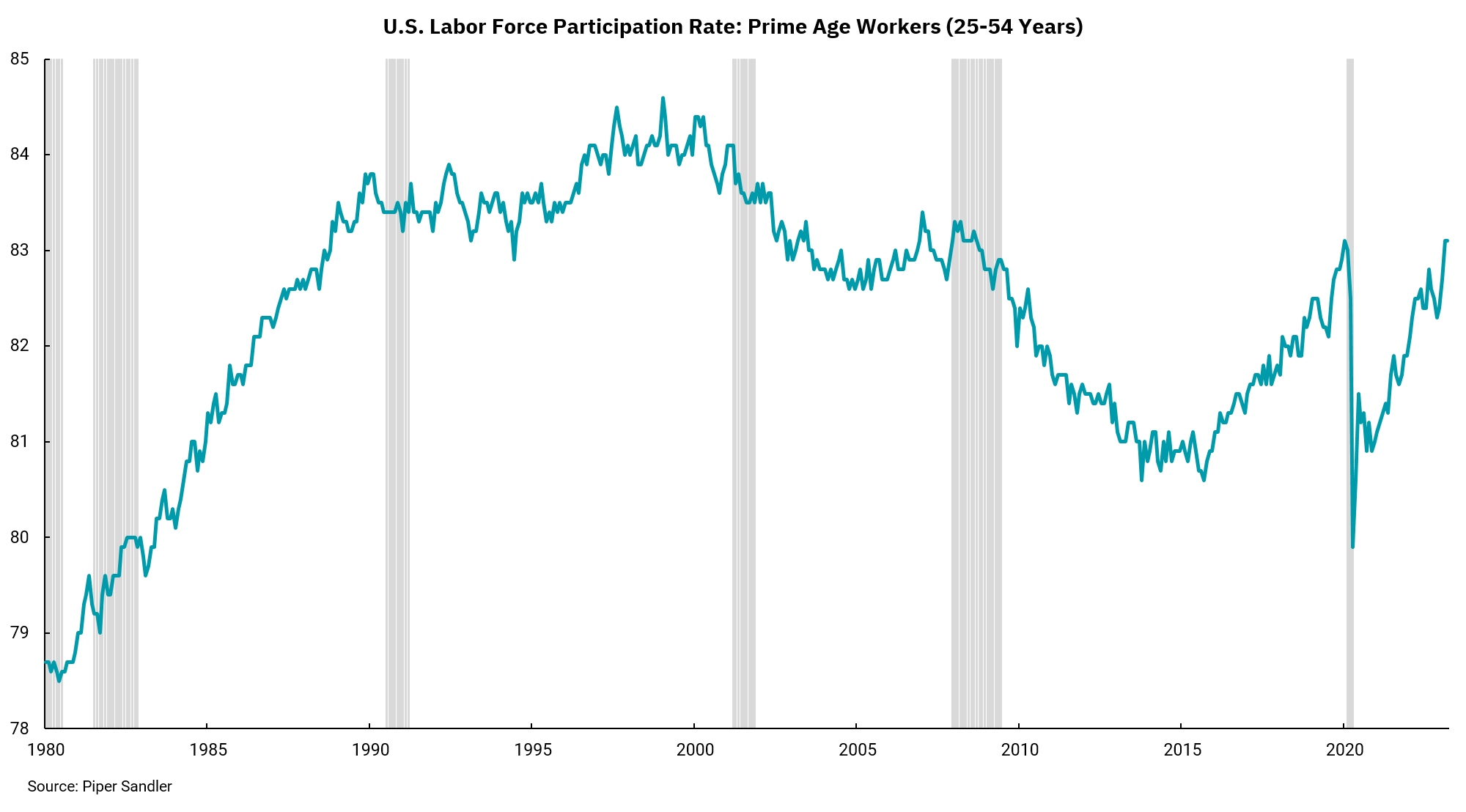

‘Prime-age’ workers are back to work

Rebounding participation rate could be good news for inflation

The job market is front and center as it pertains to the Federal Reserve, inflation and future monetary policy. Wages, along with rents, tend to be the stickier parts of inflation, so following trends within the labor market is centrally important to shaping the Fed's view.

Since the pandemic, getting people back into the labor force has been difficult, despite a record number of open jobs and unemployment at or near 3.5%. If we consider labor as a raw material for economic output, we can see why growing the labor force is so important. More people working equates to more economic output.

Thinking simply about how we can lower inflation involves either reducing demand or increasing supply (ideally both, but we are thinking about this simplistically for now). Since the Federal Reserve cannot create goods and services, they use their tools—interest rates and policies like quantitative easing and tightening—to influence demand. Lowering rates is used to spur demand or, as of now, raising rates to reduce demand. An unfortunate side effect of reducing demand is lower economic output, leading to higher unemployment.

If, instead, the labor force can grow, which increases output, the Fed may not have to try to lower demand as much and, therefore, not have to raise interest rates as high. This week's chart shows that the labor force has been declining since the late 1990s. However, recently, we have seen the prime-age labor force participation rate begin to move higher, and it’s now back to about where it was before the pandemic. This could be very good news from an economic growth and inflation standpoint, both of which could mean the Fed is close to being able to stop raising interest rates and lessen the risks of a recession.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)