As economic uncertainties linger, financial worries mount

Between higher prices and rising interest rates, it's no wonder many Americans have money woes. Financial well-being among consumers fell sharply over the last year and is among the lowest observed since 2016.

"Today's financial stress often comes from a combination of increased expenses due to inflation, and the increased cost of borrowing," said Kimberly Bridges, director of financial planning at BOK Financial®. "Consumers who turn to credit cards to bridge the gap when income lags expenses often dig themselves a deeper financial hole."

As proof, Bridges cites today's variable credit card rates that frequently exceed 20% APR and the 'multiplier effect' of compounding.

“The interest doesn’t take a break.”- Kimberly Bridges, director of financial planning at BOK Financial

Where we stand

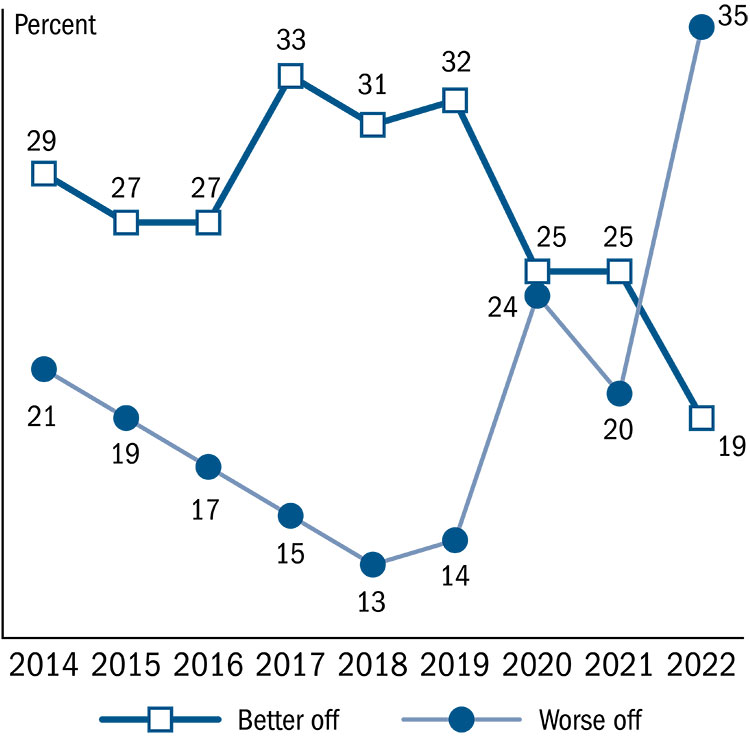

The Federal Reserve's 2022 Survey of Household Economics and Decision making found that 5% fewer adults felt they were "doing okay" financially in 2022 versus 2021. In many cases, higher household spending lagged incomes. Also falling was the number of adults who stated they are spending less than what they earn.

Source: The Fed - Overall Financial Well-Being (federalreserve.gov)

Nearly 25% more Americans over the same period reported that money has a negative effect on their mental health, causing worrisome thoughts or sleeplessness on a near-weekly basis, or even depression.

The results were age-agnostic: From Gen X through Baby Boomers, spanning ages 43-78, more than half said money was a negative influence on their lives. Concerns about physical health, relationships, work and current events ranked behind money worries.

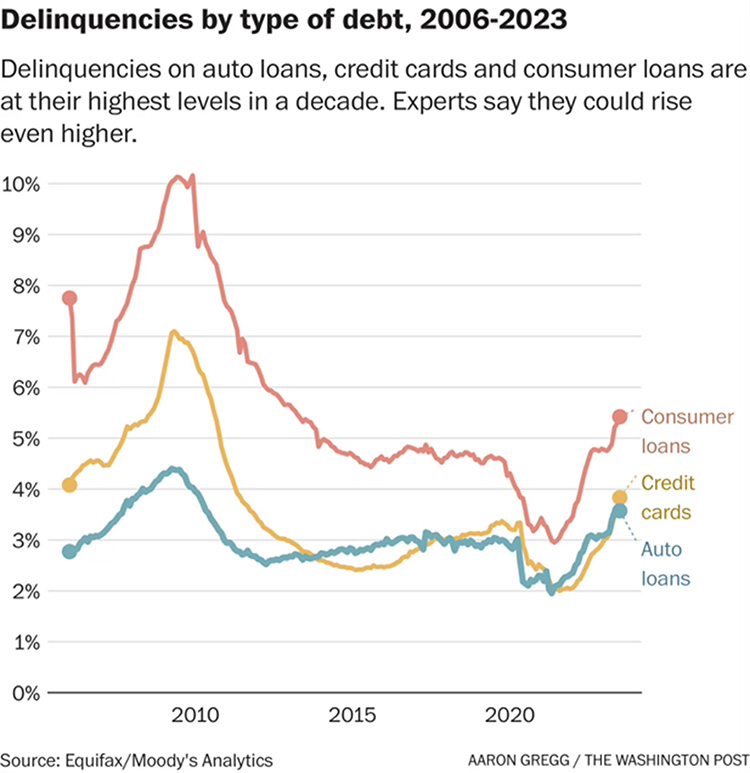

Consumer debt levels are especially concerning. Total household debt reached more than $17 trillion—a new high—and for the first time in the second quarter of 2023. That includes credit card debt, which exceeded $1 trillion. Additionally, delinquencies on credit card and auto loans are up and have exceeded pre-COVID levels, as of August 2023.

Source: Delinquencies rise for credit cards and auto loans, and it could get worse - The Washington Post

How we got here

Bridges cites four financial practices that can lead to worry and poor financial well-being:

- Not knowing your monthly finances and overall financial condition. Bridges mostly sees this in those who ignore their monthly spending patterns. "Consumers often choose not to acknowledge where their money is going and how to change their spending," she explained. "Delaying dealing with issues might work in some aspects of life, but you can't escape financial reality without it getting worse over time."

- Not fully understanding your financial commitments. This especially applies to the use of credit cards, and loans—particularly those with a variable interest rate—which can feel like a tightening financial noose. "In these rising-interest rate times, and for people with fluctuating incomes in particular, any debt tied to a variable interest rate can be troublesome. For people who got in over their heads, their worry is exacerbated by the threat of rising payments on items they already purchased," Bridges said.

- Getting involved in Buy Now/Pay Later (BNPL) programs. Buy Now/Pay Later programs are one way that consumers sometimes commit to debt beyond their means, as these programs can carry annual interest rates as high as 36%. According to Adobe Analytics, BNPL programs used for online purchases grew during the first two months of 2023, with use of BNPL purchases for groceries up 40% year-over-year.

- Not understanding the standard of living you can realistically afford based on your income. "We are inundated daily with verbal and visual messaging telling us how we 'should' live," Bridges said. "We commit to unrealistic lifestyles and when expenses exceed or accelerate faster than incomes, we too frequently resort to credit cards to bridge the gap—and trouble follows. Unanticipated debt snowballs and interest compounds to worsen the situation, heightening stress."

Five ways to enhance financial well-being

Fortunately, many of today's challenges and the resulting anguish can be mitigated by practicing personal financial management basics that transcend any economic era, Bridges said.

If you find yourself agonizing over your finances, Bridges recommends a few ways to tweak your lifestyle to combat that stress:

- Live moderately and below your means. Set your ongoing lifestyle at a level you can afford, based on a reasonable level of income that you know you can sustain or depend on. Never rely on credit to meet your regular living expenses.

- Create a budget with wiggle room, one that provides for savings and building long-term wealth. You might need to increase your income—by taking a second job or taking on a roommate—in the short-run to make that happen.

- Analyze your spending at least monthly to understand any gaps between your income and expenses, and where the money's going. Knowing your full financial picture will tell you if you have a cause for stress or not.

- Learn how to control stress you're experiencing through exercise, meditation, or other forms of recreation and positive interaction.

- Practice gratitude. During times of budget tightening it is easy to feel that our glass is half empty instead of half full. Make it a daily practice to identify things you are grateful for.

"When it comes to the use of credit, only sign up for what you understand and are comfortable with," Bridges said. "Be aware that good times don't always last, and remember that commitments made during those good times can be harmful and stressful later."