What may keep the Fed up at night

Today’s inflation has some scary parallels to the 1970s

"Inflation is declining rapidly, so the Fed will be lowering rates soon." Stock market bulls have held out this opinion, but, in the words of legendary college football analyst Lee Corso, "Not so fast, my friend."

The Federal Reserve has legions of very smart people with impressive academic credentials. They build some of the most complex econometric models to help provide a more accurate forecast of economic activity. If only their track record were a bit better—but they’re not unique. For most of us, our hindsight seems better than our foresight.

Paying attention to history is also important to the Fed. Monetary policy is an ever-evolving practice, particularly as interest rates were zero-bound for years and the Fed's balance sheet grew to levels never before seen. It might be that the future will be different from the past, but one ignores the past often at their peril.

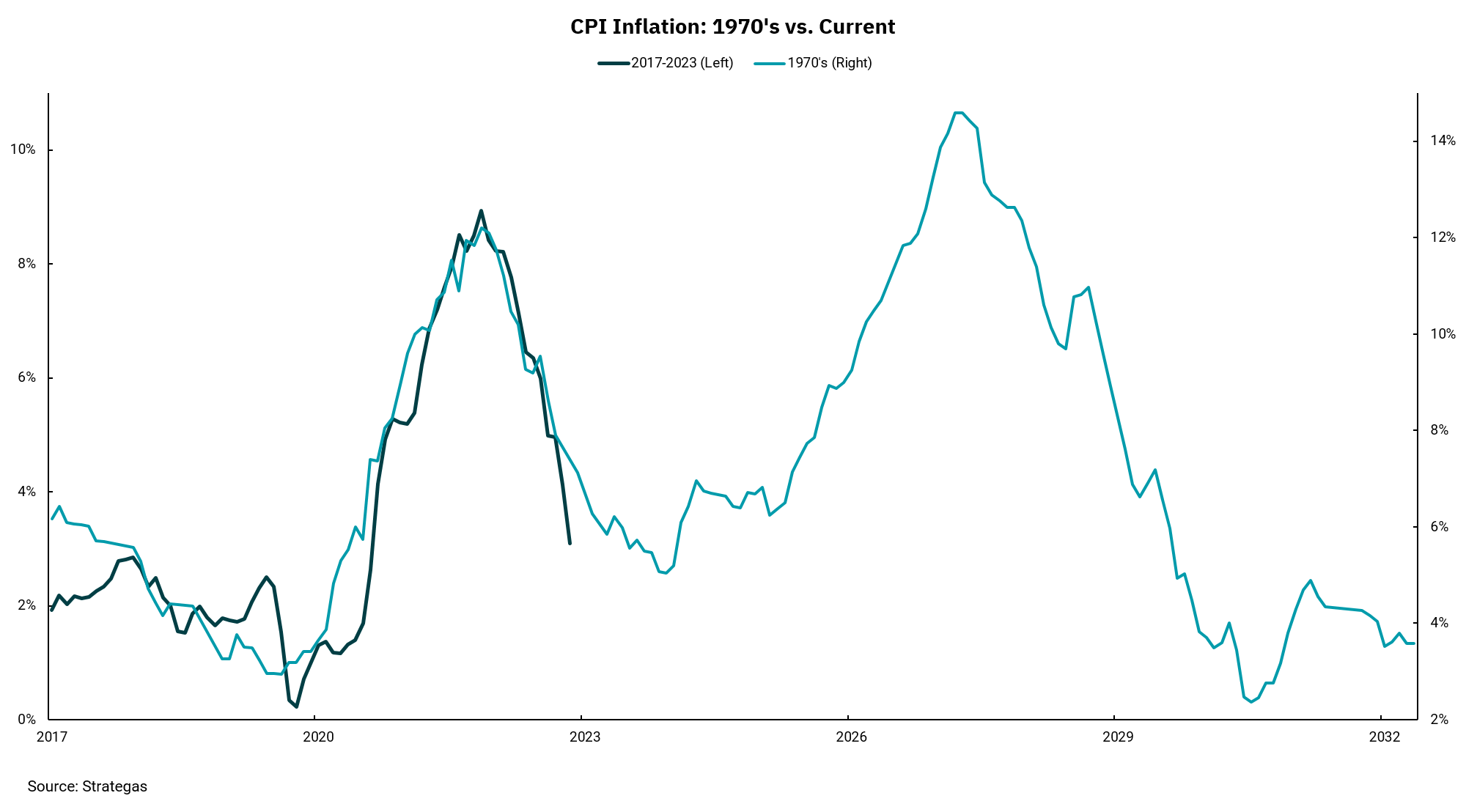

With that historical perspective in mind, this week's chart overlays our recent bout of inflation with a previous bout in the 1970s. We know Fed Chair Powell is also paying attention to 1970s-era inflation, as he has mentioned the Fed's reaction during this period as a cautionary tale about easing policy too soon. It is said the past does not repeat itself, but this chart has some serious parallels. The risk of current inflation moving forward in a similar path as it did in the 1970s surely keeps Fed Chair Powell on edge.

In the 1970s, as inflation was falling rapidly, the Fed may have eased monetary policy too soon, which allowed inflation to resurge and reach even higher levels. Then-Fed Chair Paul Volker was forced to take interest rates to 20% and trigger a deep recession where unemployment hit 10%. Only then was the Fed able to finally slay the inflation dragon.

Jay Powell does not want to have to do what Paul Volker did. The political pressure on the Fed and the damage to the economy today would be immense. It is also noteworthy to consider this chart spans over a decade—a period that can seem relatively short when looking back but seems like an eternity when thinking forward. Expect this Fed to preach patience and offer caution as we think about lowering rates and easing monetary policy. Longer-term inflation expectations will be a key input, but this is one historical economic period we do not want to revisit.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)