Unemployment is still low, but job market signals shifting

Recession indicators continue to grow

The number of indicators pointing to an increased chance of recession continues to grow. The treasury yield curve has been inverted for several months, and recent data on credit availability from banks points to, at best, slower economic growth going forward. At the same time, consumer spending remains relatively strong, supported by a robust job market, where the latest reading on headline unemployment matched a cycle low of 3.4%.

However, we are seeing signs of a shift occurring on the fringes of the job market. In the recent Job Opening and Labor Turnover Survey (JOLTS), the number of open jobs declined to 9.59 million. This is down from a recent high of over 11 million open jobs. While this still represents almost 1.7 jobs for every unemployed person, this ratio is down from over two open jobs per unemployed person. Open jobs have been a metric the Federal Reserve has mentioned as important as they think about the path of monetary policy going forward.

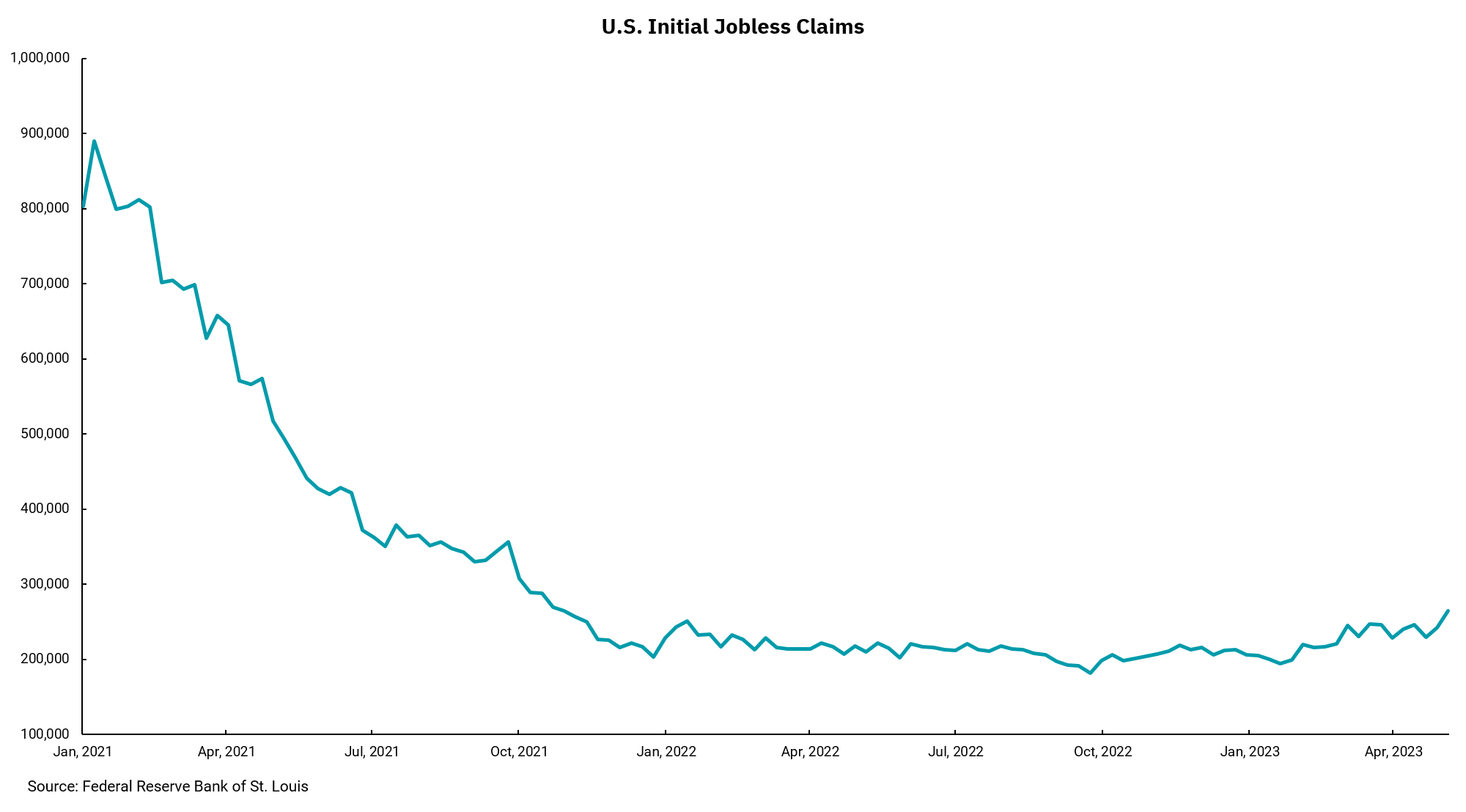

Another data point where we have begun to see some cracks is in the weekly jobless claims. This week’s chart only goes back to 2021. We are looking at this shorter period to exclude the pandemic period to avoid all of the data being overwhelmed by the gigantic increase in jobless claims when the economy shut down. Thankfully, we saw a very quick rebound, and the downtrend from this recovery can be seen as weekly jobless claims fell from around 900,000 in early 2021 to a low near 200,000 last year. The 2022 levels represented the lowest weekly jobless claims in decades, with a labor force much bigger than when we last saw numbers like this.

The most recent report showed jobless claims increasing to 264,000, up 22,000 for the week. The increase from 200,000 to now 264,000 can seem small when looking at the chart and seeing the much higher numbers in 2021, but past increases of a similar amount have preceded periods of increased unemployment. The Fed’s forecast is for unemployment to rise slowly over this year as the impact of raising rates and reducing the size of their balance sheet take hold. The increase in weekly jobless claims might provide them with the information they need to pause in their rate increase cycle and see how the economy and unemployment evolve from here.

Get By the Numbers delivered to your inbox.

Subscribe (Opens in a new tab)