The good (and bad) news about inflation

It’s coming down, but Fed must remain vigilant

After a significant bout of mid-month volatility spurred by financial system tremors, having a week of relative calm was good. Information from the Federal Reserve on bank funding shows that the worst of the initial liquidity issues may be behind us. However, that is not to say we are out of the woods. The higher-rate environment and a slowing economy may reveal other areas of weakness within the financial system. Still, as of now, economic momentum remains and credit markets are not indicating widespread issues. The resilience of the equity markets has been impressive.

Beyond the immediacy of the liquidity issues, we would expect a response from bank regulatory authorities. Without knowing any specifics, one could reasonably expect higher oversight and rule changes designed to reduce risk within the banking system further. This has been the response to past banking issues, as we try to write new rules and regulations to keep the same mistake from happening again. Overall, efforts to reduce risk tend to reduce profit margins which will be a headwind for financials and the broader economy going forward.

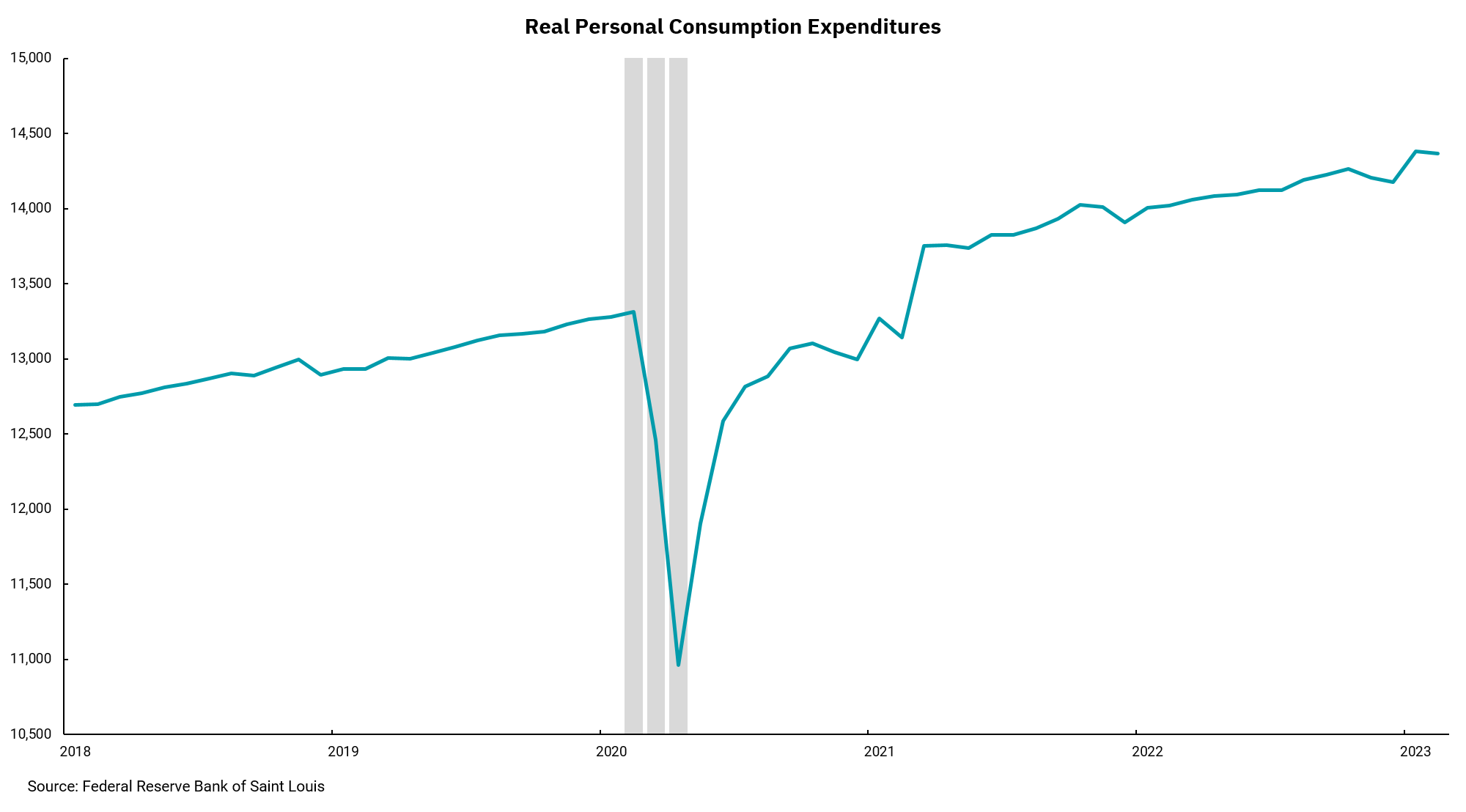

As the Fed utilizes its tools to improve financial system liquidity, it must keep in mind the ongoing problem of inflation which remains too high. The release of the Fed’s preferred measure of inflation, the core Personal Consumption Expenditures index (PCE), brought some welcome news on the inflation front as the monthly and year-over-year readings came in slightly lower than expectations and continued the trend toward lower inflation. This is good news…to a point. The fact remains that inflation is far above the Fed’s recently confirmed goal of 2%, which would indicate a need to remain vigilant, or put more simply, keep rates higher for longer than the market’s current expectation.

A lot can and will happen over the next few months, which may alter our viewpoint, but while bank liquidity issues are scary and require a response, the bigger, longer-term issue for the Fed and the economy remains inflation.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)