How much can the U.S. tighten its purse strings?

More than 60% of the annual federal budget is mandatory spending

Raising the U.S. debt ceiling is not going to be easy. Then again, when is a budget discussion of any kind easy when resources are limited while wants and needs abound?

The good news, or maybe the bad news, is that we have some time before we risk deciding on what bills to pay or, worse, not being able to pay. Treasury Secretary Janet Yellen has indicated the ability to use funds in various accounts to operate the government until mid-June. However, the amount of money from the Federal government that flows into our economy and capital markets is huge. Any interruption in this flow of funds would cause significant problems.

We know government support had to increase, with significant help from the Fed’s monetary policies, to avoid a negative economic outcome as the pandemic raged. But now we have some tough decisions as much of the money we spent was borrowed when interest rates were much lower. It is also much harder to reduce spending than increase spending. Increasing revenue through tax increases is also a way to reduce future deficits, which will slow the growth of outstanding debt.

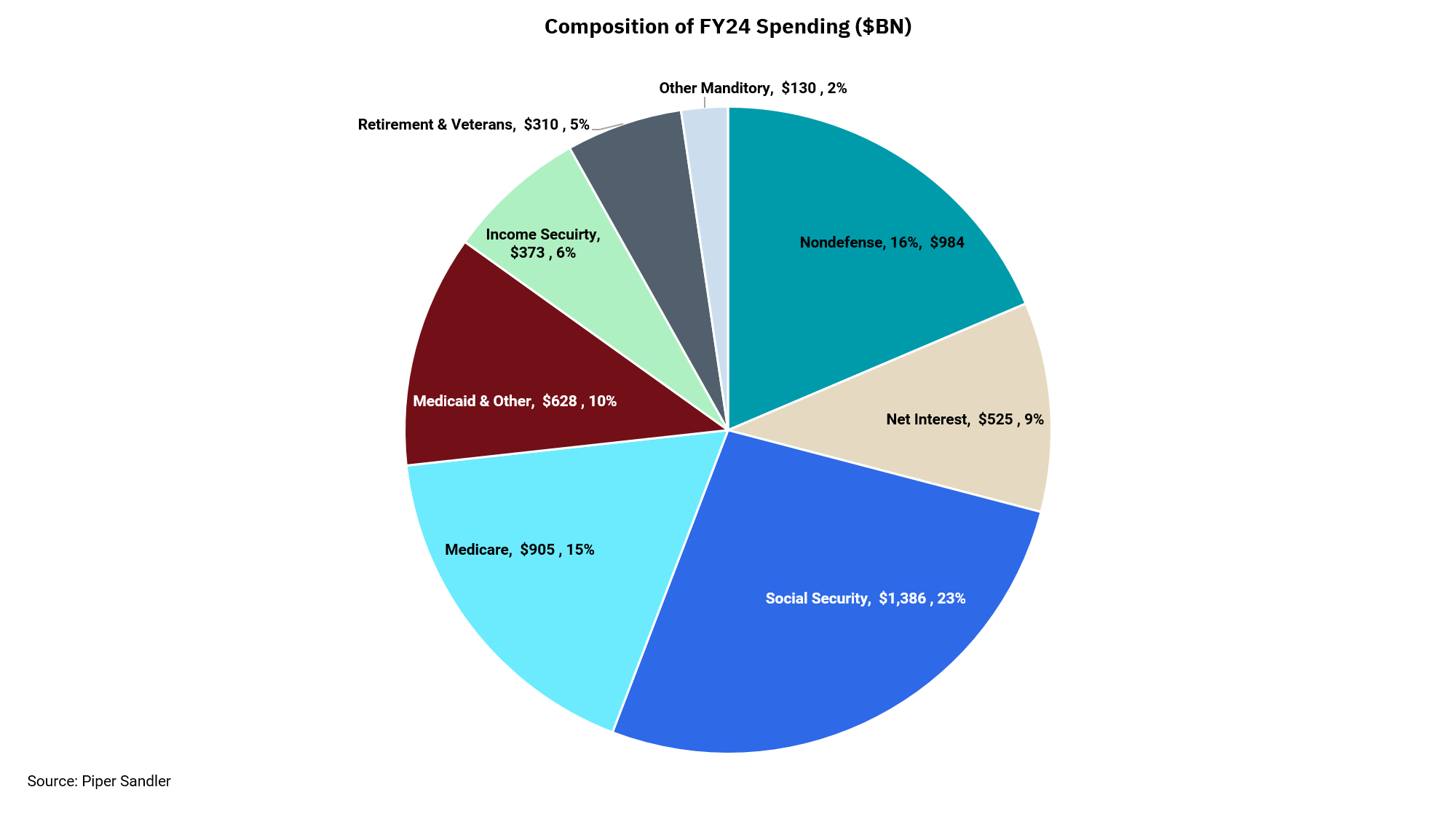

This week’s chart provides insight into how the government's revenue is spent. There are two big “buckets” to consider - mandatory spending, which is required by law, and discretionary spending, which is subject to the annual appropriations process.

The majority of the annual budget is mandatory spending. This bucket includes everything but defense, non-defense, and net interest in the chart. These three categories of discretionary spending total only about 39% of the budget, which means about 61% of the annual federal budget is mandatory spending.

Within the discretionary area, interest expense is roughly 9% and growing. (Although one could easily argue that interest expenses are mandatory spending, as a default on government debt would be very bad.) Defense spending is another category that appears challenging to cut as the global political environment is not calmer. This leaves only about 16% of government spending on which to negotiate.

One can see why we expect the negotiation process to be difficult, although both sides ultimately will have to agree upon some revenue increases and some spending cuts. It won’t always be pretty, but we will get this done.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)