What’s the ‘X factor’ in making economic forecasts?

Consumers sometimes react in unexpected ways

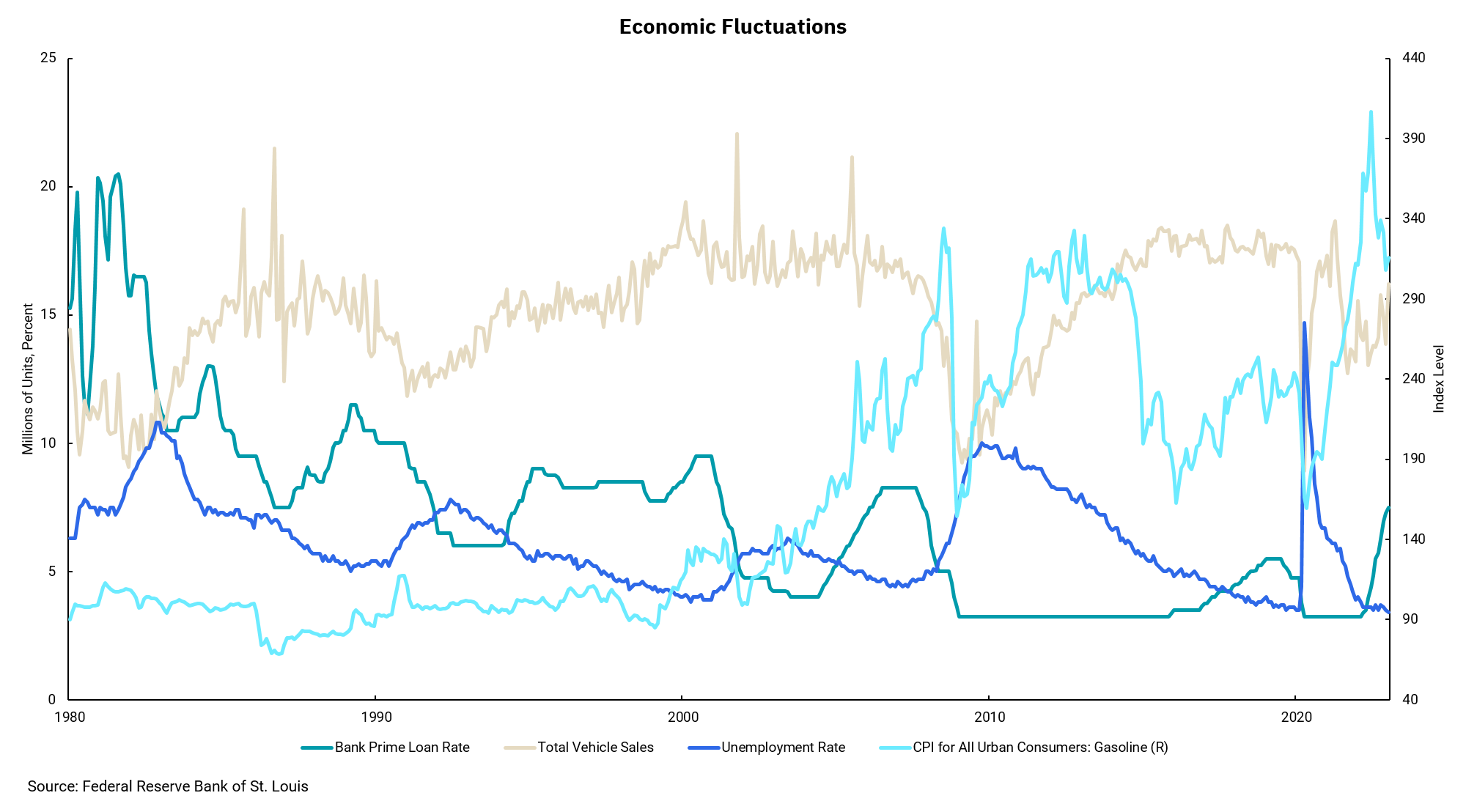

The U.S. economy is a complex system, which makes attempts to forecast or control outcomes exceedingly difficult. While we know Fed monetary policy and fiscal action from Congress have an impact, accurately predicting how people will react to financial inputs is a continual learning process, even with history acting as a guide. If we get to basics, the Federal Reserve uses interest rates to influence demand, lowering rates to spur demand and raising rates to slow demand. We can see the impact of this policy most directly within markets where consumers borrow money often, think housing and autos. As the cost of money goes up, consumers can buy less. Interest rates are one factor impacting vehicle sales. However, it’s not the only one, as they also can be impacted by the overall level of employment within the economy.

And it’s not just vehicle sales that are impacted by the level of employment. Over time, the domestic economy has evolved to be driven more by consumer spending and less by outright goods production. This means another important variable in the economy overall is employment. This explains the Fed’s focus on our current robust employment market as a source of inflationary pressure. It would be easier if the various inputs interacted in the same way all the time and by the same amount. Since they don’t, we are always considering a range of outcomes within our forecasts. And the Federal Reserve does the same.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)