Inflation remains key variable for Fed

Prices coming down overall, but ‘core’ inflation still sticky

It may be too soon to sound the all-clear as it pertains to banking system liquidity issues, but market and borrowing data show that the level of stress has subsided. This trend allows the Federal Reserve to return its focus to the economy and inflation as they prepare for their meeting on May 2-3.

Economic data, along with corporate earnings, continue to show a resilient level of growth, supporting consumer spending. Yes, there are some early signs that the Fed actions over the past year on rates and quantitative tightening are beginning to bite. For example, weekly jobless claims are in an uptrend, and Q1 2023 GDP growth was reported at a below-trend level of 1.1%. Nevertheless, overall growth remains positive, and the employment market remains robust as headline unemployment is 3.5%. Within this environment, inflation remains the key variable for the Fed and its outlook on future monetary policy.

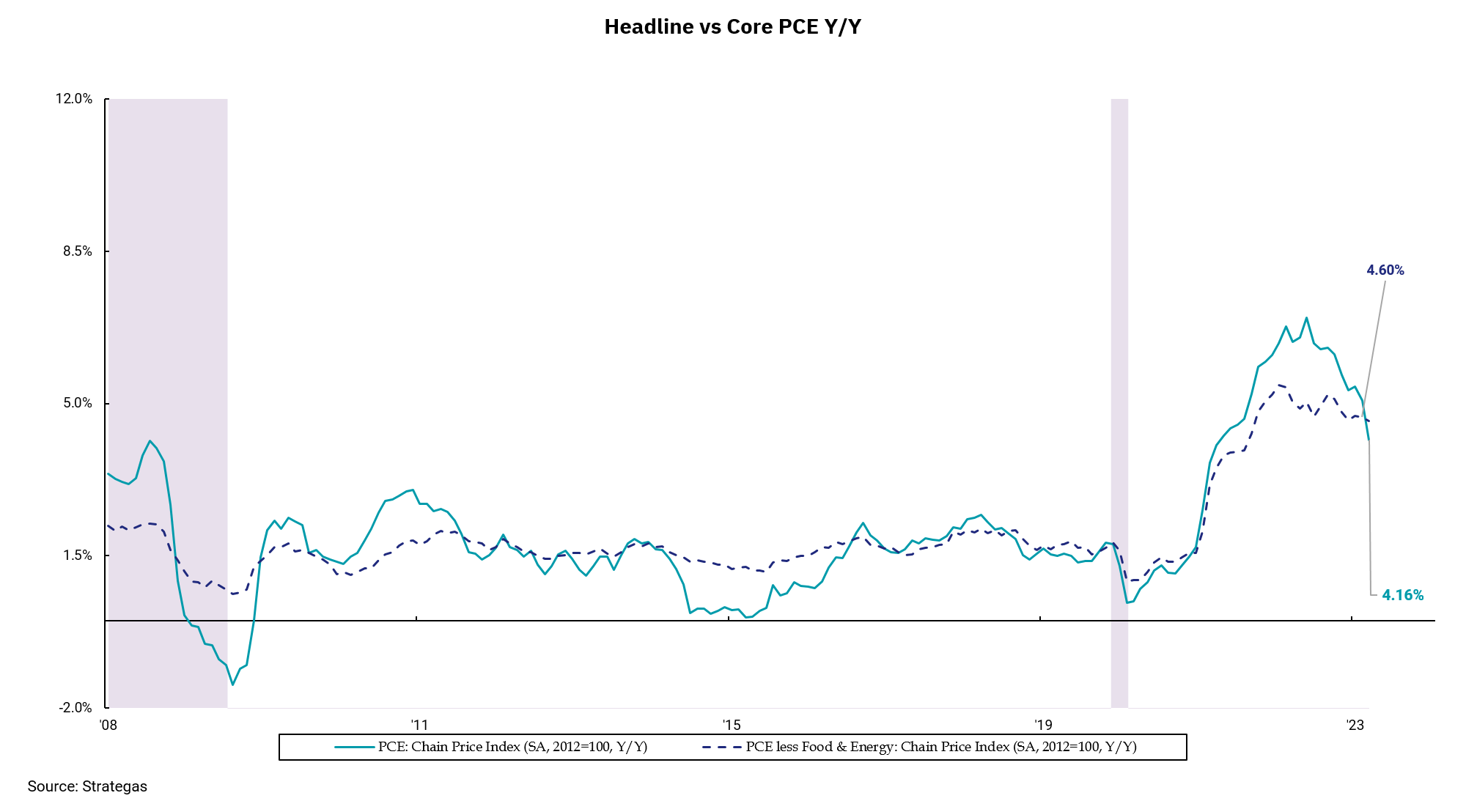

Among the various measures of inflation, the personal consumption expenditures, or PCE, index remains the Fed’s favorite. As with all measures, it is core PCE that is more important than the headline number. This week's release of PCE data showed a similar trend to that seen in recent CPI (Consumer Price Index) and PPI (Producer Price Index) reports. The good news is that inflation is trending lower overall. However, core inflation remains sticky at levels that provide the Fed with evidence the job is not done.

Specifically, headline PCE was up 0.1% and 4.2% year-over-year, while the core number was reported up 0.3% and 4.6% year-over-year. The shorter-term trend shows core PCE over the last three months moving higher at 4.9%, indicating some acceleration. We are now seeing core inflation exceed headline inflation in multiple inflation measures—CPI, PPI, and PCE.

This will make for an interesting discussion at the FOMC meeting May 2-3. Trends in inflation and growth are a bit lower, and monetary policy acts with a lag, meaning the actions already taken will continue to impact the economy, employment and inflation. But has the Fed done enough to get inflation back to its 2% target? The market expects another 0.25% increase this week, after which a pause is expected. That sounds about right to us. Inflation is going in the right direction, but the destination is still ahead.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)