Housing market index declines are slowing

Home builders still facing high construction costs

Housing is a very interest-sensitive area of the U.S. economy. Lower home mortgage rates tend to make housing more affordable as lower debt service costs broaden the pool of potential home buyers. In reverse, higher interest rates increase debt costs and lessen the pool of potential home buyers.

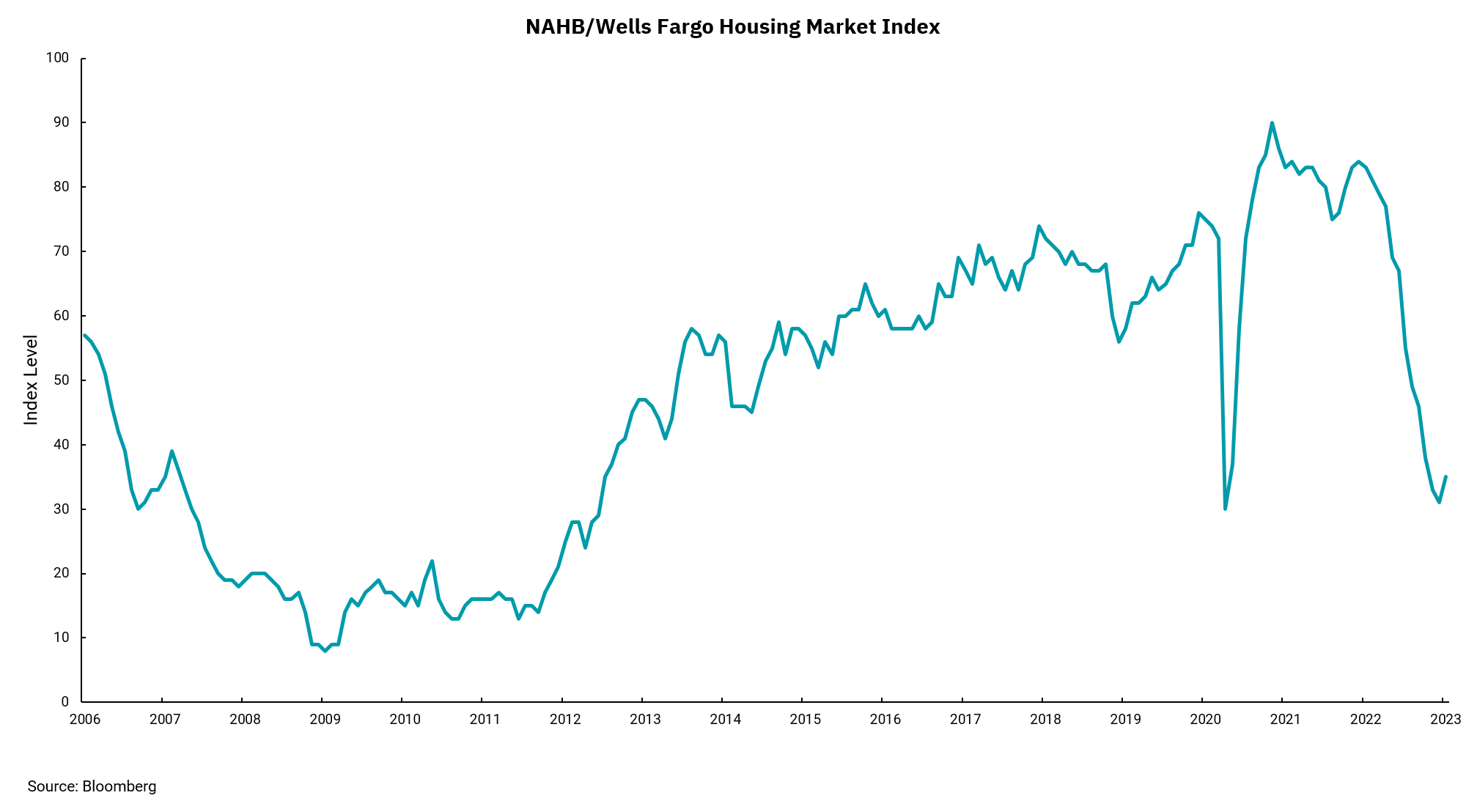

As a result, it is not surprising to see various measures of the housing market show declines as the Federal Reserve continues raising interest rates to slow inflation. This week’s chart is from the National Association of Home Builders and Wells Fargo, where home builders rate market conditions for new home buyers today and in six months, as well as rating the amount of prospective buyer foot traffic.

The combination of higher interest rates and home prices that increased dramatically after the onset of the pandemic has materially increased the mortgage payment for the average-priced house in the U.S. Since most buyers purchase homes based on the size of the mortgage payment their income can service, higher rates have the impact of lowering the price of a house the buyer can afford. The result is a dour mood amongst new home builders as construction costs have not come down as much as interest rates have risen. Existing homes are seeing a similar impact reflected in overall reduced affordability measures. One could expect some price declines, with some markets more at risk than others, but the overall supply of homes is limited, which could limit the amount of downside to housing prices nationwide.

Housing is not the largest sector of our economy, but it is an important leading indicator of economic direction. Recently, longer-term rates have declined from recent highs, which could help the housing market in the short run and explain the slight rating rebound shown in the chart. However, home mortgage rates remain far above levels of only a year ago.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)