Don’t let that crowded airport fool you

Consumer spending on services not fully recovered—yet

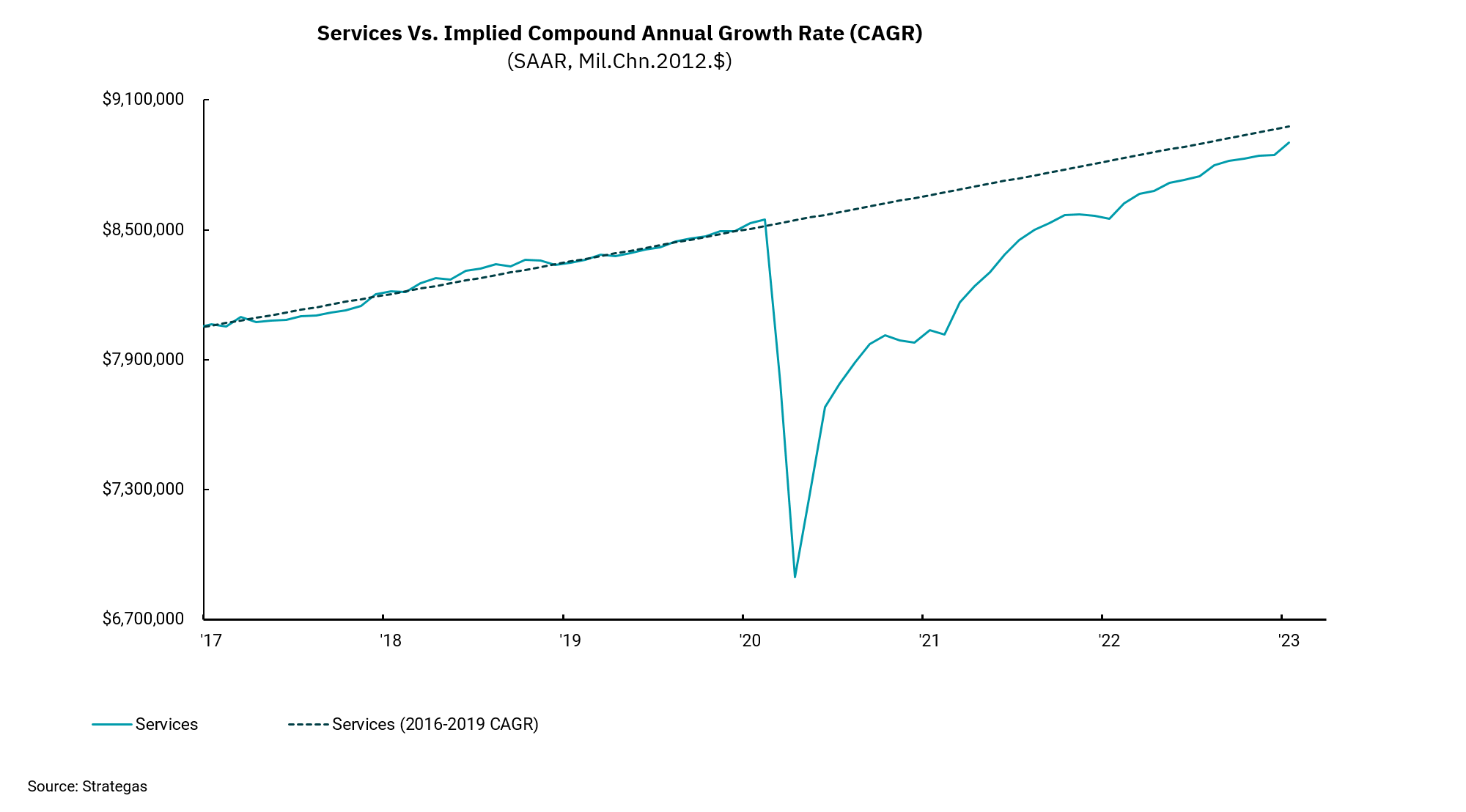

Spending on services is roughly two-thirds of consumer spending which makes up roughly 70% of U.S. economic activity.

Both the goods and the services sectors slowed dramatically early in the pandemic. However, unlike goods, where we saw spending and activity return to its long-term trend line and then exceed it, the services sector of our economy has yet to fully recover to the trend line in place before the pandemic. This has important implications as we consider economic growth and employment moving forward.

We have seen the goods sector of our economy slow as the Fed has raised rates. Still, the ongoing recovery of services spending could explain the strong employment market and improving levels of consumer spending.

Monthly employment data shows hiring in the hospitality and leisure areas of our economy has been consistently near the top of job creation. Within the Job Openings and Labor Turnover Survey (JOLTS), this sector continues to have numerous job openings. If you have flown recently, you have seen full planes and crowded airports. And the outlook for spring break travel is strong, with air, hotel and restaurant bookings all showing strength.

In sum, while inflation is taking a bite out of consumer spending and incomes, for now, the U.S. consumer continues to shift spending away from goods and into services.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)