The Fed: rates to stay steady into 2024

Full effects of previous rate hikes remain to be seen, says BOK Financial CIO Brian Henderson

On Wednesday, the Federal Reserve announced it would not raise rates in December. They instead are waiting to see if the already-high rates will continue to bring inflation down.

The Federal Open Market Committee (FOMC) has been holding the Federal Funds rate at a range of 5.25% to 5.5% since the summer, when committee members last decided to hike rates on July 26.

Nevertheless, the FOMC’s decisions not to raise rates at its September, November and now December meetings don’t mean that consumers and businesses with debt have had much of a reprieve. Keeping the Federal Funds rate at its current level—considered “restrictive,” meant to slow the economy—also keeps the interest rates high on debt for consumers and businesses.

Indeed, consumers and businesses with credit card debt and variable-rate loans are among those who have been feeling the brunt of the rate hikes, said BOK Financial® Chief Investment Officer Brian Henderson. For instance, as of Dec. 11, the average credit card interest rate was 27.82%, according to Forbes Advisor’s weekly credit card rates report.

The high rates also affect consumers and businesses, incurring new debt, such as mortgages. “When someone sees a mortgage rate today of 7% on top of the relatively high price for a home, it can make it unaffordable on the front end. That’s why we are feeling the full effect of the rate hikes in the residential housing market, and one of the reasons home sales are down,” Henderson explained.

Inflation needs to fall more before the Fed cuts rates

However, Henderson noted that some other areas of the economy haven’t felt the full effects of high rates. For example, elevated mortgage rates haven't affected consumers staying in fixed-rate mortgages. Meanwhile, he explained that many large corporations that raised money through the corporate bond market did so in 2021, when rates were low, and they haven’t come due yet.

As time passes, more and more of that fixed-rate debt will come due, which means that some of it will then have to be rolled over at the now-higher rates, Henderson added. That’s one of the ways that the Fed’s previous rate hikes should continue to percolate through the economy—working to bring down inflation further, even without more rate hikes. These strategies take time.

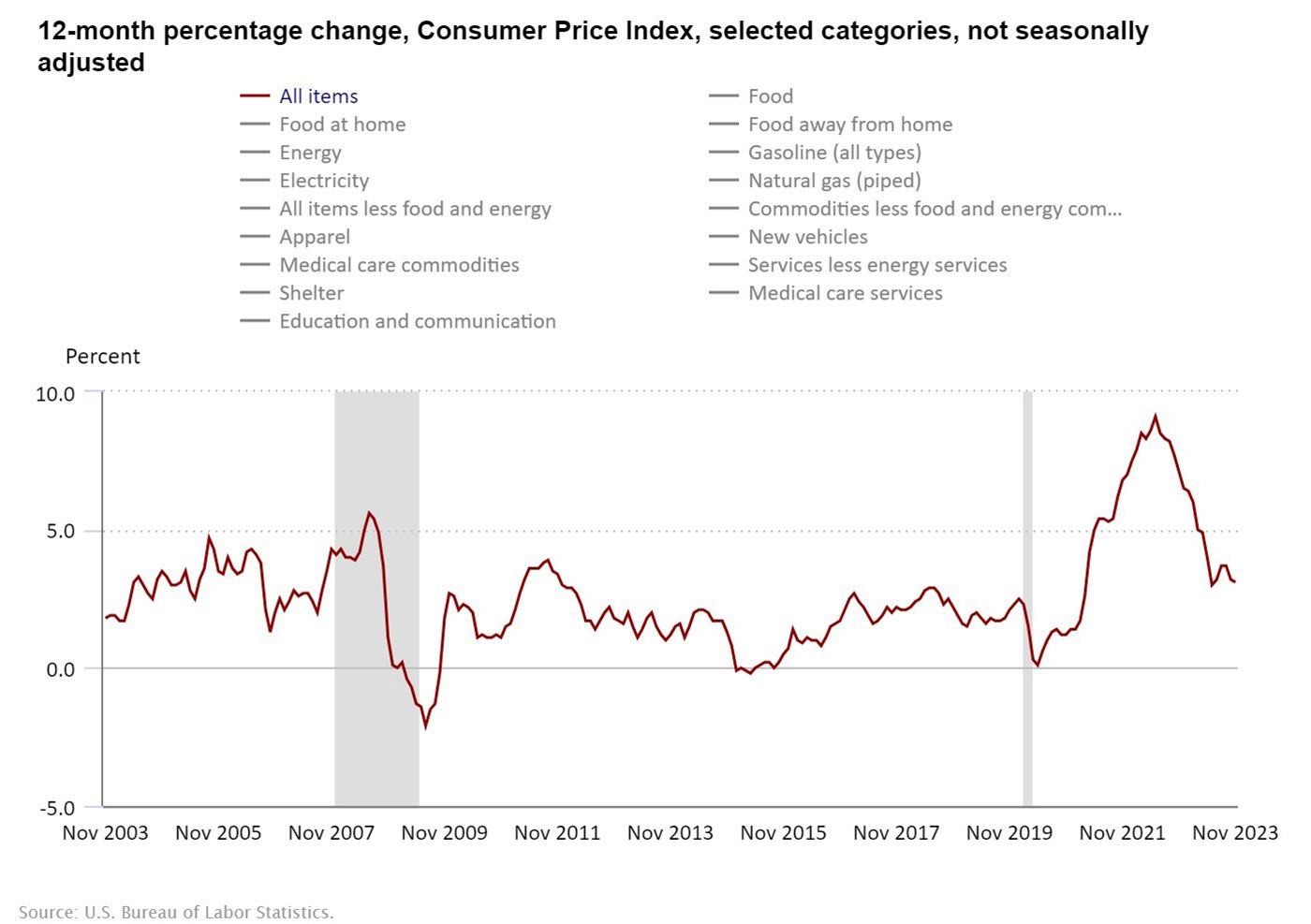

Already, year-over-year inflation has dropped from 6.4% in January 2023 to 3.1%, as of November, according to the Consumer Price Index (CPI). Core inflation (which excludes food and energy prices) has fallen from 5.6% in January to 4% in November. However, these figures are still above the Fed’s 2% target, and while the Fed doesn’t necessarily have to see inflation hit 2% before they start cutting rates, they likely will want to see it fall to at least 2.5%, Henderson said.

Unemployment likely to rise

In order for that to happen, there will likely have to be more balance in the economy, he continued. “The Fed probably feels pretty good with the balance between supply and demand in the goods sector, but not on the services side, which makes up the lion’s share of our economy. It’s all labor related.”

Although the labor market’s continued strength seems like good news, it’s also a major part of what’s keeping the cost of services—and inflation overall—high. And the longer inflation stays elevated, the longer the Fed will likely maintain high rates to try to bring prices down.

Henderson estimated that unemployment would have to go over 4% for the Fed to safely cut rates, reducing the risk of reversing course and raising them again if inflation starts edging higher. Yet unemployment dropped from 3.9% in October to 3.7% in November, according to the Bureau of Labor Statistics.

Rent, too, will have to continue falling, Henderson added. Although the average rent cost decreased by 0.2% from October to November, it’s up by 3.3% year-over-year, according to the Zillow Observed Rent Index (ZORI). Moreover, the index showed rents are up a whopping 29.4% since the beginning of the pandemic. This high rental cost affects renters and non-renters alike because of its impact on overall inflation.

Even with sky-high rents, there’s good news amidst all the economic data. “The economy is slowing, allowing inflation to come down, but growth is still positive,” Henderson said. This situation increases the odds of the economy achieving a soft landing, which means that the recession consumers and businesses have been worrying about since the rate hikes began may never come.