Inflation’s dropping—but July Fed rate hike still likely

Tight labor market keeping core inflation high

We got some great news on inflation last week, as both the Consumer Price Index (CPI) and Producer Price Index (PPI) were lower than market expectations. It is unsurprising to see inflation slow from the rapid increases we witnessed a year ago. However, it is also important to realize that overall price levels are increasing much slower.

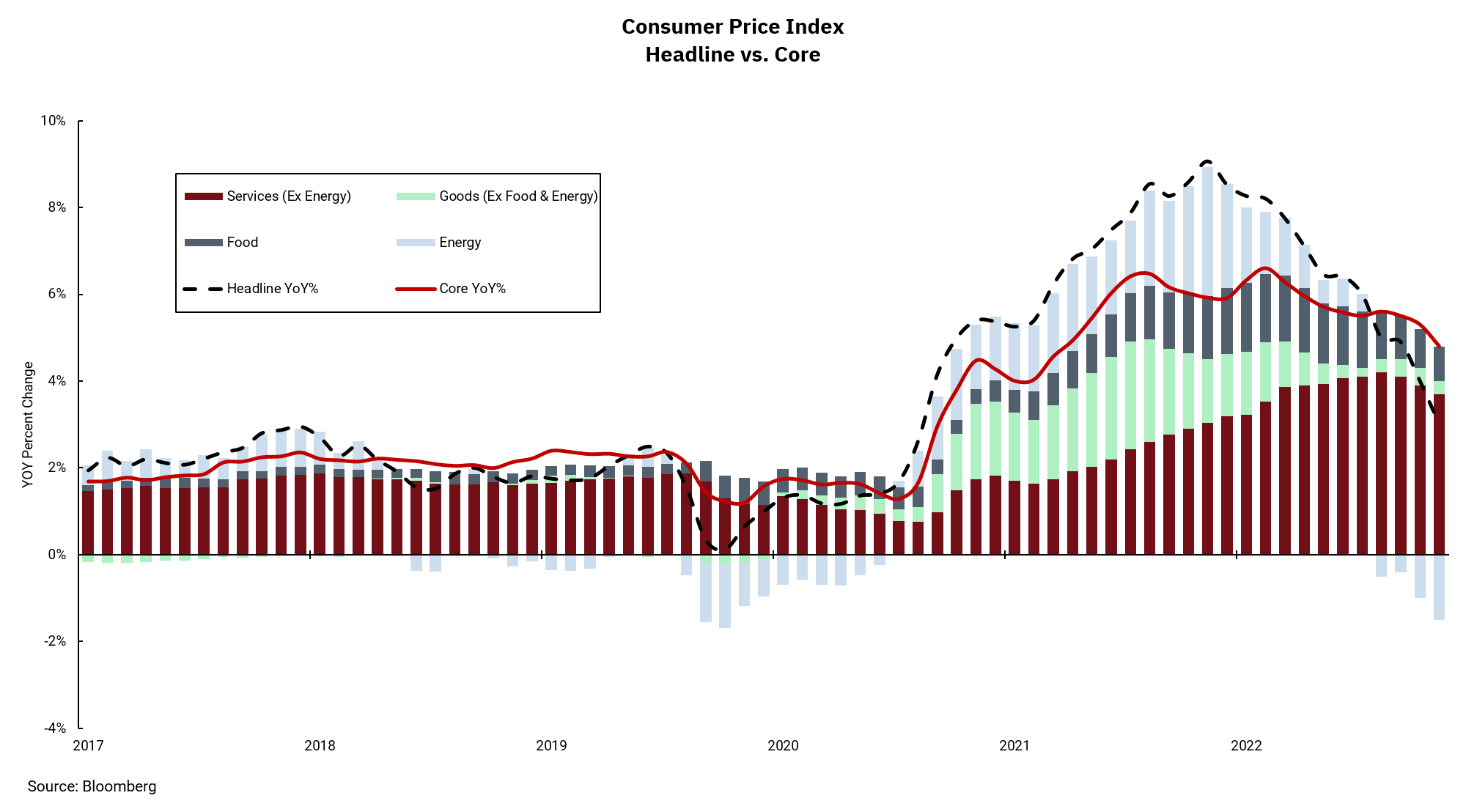

This week's chart breaks down the CPI into its individual components. This is important because we know some prices within our economy can move around a lot; think food prices, where seasonal availability can lead to price variances, or energy, where global demand and supply issues can cause price volatility.

A chart review shows energy prices have decreased for the last four months. This has been a tailwind for U.S. consumers, as energy is a common expense, and we have seen food inflation moderate. Both of these factors help explain why headline inflation, the measure of all prices, is falling rapidly, showing to a 3% increase year-over-year in the June data, down from a peak of over 9% a year ago.

At the same time, a closer inspection of the data shows why it might be too early to think inflation is no longer a concern. While we all spend on food and energy, the historical volatility of prices in those areas means that the Federal Reserve pays more attention to other areas of inflation, which tend to move more slowly and in longer-term trends. These areas make up what’s known as "core inflation," which includes rents and wages (represented in the chart by the "Services" bar).

The good news is we see inflation pressures subsiding there, too, but at a much slower pace. While core inflation increased throughout 2022, it did not increase as much or as fast. We are now in a position where the broader "headline" inflation readings are below the narrower "core" inflation readings.

The Fed has identified the labor market as a key input into core inflation. We remain in a position where competition for labor is leading to wage growth which could make it difficult to get inflation back to the Fed's 2% target. As a result, we welcome the good news on overall inflation and expect price pressures to continue to ease overall. But the Fed will need to see core inflation moderate more before reducing interest rates. This means we should be watching the labor market closely for signs of slower wage growth as a key to the Fed lowering interest rates in the future.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)