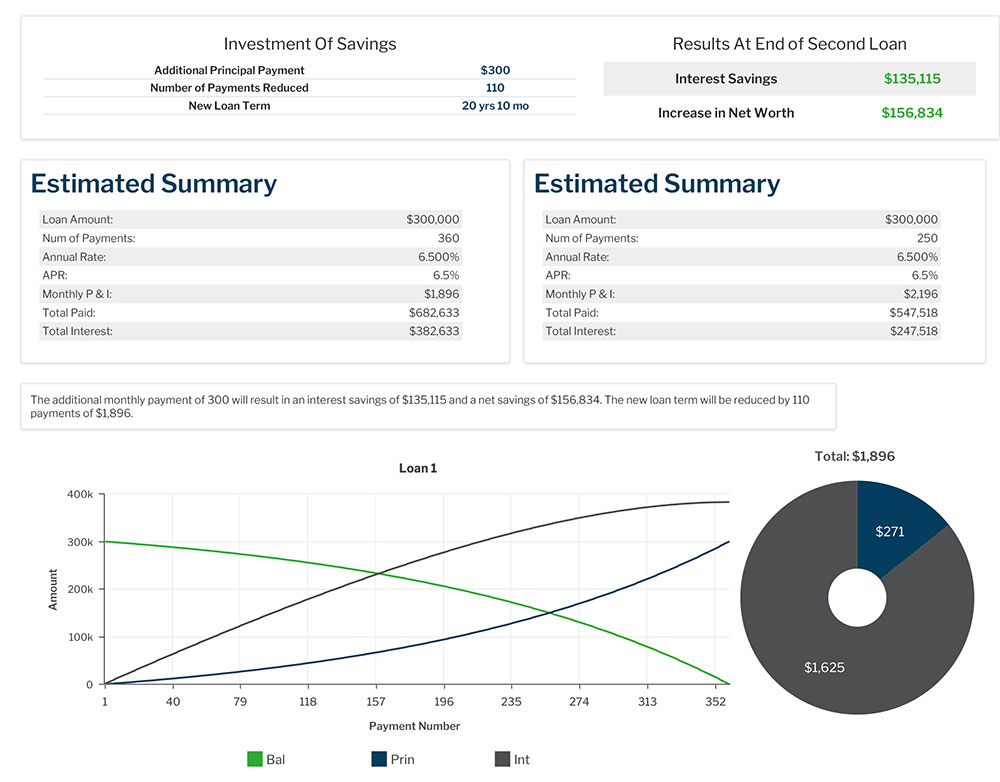

The example on the left is a loan where the mortgage owner never makes overpayments, while the one on the right shows the results of paying an additional $300 per month.

“You can see the savings are significant from interest and term reduction,” Bates said.

But how does it work?

“Most mortgages are amortized loans,” explained Michael Merritt, mortgage servicing operations manager for BOK Financial®. “What that means is that each payment has a scheduled amount that will go toward interest and a scheduled amount that will go toward the principle of the loan based on the original loan amount and interest rate.”

At the beginning of the loan, more funds are applied toward interest because the principal balance is higher, Merritt explained. “This is not a pre-set amount but a calculation every month; you can change it by every extra dollar paid over your normal payment amount.”

Merritt pointed out there are numerous online calculators that allow users to enter their balance, length of loan and interest rate to see how any additional payments toward a reduction in principal would affect the life of the loan.

Other approaches

Over-payment isn’t the only way to shorten the term of a loan and lower the amount of interest paid though.

“The most effective way to do this is to pay extra money each month toward your principal balance,” said Merritt. “When you do this, each payment after the principal payment will update the amortization schedule and have more of the payment go toward your principle and less toward interest.

“Even small amounts of additional payments each month can add up and take time and interest off of your loan. Every dollar helps.”

Another way some mortgage owners accomplish this is a bi-weekly payment program. Using this method, half of the mortgage payment is drafted every two weeks and sent to the mortgage company. This is also referred to as a budget payment plan and is well suited for people who get paid every two weeks.

“When a full payment is received it will be posted to the loan,” he explained. “Going this route, a customer will make 13 payments in the course of a year, not the traditional 12.

Be sure to call your mortgage company to ensure the 13th payment is posted as a principal reduction, not just a normal monthly payment.”