Do rate hikes always increase unemployment?

History shows Fed eventually has to reverse course

The Federal Reserve voted unanimously to increase rates again at their May meeting by 0.25%, taking the Fed Funds target to its highest level since 2006 at 5-5.25%. Despite recent turmoil in the banking sector and some signs of economic weakness, their concerns about inflation led them to make this additional rate hike.

The good news is that inflation has been declining, especially at the headline level. However, we know the Fed pays the most attention to core inflation, which has been receding more slowly and now exceeds the headline measure in the CPI (Consumer Price Index) and PCE (Personal Consumption Expenditures Price Index). The trend is still lower, but an imbalanced labor market is a key reason the Fed remains concerned about longer-term inflation levels.

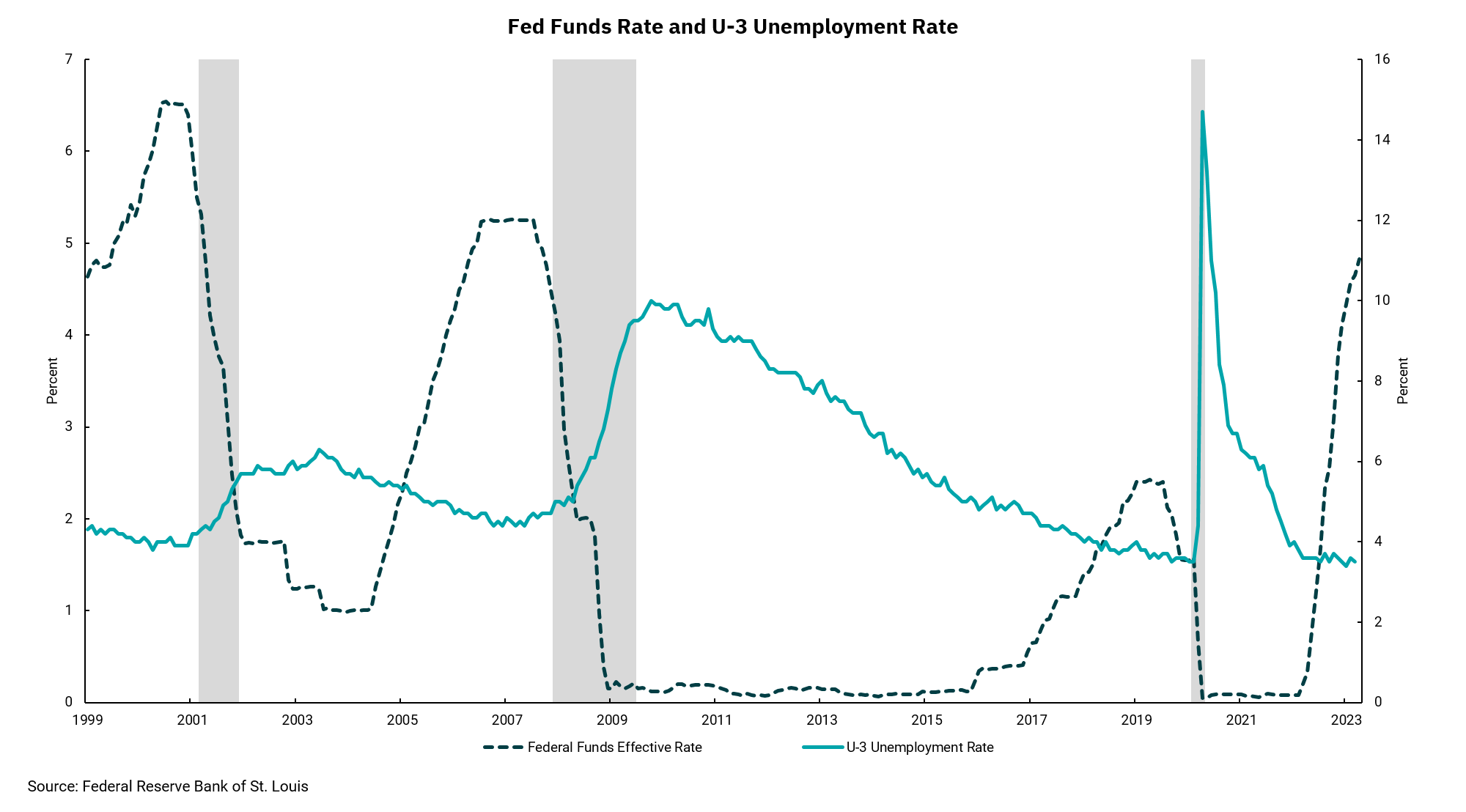

This week's chart was a bit of a study to see if the labor market has reacted to higher rates from the Fed in the past. After all, interest rates and quantitative tightening are the primary tools that the Fed uses to implement monetary policy. We did not overlay the Fed's balance sheet in the chart, as that only became a tool during the financial crisis. Still, we can assume that the growth, and now decline, in the size of the Fed's balance sheet has some influence over economic activity.

Looking at the chart, we can see periods of Fed tightening followed by gray bars, representing recessions, where unemployment rises. This could lead us to conclude that higher rates do, in fact, begin to affect the unemployment rate and the economy, with the Fed eventually lowering rates as unemployment rises and economic activity slows. We might also interpret this as a tendency for the Fed to "over-tighten" and then have to reverse course and ease aggressively to avoid too much economic weakness and an overshoot of unemployment rising too far.

The Fed's tools are blunt instruments within the economy. Past periods of inflation at the levels we saw last summer give valid reasons for the Fed to be cautious to avoid a repeat of the late 70s and early 80s. But the chart also reveals the risk of the Fed having to reverse course dependent on the economic outcome of their tightening cycle.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)