Gas prices driving up inflation again

Big shift in Fed policy still unlikely

The Federal Reserve's rate-setting committee, the Federal Open Market Committee (FOMC), meets this week to discuss their economic outlook and consider what, if any, changes need to be made to their current monetary policy. It has been an active 18 months since the Fed started raising rates in March 2022. Early expectations were for a gradual pace and for total rate increases from 0.5% to 1%. In the words of the famous baseball player Bob Uecker, they missed that forecast “just a bit outside.“

As inflation roared ahead, the Fed realized they had to play catch up and began raising rates by 0.75% per meeting to slow inflation and, as a by-product, slow the economy. The good news is that inflation has slowed. The better news is the economy has remained firm with positive gross domestic product (GDP) growth and an unemployment rate very near 3.8% versus 3.5%, the level it was at as they began to raise rates. We are not alone in being surprised at the economy's resilience in the face of a very aggressive Fed tightening cycle.

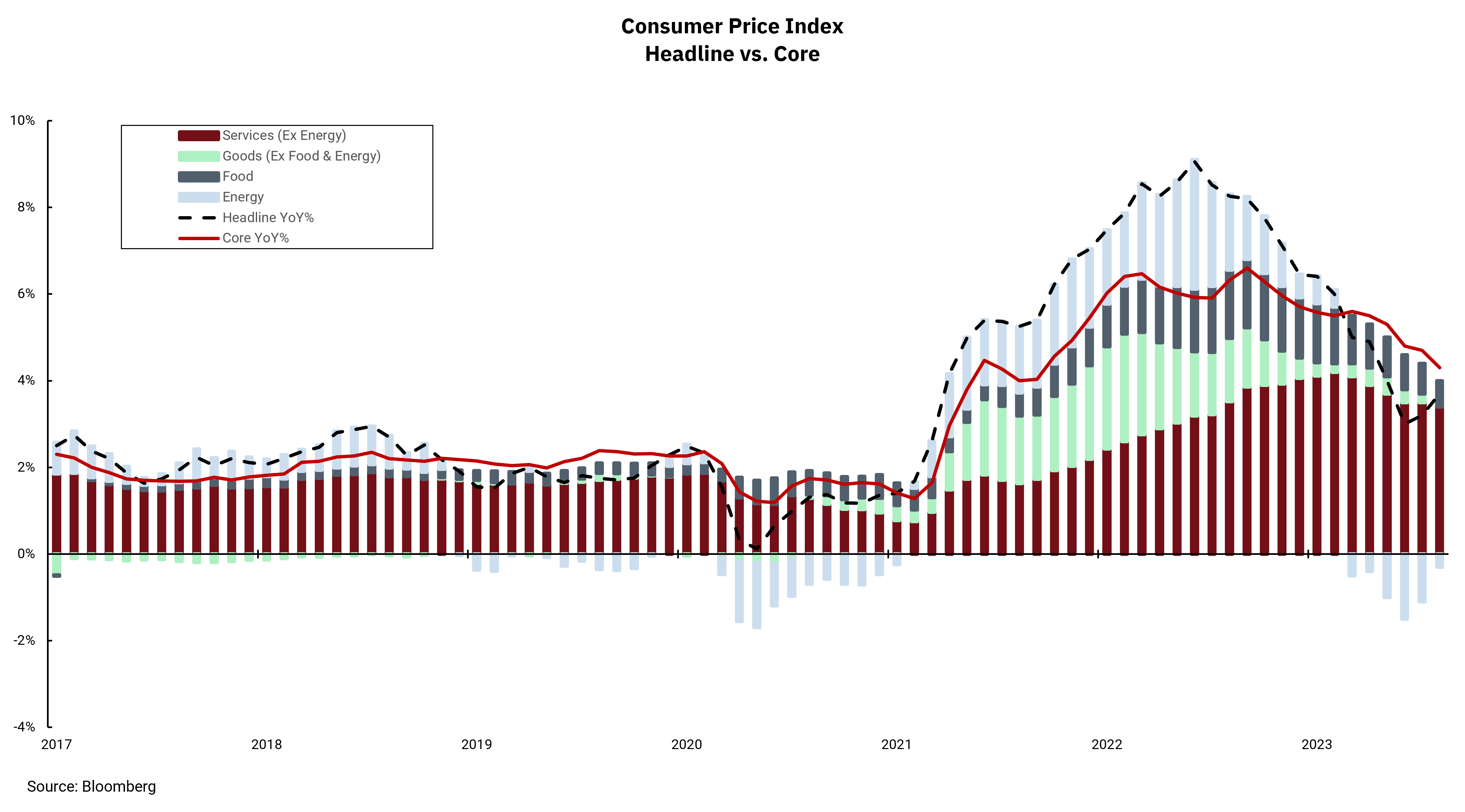

As we consider the Fed's actions from here, it may be that the easiest part of their job is behind us. Headline inflation has now turned higher for two months in a row. And while core inflation is still trending lower, it remains above the headline rate. Notably, headline and core are still well above the Fed's 2% target rate. The main culprit behind the recent increase in headline inflation has been energy prices. Crude oil has increased over the last 60 days, reflected most directly at the gas pump. And while the Fed pays more attention to inflation measures that remove volatile energy and food prices, the fact is, higher energy prices eventually work their way into much of the inflation picture.

We sense that the inflation shift is not enough to trigger a significant shift on policy from the Fed. The target rate on overnight Fed funds, 5.25-5.5%, is higher than current inflation rates, meaning current policy is restrictive. Borrowing costs for businesses and consumers have risen, which should slow economic growth over time. Yet, accommodative fiscal policy, with the government running growing deficits, is muting some of the effects of higher rates and could exacerbate inflationary pressures.

Hence, we think the Fed needs to remain vigilant and the chances of lower rates appear more distant. Ideally, the Fed could be done raising rates and can let the impacts of what they have done so far work their way through the economy. But any resurgence of inflation that lasts more than a few months could open the door to even higher rates.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)