Fiscal governance concerns cause U.S. debt downgrade

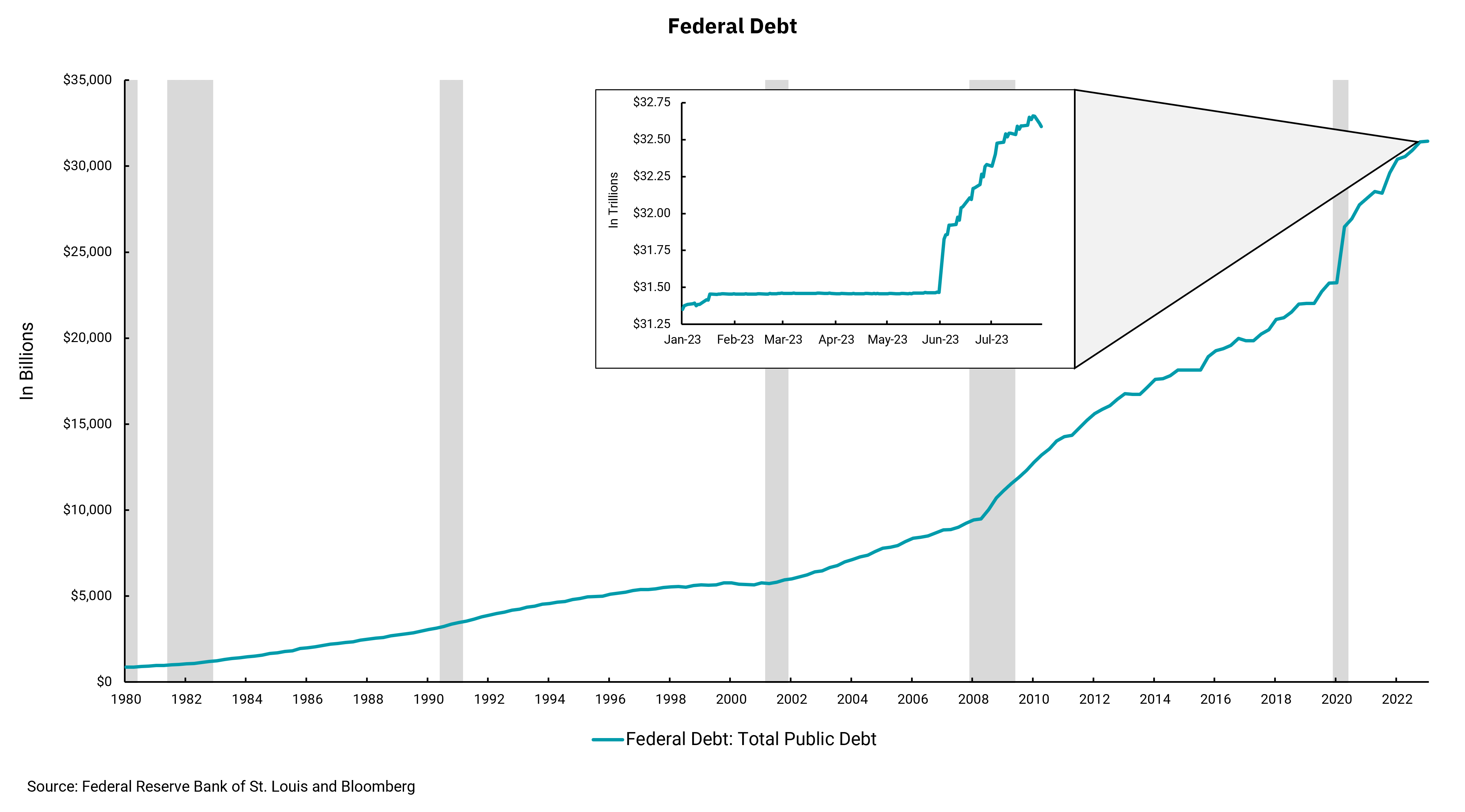

Federal debt on steep upward climb

We continue to be impressed with the resilience of the U.S. economy. Despite the Federal Reserve's aggressive cycle of interest rate increases, with overnight rates now at the highest levels since 2001, economic growth remains positive. The most recent report on employment from the Department of Labor shows the headline unemployment rate dropping a tenth of a percent to 3.5%. Additionally, recent measures of inflation, especially at the headline level, show price increases are slowing and providing some relief to consumers.

At the same time, the employment report showed wages, a key component of core inflation, remain firm and highlighted a labor market that is still unbalanced. While corporate earnings have, on balance, exceeded estimates for the second quarter of 2023, they are still lower on a year-over-year basis. Amid this somewhat mixed economic data, one of the major bond ratings firms, Fitch, downgraded U.S. sovereign debt from its highest rating (AAA) to one notch below (AA+). They join Standard and Poor's (S&P), who downgraded U.S. debt to the same rating back in 2011.

Not surprisingly, the response from politicians and administrative officials was not positive. Blame was quickly assigned along partisan lines, and Treasury Secretary Janet Yellen strongly disagreed with the decision, calling it "arbitrary and based on outdated data." Several economists, too, were quick to dismiss the action based on the current economic strength of the U.S. and the recent suspension of the debt ceiling, which avoided a government default.

Fitch based their action on a "steady deterioration in governance standards over the last 20 years" concerning "fiscal and debt matters." They also pointed to the expected "fiscal deterioration over the next three years and the high and growing general government debt burden.”

One does not need to be an economist to look at this week's chart, see the upward slope of our outstanding Federal debt, and notice the increasing steepness of the slope in recent years. The highlighted part of the chart is what happened as we went through our debt ceiling debate process, the flat line, and what has happened since then, an additional $1.2 trillion in debt. This occurs as the Federal Reserve is increasing rates, directly impacting the government's interest expense. We can agree that the risk of default on U.S. debt is zero, but one can also say a review of our fiscal path’s sustainability is warranted.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)