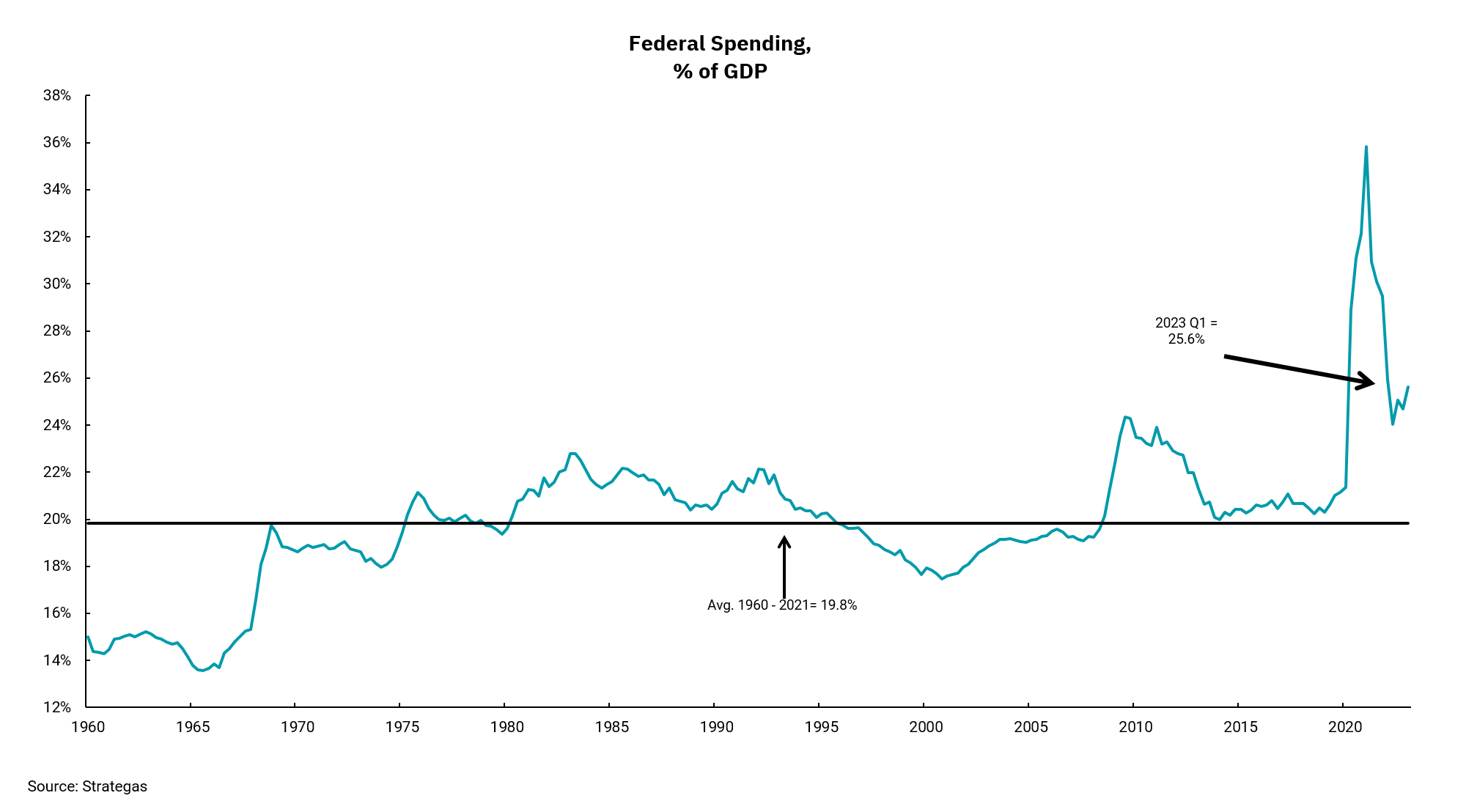

Federal spending still above ‘normal’

Totals exceed levels during the financial crisis

With the clock ticking, we are beginning to see some tentative signs of a debt ceiling extension which would help the U.S. avoid a disastrous default on its debt. Just as importantly, such an extension would prevent an interruption in cash flows from the federal government into our economy at large.

This week’s chart shows the materiality of these cash flows compared to the U.S. gross domestic product (GDP), the broadest measure of economic output. Government spending has been on an uptick since 1960. Past periods of economic stress, like the financial crisis and recessionary periods, show a pattern of increasing spending followed by declines as the economy grew. There is some intuitive sense to this, as periods of slow or negative growth result in slower tax collections as demand for social support increases. In comparison, periods of economic prosperity result in higher tax collections and generally lower demand for social support.

As with much of the economic data we follow, the pandemic-related response was unprecedented – both from a monetary, and in this case, fiscal standpoint. In an effort to mitigate the risk of an extended period of economic decline, the federal government upped its spending to levels unseen in our history. And as one would expect, the economic recovery has led to higher revenues and federal spending has declined.

However, as we think about moving ahead, we can see the decline in spending has not returned to pre-pandemic levels. Instead, the federal government continues to spend at levels that exceed the peak of spending during the financial crisis.

Of course, spending is only one side of the economic equation, revenues being the other. The difference between spending and revenue equates to our annual budget deficit, which accumulates over time to total our outstanding debt.

We think it is important to temper expectations of a quick return to anything close to a balanced budget, and neither Republicans nor Democrats are calling for that. And while we know it is always harder to cut spending than to add to it, a big-picture view would indicate we are now spending at levels that may not be sustainable in the long run. As we have stated before, the need for leadership in Washington is high. We must balance short-run economic needs against the longer-term costs of those decisions.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)