2024 may start strong—but growth to slow

Economic growth may increase in first quarter, despite high rates

March 2024 will mark two years since the Federal Reserve began raising rates as part of its efforts to bring down inflation.

Over these past two years, many—myself included—have been anticipating that the U.S. economy will slow—and understandably so. After all, these rate hikes are designed to lower the demand for goods and services, which theoretically should bring down prices.

On one hand, the Fed’s efforts seem to be working, as inflation has been trending downward. Based on the Consumer Price Index (CPI), year-over-year inflation was 3.1% as of November, and core inflation (which excludes food and energy prices) was at 4%. By comparison, in January 2023, CPI was 6.4% year-over-year, and core CPI was 5.6%.

Are we there? Not yet.

But to the question of if the economy has finally slowed enough, the answer is: not yet. Core inflation, a focus area for the Fed, is still double the Fed’s target.

Moreover, economic growth is likely to increase slightly in the first quarter of 2024 rather than slowing further, as one would expect given the continued high rates.

So, what’s happening?

The potential uptick in growth in the quarter is mostly due to a factor outside of the Fed’s control: the resolution of the auto workers’ strike.

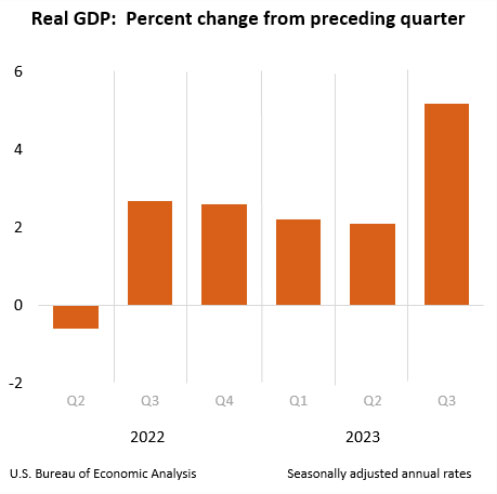

The strike held back manufacturing activity in the fourth quarter of 2023 to such an extent that we already saw weakness in the manufacturing sector during the quarter, even after the strike ended. When fourth-quarter 2023 gross domestic product (GDP) numbers are released, they’ll likely show slower-paced growth, which may seem especially paltry compared to the third quarter, when GDP grew by a whopping 5.2%.

Growth in the first few months of 2024 likely will be nowhere near the third quarter’s level. Instead, it will likely be around 2%, which could be lower if the federal government temporarily shuts down in January. If a budget isn’t passed in time, some agencies’ funding will expire on January 19, causing a partial shutdown, and the funding for the remaining agencies will expire on February 2. If that does happen, it would reduce government spending in the short term, negatively impacting economic growth.

Positive outlook for investments so far

Still, financial markets tend to do well in the first quarter of any year, and their performance during this one is likely no exception. If inflation keeps trending downward and the Fed is done raising rates, that would be positive for both bond and equity markets.

However, inflation surprises are a risk. For example, if the conflict in the Middle East heightens and Iran becomes involved, that could raise energy prices, as would an escalation in the war between Ukraine and Russia. Those scenarios and their impact on inflation would negatively impact bond and equity markets.

For that matter, differences between market expectations and reality could negatively impact markets, even if the fundamental drivers in the quarter are positive. For instance, if corporate earnings are strong but below expectations, that would be negative for the market even though the numbers are good on an absolute basis.

The bottom line is that bond and equity markets should do fine during the quarter with the current economy trend. However, as always, there are risks.

Bigger picture is a slowing economy

All that said, if growth upticks in the first quarter, it’s not a sign that the economy will reaccelerate through the entire year. Given the high interest rates we’ve had and likely will continue to have for some time, the trend is still for the economy to slow. That doesn’t mean we are headed for a recession—we’re still a long way from that—but we’re also not likely to have many more quarters of 5.2% growth anytime soon.

Although the U.S. economy has proved to be more resilient to rate hikes than anyone thought, the higher rates still dampen growth. Meanwhile, tighter bank lending standards have made it more difficult for companies and individuals to gain access to capital. Simply put, the cost of borrowing money is high.

One consequence of this high cost of borrowing is that fewer construction projects for multifamily housing, such as apartments, are starting. In the short term, rents should come down somewhat because of the number of already-started multifamily housing projects being completed. However, in the longer term, the reduced supply caused by fewer new projects may raise rents.

Even if you’re not a renter, rent prices still affect you because of how much rent costs make up the services sector of the economy. For inflation to keep trending down, rents must also keep moving lower. In this sense, the tighter economy might adversely affect keeping inflation high.

And so, while inflation has come down substantially over the past two years, we’re not out of the woods yet.

For more on what may be ahead in 2024, see our annual outlook.

2024 Annual Outlook

BOK Financial investment experts provide their outlook on key issues expected to affect the economy and financial markets for the year ahead.