Move aside baseball—spending is a favorite American pastime

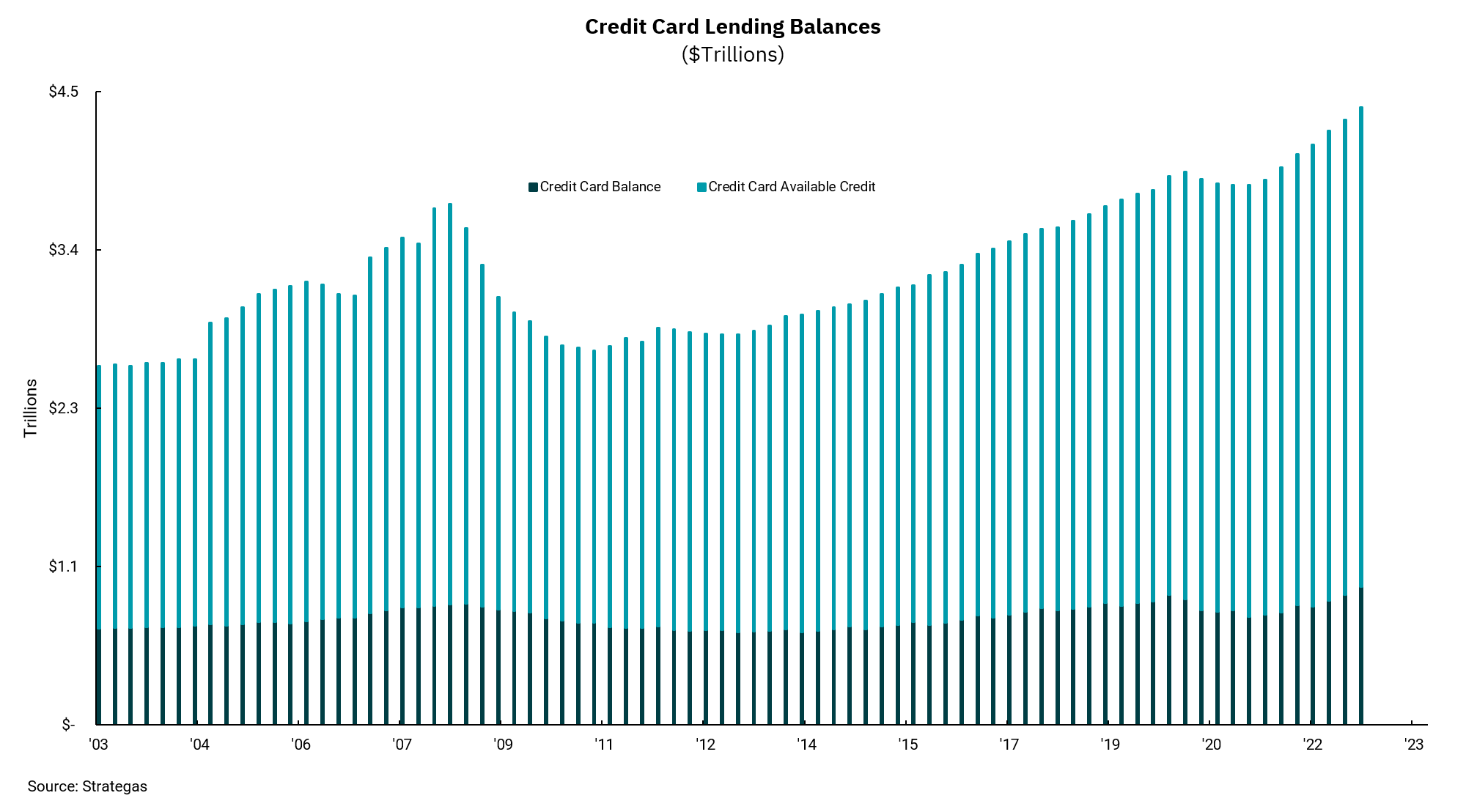

Credit card balances are up, despite declining early during Covid

U.S. consumers have been adding to their debt levels at an accelerated rate. For a brief period during the early days of the pandemic, we saw overall debt levels, including credit cards, decline as consumer pocketbooks were filled with multiple rounds of fiscal stimulus. It did not take long, though, for spending to reassert itself as a favorite consumer pastime.

This week's chart focuses on credit card balances, which have reached an all-time high. There are a couple of interesting highlights from this data, which goes back to 2003. During periods of economic stress, like 2008-2009 and again early in the pandemic, banks tend to cut back credit limits. Some of you may remember this happening to you. But as the economy recovers and grows, credit limits are expanded and are now at a record level.

Based on the ratio of balances versus available credit, we do not see a "tapped-out" consumer. That is, unlike our government which has hit its "credit limit," consumers still have lots of credit card borrowing power. While this could support economic growth, we have to realize the cost of this credit is now much higher. As the Fed has increased interest rates, the average rate on credit card balances is nearly 20%. And we have seen delinquencies rise among borrowers with lower credit scores.

In sum, while having access to greater borrowing can be a good thing, using this access can come at a high cost.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)