Feeling the pinch of a smaller tax refund?

Decade-low refunds may dampen consumer spending

Tax season...a term that can trigger a wide range of emotions. For some Americans, tax season means a refund from the government which can help fund big-ticket purchases like cars or family vacations. For others, getting a refund means helping to make sure ends meet during a period of high inflation. And for others, it means writing a check to the IRS. Whichever side of the equation one falls, we all know this is the time of year we think about the IRS.

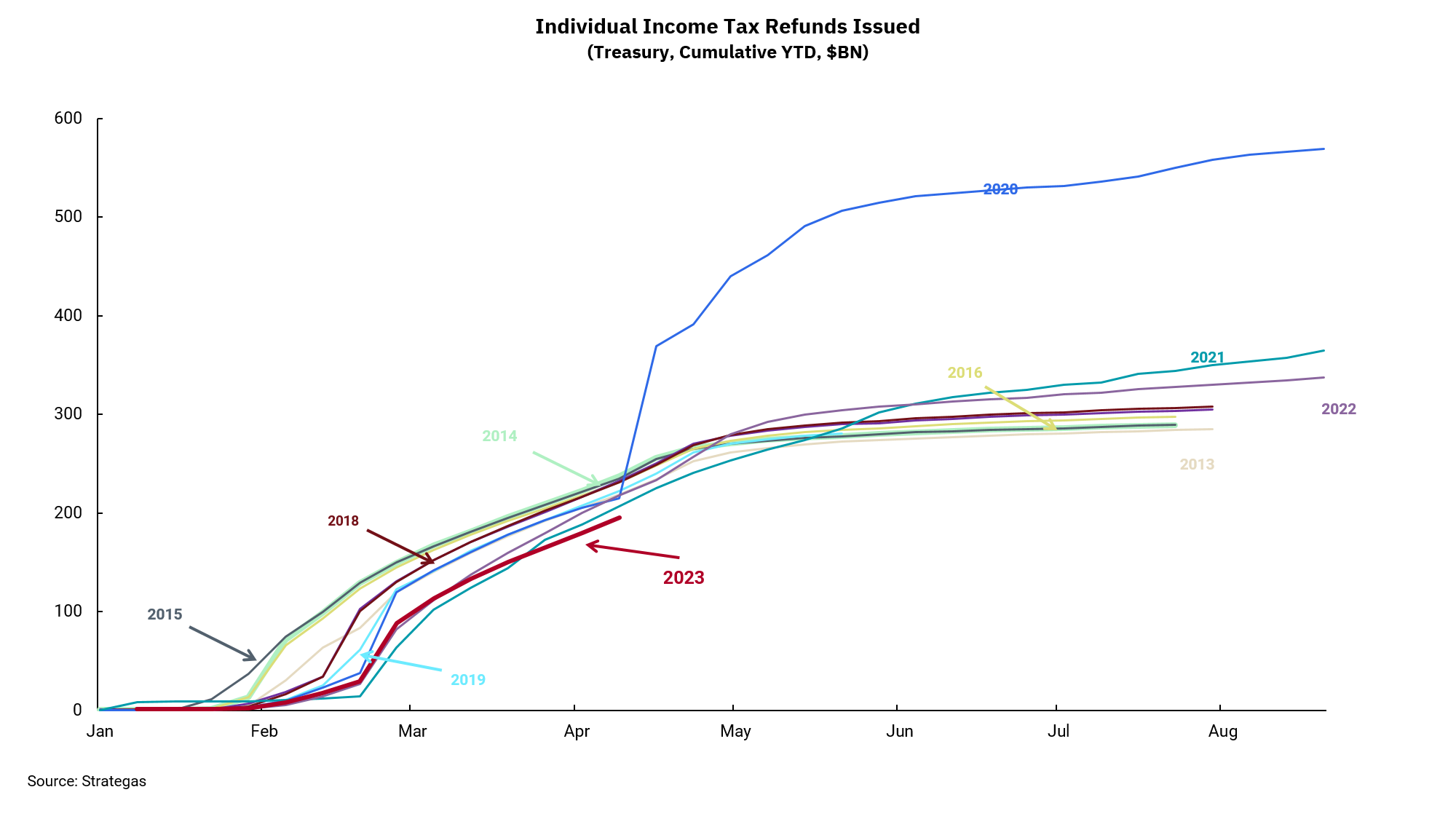

It can be interesting to look at tax seasons over time and compare the cumulative amount of refunds to taxpayers, who also tend to be consumers. This busy chart shows that most years are relatively tightly bunched, meaning the cumulative "tax refund stimulus" is about the same year over year.

The outlier, of course, is 2020, when Congress used the tax code as an active part of putting fiscal stimulus directly in the pockets of U.S. consumers. The benefit of this largesse has now diminished for the most part, and we have been left with the hangover of higher inflation. But just as importantly, 2023 is at or near the bottom of the range we have seen since 2013. This may mean a bit smaller jolt to consumer spending is in store this year.

As companies begin reporting first-quarter 2023 earnings, we will watch for comments on the health of the U.S. consumer and outlooks for the rest of 2023. Not every company will say the same thing, but with inflation still high, the job market showing some early signs of weakening, and the pandemic stimulus over, it would seem consumer spending is facing some headwinds.

Moreover, looking forward, ongoing budget deficits and the looming problem of the debt ceiling may very well bring tax policy into the spotlight over the next few months.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)