Why the Fed is avoiding a ‘stop-and-go’ approach

Backing off rates too soon may mean a longer struggle overall

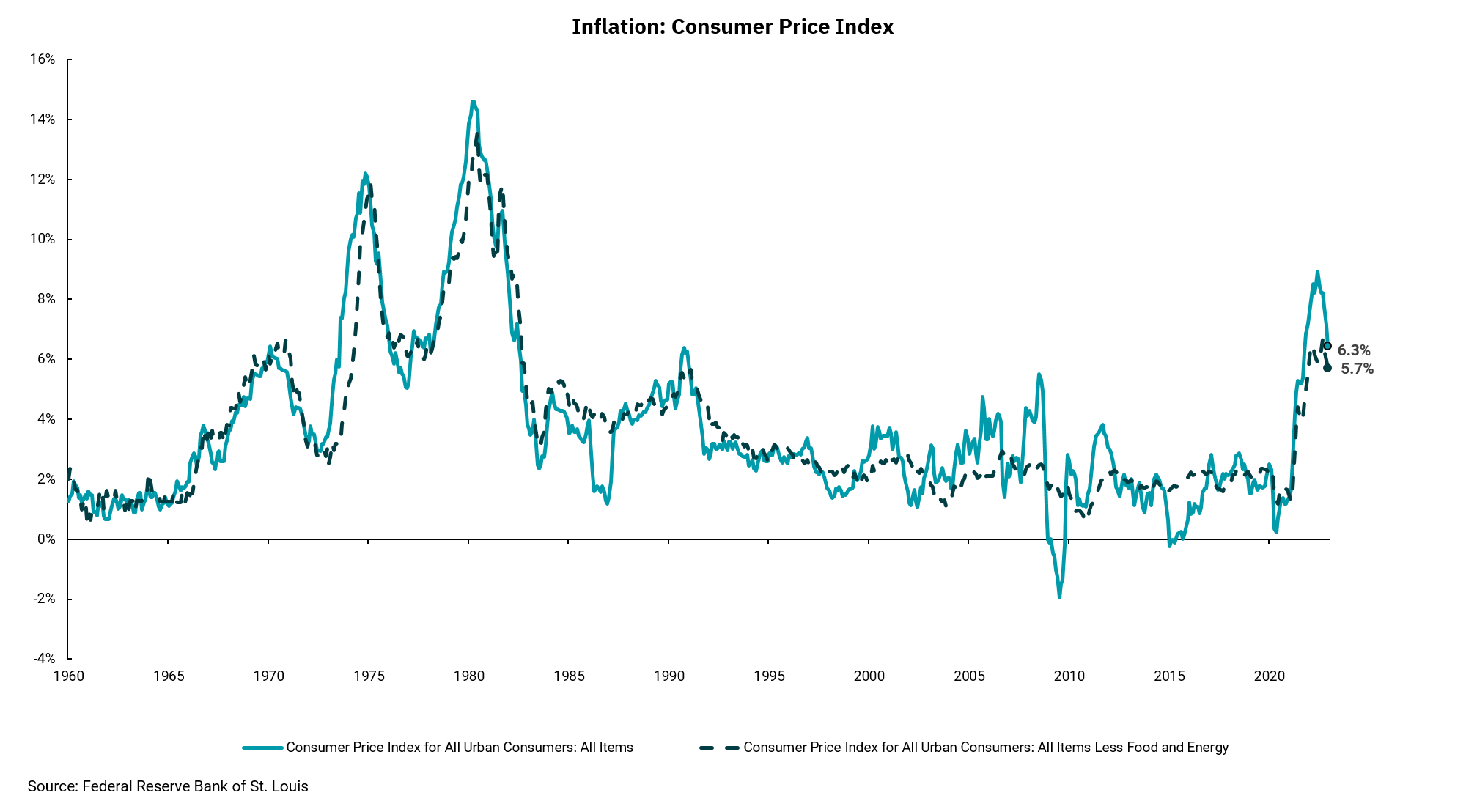

Recent data on inflation, as measured by the Consumer Price Index (CPI), indicates the trip toward the Fed's 2% target might be bumpy. While we saw headline and core inflation measures decline year-over-year, the month-over-month numbers moved slightly higher than expected. Volatile food and energy prices, along with rents continuing to rise, led to higher-than-expected numbers, and the labor market remains robust with low unemployment and numerous job openings.

We know this recent bout of inflation is the worst since the early 80s. However, in this week's chart, we wanted to look at a longer period, as doing so helps reveal why the Federal Reserve is still so cautious on inflation. Note the left-hand side of the chart where we see an early bout of inflation in the late 60s and early 70s. In response, the Federal Reserve increased interest rates but quickly eased as the economy slowed. Unfortunately, this easing of monetary policy led to a quick rebound in inflation, which peaked at an even higher rate of 15% before the Fed again raised interest rates and slowed the economy.

By this time, Paul Volker was the Chairman of the Fed. He embarked on tightening monetary policy, which took short-term rates to 20% and eventually led to a very deep recession with unemployment reaching over 10%. Even as the economy weakened and inflation slowed, Chair Volker kept rates high to finally make sure it would not come back as it had previously done. The early 80s were not a good period in U.S. economic history; however, as the chart shows, inflation did not come back and we entered a long period of slowing and more stable inflation.

It was not only monetary policy at play over all this time, but current Fed Chair Jerome Powell wants to avoid the "stop-and-go" monetary policy of this earlier period. The lesson learned was to not back off on policy rates too soon lest we risk inflation coming back even stronger. This is one important reason why we think the Fed will be careful as they consider inflation and monetary policy over the coming months and quarters. Rates may fall more slowly than we have seen in recent periods.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)