Debt ceiling talks may be heated

Split Congress, high-interest rates are factors

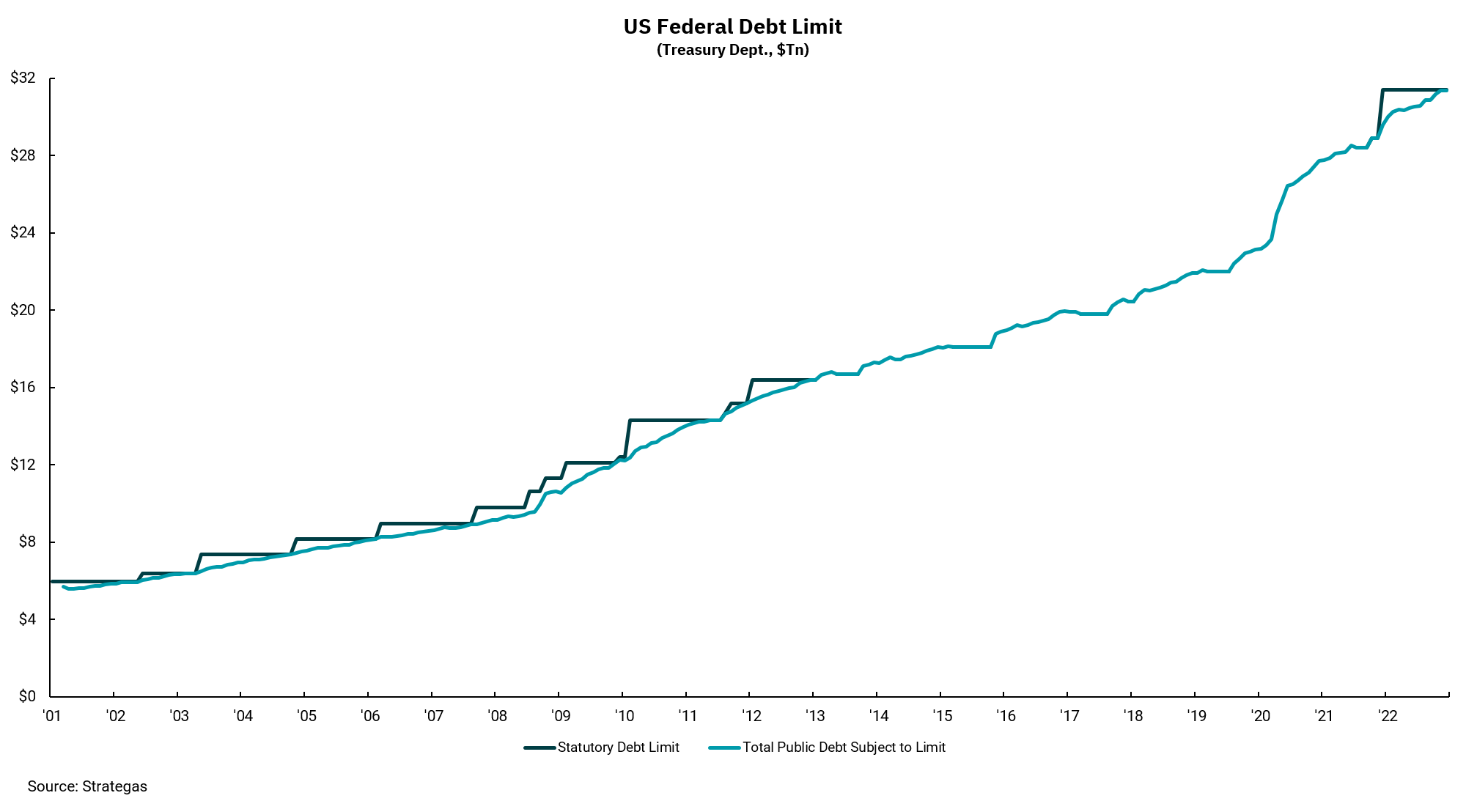

Last week, Treasury Secretary Janet Yellen announced that the U.S. had hit its debt ceiling of $31.4 trillion. The debt ceiling is the statutory limit for the federal government. In consumer terms, it is our country’s credit limit.

Ongoing annual budget deficits accumulate to equal the total amount of debt outstanding. Unlike most state governments, the federal government does not have to have a balanced budget. The last time the budget was balanced, where receipts equaled expenditures, was in 2001 during the Clinton administration. That period of fiscal discipline did not last long.

Periods of economic stress – such as the Great Recession in 2008-2009 and, most recently, the global pandemic - generally result in increased spending and more rapid debt accumulation. In addition to Congress setting a dollar limit, they can pass an ability for the government to borrow for a specific time frame. These periods are represented on the graph where there is no solid dark line.

Some factors could mean the current debt ceiling negotiations will be the most contentious since the Obama administration in 2011. First, as then, we have a split government, with the Republicans holding a narrow majority in the House and the Democrats with a narrow majority in the Senate. Second, as a percentage of GDP, pandemic-spurred government spending grew to levels not seen since WWII. And while this percentage has declined from its peak, it remains at levels far above longer-term averages. Finally, the cost of debt has increased rapidly as the Federal Reserve has raised interest rates in response to inflation.

All of this points to what could be an extended period of debate on spending and taxes. We anticipate an agreement will be reached, but it could be bumpy between now and then.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)