What the Fed’s shifts in monetary policy mean for you

While some debt has become more costly, rate hikes have helped savers

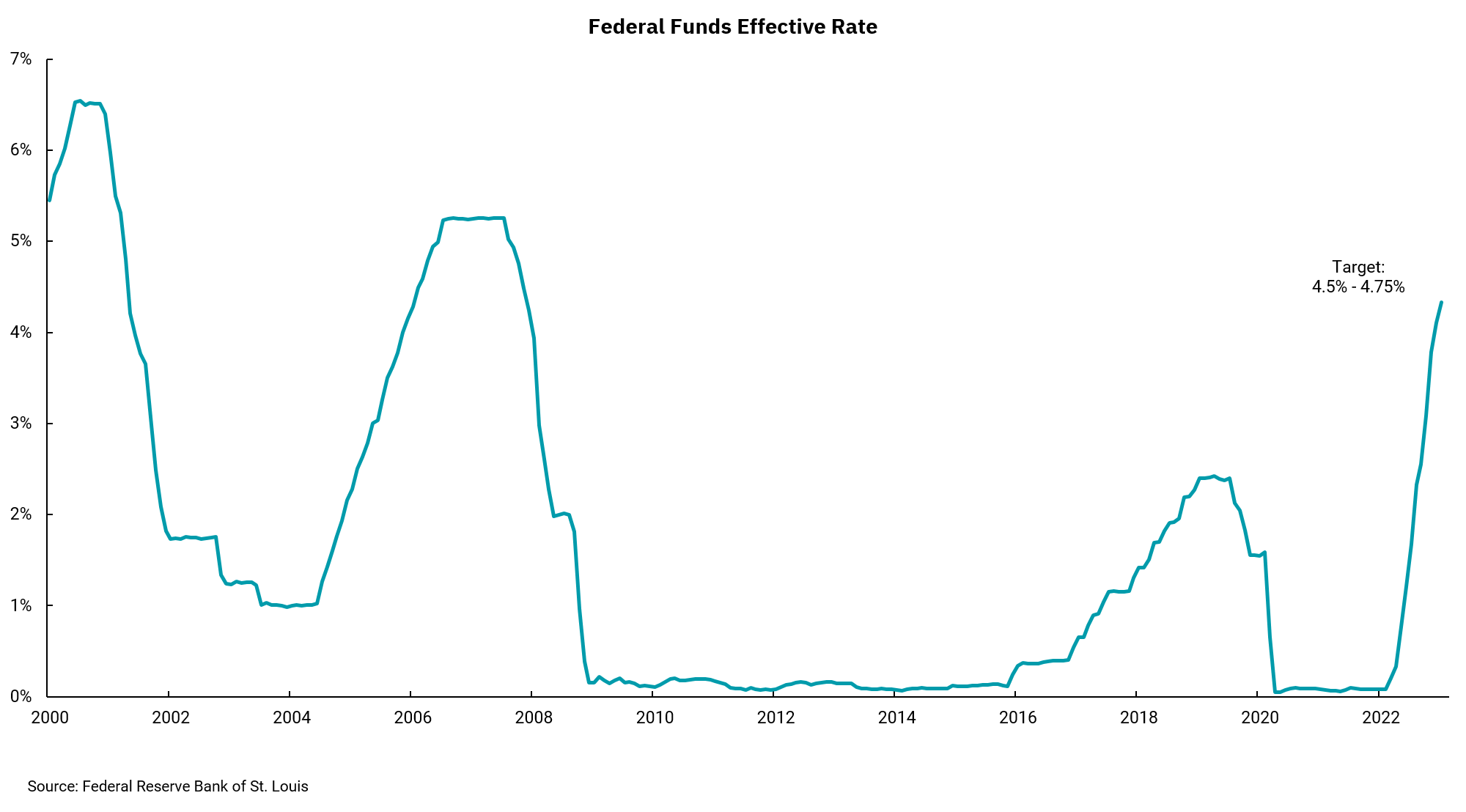

The Federal Reserve’s dramatic shift in monetary policy has been a regular topic of discussion. On Feb. 1, the Fed announced its most recent action on interest rates, raising the target for overnight fed funds to 4.50-4.75%. As a result of this action, we have seen most commercial banks raise their prime borrowing rate and consumer debt tied to short-term interest rates, such as credit cards, has also increased. As the chart shows, the Fed’s moves have been rapid, meaning the cost of variable-rate debt has increased just as rapidly.

Not every interest rate, however, is directly tied to the Fed’s overnight rate, and we have seen some rates, such as home mortgage rates, fall over the past few weeks. These rates are still well above levels we saw a year ago but significantly less than they were 60 days ago. This means that while the Fed can control the price of money in some markets, it does not control the price of money everywhere.

It’s also important to note that while the Fed’s rate increases have raised debt costs for many borrowers, the same actions have been a windfall for savers. After years of earning virtually nothing on short-term investments and overnight deposits, savers can attain much higher rates on CDs, Treasury Bills, notes, and other short-term investments.

Looking forward, Federal Reserve Chairman – Jay Powell – indicated after the Feb. 1 meeting that more rate increases may be needed, and the forecast was for rates to remain high for the remainder of this year. We have seen the Fed slow their rate of increases from 0.75% to 0.50% to only 0.25% at this meeting, and expectations should be for one or two additional 0.25% increases. At that point, short-term rates would be at 5-5.25% and should allow the Fed to pause on rate increases and let the economy and inflation sort things out. We have seen signs of inflation declining, which is good, but the absolute inflation rate remains well above the Fed’s 2% target.

There are risks to the Fed’s outlook, but the most recent data on the U.S. job market indicates the economy is still growing and jobs remain plentiful.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)