More than the mortgage

4 expenses you need to be aware of when buying a new home

Buying a new home is an exciting time, especially when it's your first home. You may feel ready to go when you have the down payment and monthly mortgage amounts factored into your budget, but don't forget there are additional expenses to consider in the cost of homeownership other than how you'll decorate your new living room.

Working with trusted local loan officers and realtors is key to finding the right fit in a new home—and understanding the entire scope of your home purchase.

"Mortgage professionals walk people through the process of buying a home, what they can qualify for and what to expect in the future," said Bill North, North Texas market leader for BOK Financial Mortgage®. "Loan officers also provide ongoing support and advice post-closing on topics like benefits of refinancing or how to use the home's equity for other needs in the future."

More than the mortgage payments

Being able to cover your monthly mortgage payments is important, but there will be other ongoing costs associated with home ownership.

"In addition to the principal and interest payment, you have taxes, insurance, homeowner's association (HOA) dues and maintenance costs to consider," said North.

Get your finances ready

The first step to preparing for homeownership is getting your financial house in order and working with a loan officer, North said.

"A loan officer will review your income, assets, liabilities, debt and credit score, and tell you what you may need to work on, such as improving your credit," he explained. "We'll also consult with borrowers on local programs that can help with down payment and closing costs. A good loan officer will help you understand the process and let you know when you're ready to move forward with homeownership."

When North meets with clients, he breaks down all the financial considerations for buying a home. He suggested the following ways to prepare yourself.

1. Factor in insurance costs

Because homeownership is a long-term commitment, repairs will need to be made along the way—some of which may be covered under insurance. Homeowner's insurance has risen in cost in recent years due to the increasing costs of labor and severe damage done to homes in natural disasters.

2. Maintenance costs are part of life

Homes also require a certain amount of upkeep not covered by insurance. The grass will need mowing, appliances will break down and things will need replacing. You need to budget for repairing or replacing things like the dishwasher and the roof, as well as services such as gardening and housekeeping if you're not going to take care of that yourself.

"The rule of thumb has been to set aside 1-4% of the home's value every year for repairs," said North. "So, if you have a $200,000 home, budget to spend at least $2,000 annually on repairs, maintenance and updating."

If you've only rented before and had these things handled by a landlord, the costs may come as a surprise. Be sure to check for the average prices on these items and services, and take time to crunch the numbers.

3. Homeownership taxes continue past the mortgage

Every homeowner must pay property tax, which may include state, county and school district taxes. How much you pay will be dependent on local tax rates. This expense may be included in your mortgage payments while you're paying off the house, but once the house is paid for, property taxes continue. They go on for as long as you own the home. It'll be up to you to pay them when they separate from the mortgage payment.

Some neighborhoods also have homeowner's associations (HOAs) that enforce guidelines on the homes in the community. This may range from keeping your landscaping in shape and the colors you can paint your house to noise and parking ordinances. HOAs typically require an annual fee and may leverage fines for breaking the rules. Be sure to check if the neighborhood you're considering has an HOA and what the fees and requirements are.

4. Moving on up

If you're considering an upgrade, remember that moving into a more luxurious home could increase your overall cost of living. The surrounding stores in your new neighborhood may be higher end, your children may feel peer pressure from classmates to have more expensive clothing, supplies and tech gadgets, and you may feel the need to "keep up with the Joneses."

North said, "Just because you can afford a specific payment on a house doesn't mean you should spend that much." He suggests would-be homeowners build a holistic budget for all their living expenses, including the house.

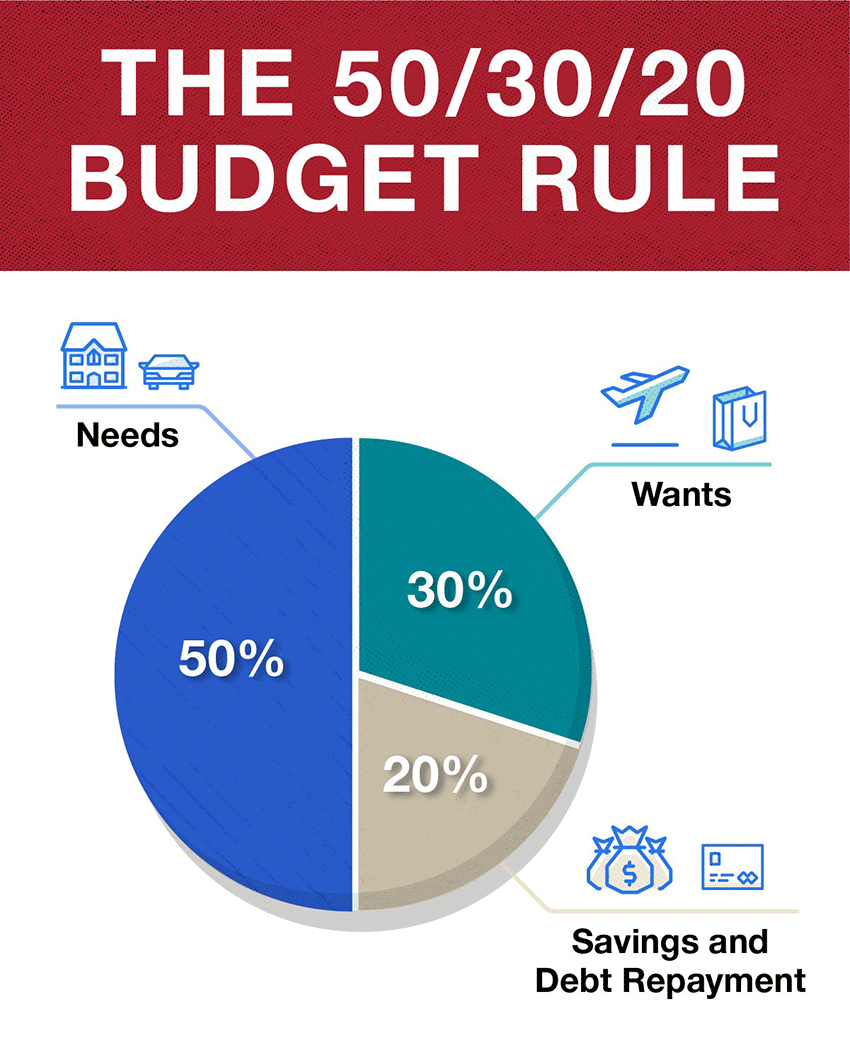

"A good strategy is 50% goes to must-haves, including housing, utilities, food, transportation, childcare and insurance. Another 30% should be allocated to wants such as vacation, entertainment and home décor, and 20% should go to saving for emergencies and retirement."

The benefits of home ownership

The prospect of homeownership is exciting and worth working toward because the benefits may include:

- Real estate values may increase over time. Homeowners build equity as they pay down their mortgage and values may increase.

- More stable housing payments year to year versus renting.

- Pride in ownership and strong community ties.

- Tax incentives (mortgage interest may be deductible).

- The ability to renovate and update a home to fit your needs.

Homeownership is generally a good investment because values historically continue to increase, North said. Keeping a home well-maintained will help it hold its resale value to provide generational wealth to pass on to children or add to your retirement nest egg down the road.

With a bit of preparation, homeownership doesn't have to come with surprise costs and can serve as a good investment in a lifetime of fond memory making.