Markets predicting lower interest rates ahead

Slower economic growth may also be in the forecast

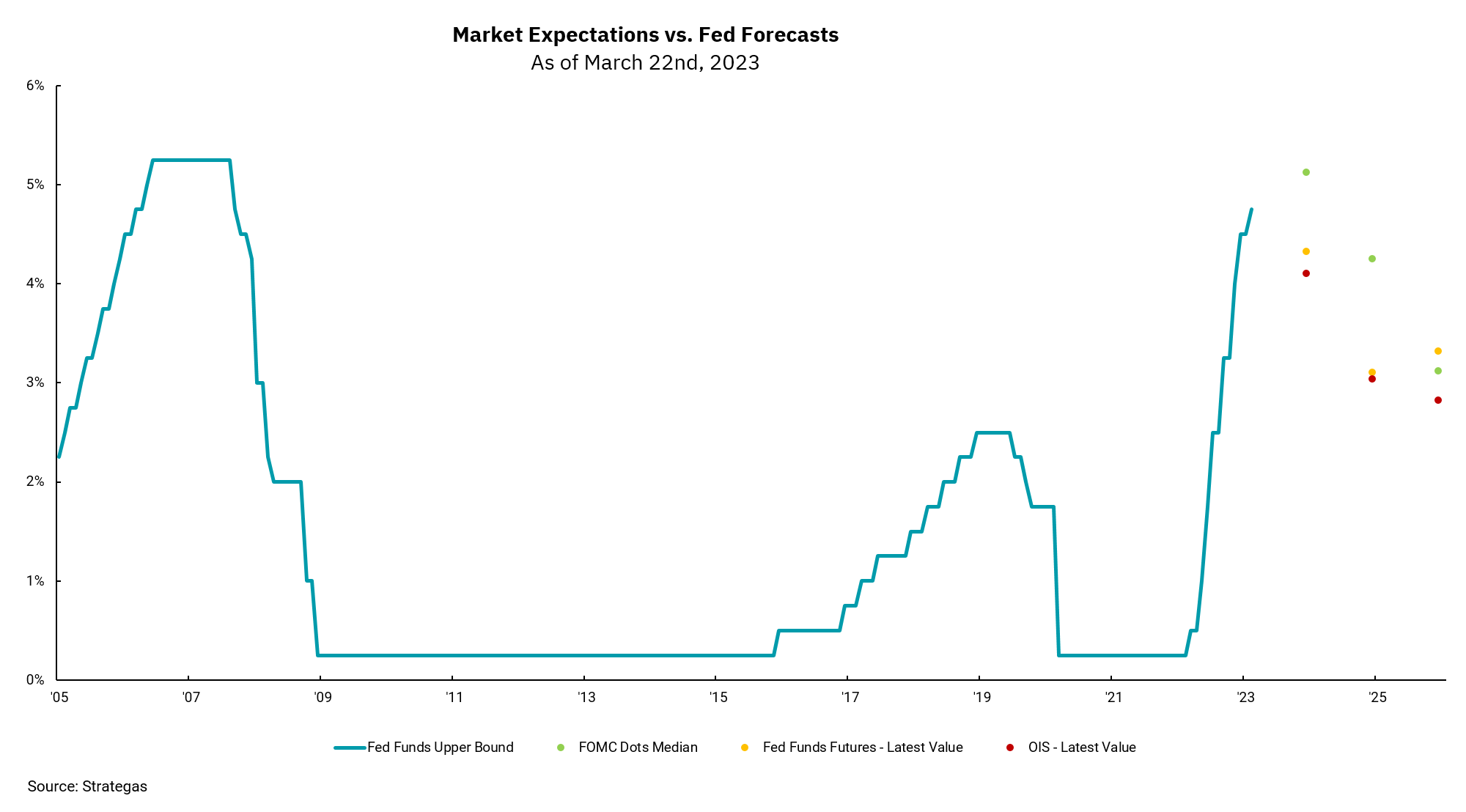

The Federal Reserve met on March 21 and 22 to discuss their economic and inflation outlook and what it means for monetary policy. Based on their discussions, the Fed announced a 0.25% increase in overnight rates, bringing the new range to 4.75-5%.

This is the highest Federal Funds rate since 2007, and it is the latest move in a very sharp rate increase cycle that began a year ago.

Meanwhile, early data on growth in the first quarter looks positive, between 2% and 3%. The employment market is still strong, with the latest reading on headline unemployment at 3.60%. However, inflation, while cooling on a year-over-year basis, is still far above the Fed’s 2% target rate.

Looking at these factors, it is no surprise that the Fed moved rates up. But recent tremors in the financial sector, both domestically and globally, raise legitimate questions about the ability of the Fed to continue to fight inflation with tighter monetary policy while at the same time providing short-term liquidity to the banking sector.

One way to see this difference is to look at the forecasts of the Federal Reserve on future interest rates, noted as the green dots on the chart, and the market’s forecast of rates. We look at a couple of market forecasts: the yellow dots are the Federal Funds forecast, and the red dots are the “overnight index swap” (OIS) market. Both of these are below the Fed’s forecast over the next few months, indicating the market is pricing in lower interest rates sooner than the Fed is forecasting.

Lower rates are better for borrowers, but this could also be a market forecast for much slower economic growth. We need inflation to decline, but a rapid descent from a much weaker economy would not be a good outcome.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)