Fed seems optimistic for smooth landing

Outlook for lower rates might spur some auto and housing demand

As we recently discussed, the questions around the Fed’s actions at their recently concluded December meeting were less about their actions on rates and more about their outlook for the economy and policy as we move into 2024. Their decision to hold interest rates steady was expected. Despite having penciled in an additional rate increase this year, recent economic data did not indicate an increase was warranted. However, The Fed’s updated Statement of Economic Projections (SEP) and their updated outlook on policy rates in 2024 did include some surprises.

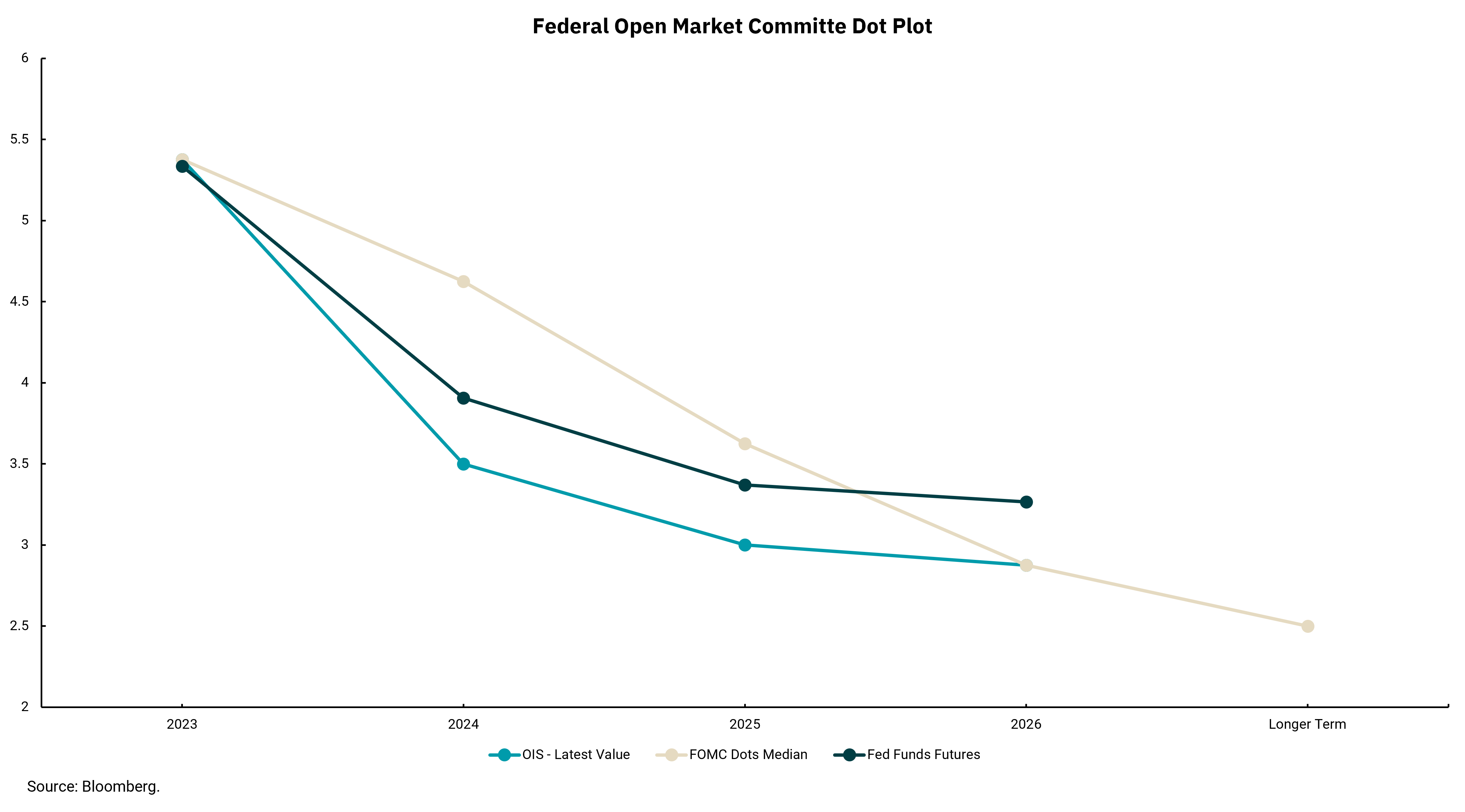

Using the term “surprising” might understate the materiality of the change. As recently as Dec. 1, Fed Chair Powell commented, “It would be premature to conclude with confidence policy is sufficiently restrictive…or to speculate on when policy might ease.” The Fed’s forecast for the Federal funds rate at that time showed no rate cuts for 2024. After their December meeting, the updated SEP now includes three rate cuts for 2024, and Fed Chair Powell’s comments at his post-meeting press conference were a nearly 180-degree turn from his recent commentary.

The market has been ahead of the Fed in calling for rate cuts in 2024. In some ways, the Fed may be reading the economic tea leaves in a way that more closely resembles that of market participants. Even as the Fed now forecasts three rate cuts, the market is forecasting up to six, and a rate cut by March shows near 100% certainty. Yet recent economic data has not weakened appreciably, and within a strong employment report where headline unemployment fell from 3.9% to 3.7%, average hourly earnings, a measure of wage inflation, came in hotter than expected at up 0.4%. So, while it is true most measures of inflation continue to improve, they remain well above the Fed’s stated 2% target and the labor market remains imbalanced with greater demand than supply.

The positive aspect of this recent shift from the Fed is it will improve the outlook for growth into 2024. Consumers have been resilient, and the job market has remained strong, but some cracks have begun to show around the edges. An outlook for lower rates might help alleviate some stressors within the economy. It might also spur a level of demand, which could reignite some cooling inflationary pressures, as there is strong underlying demand across housing and autos, among other areas.

This forecast from the Fed is a strong statement; some might call it a bet on their part that inflation will continue to cool. We can appreciate their optimism and the outlook for a smooth economic landing without a recession. I hope they are right.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)